Favorite Balance Sheet Accrual Ratio

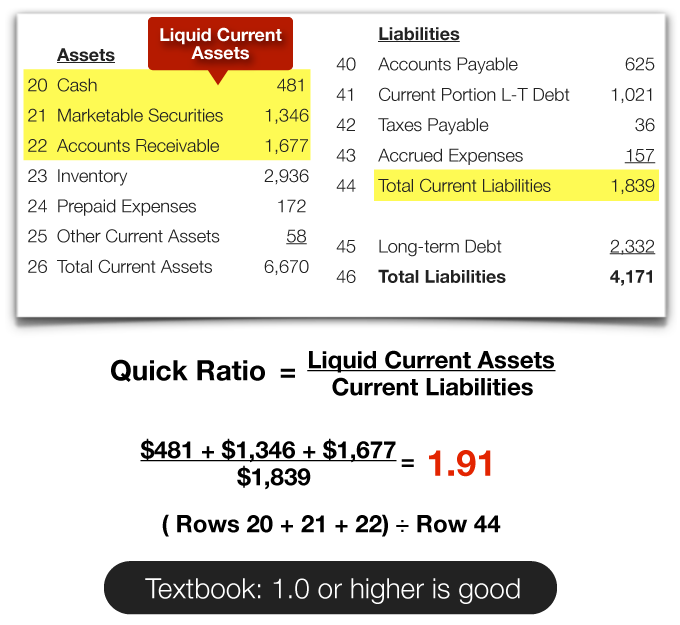

They are only recognized at year-end when accountants begin to calculate the amount of expenses that have occurred in the given year and the appropriate payable amount for those accounts.

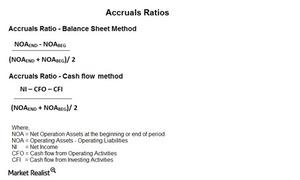

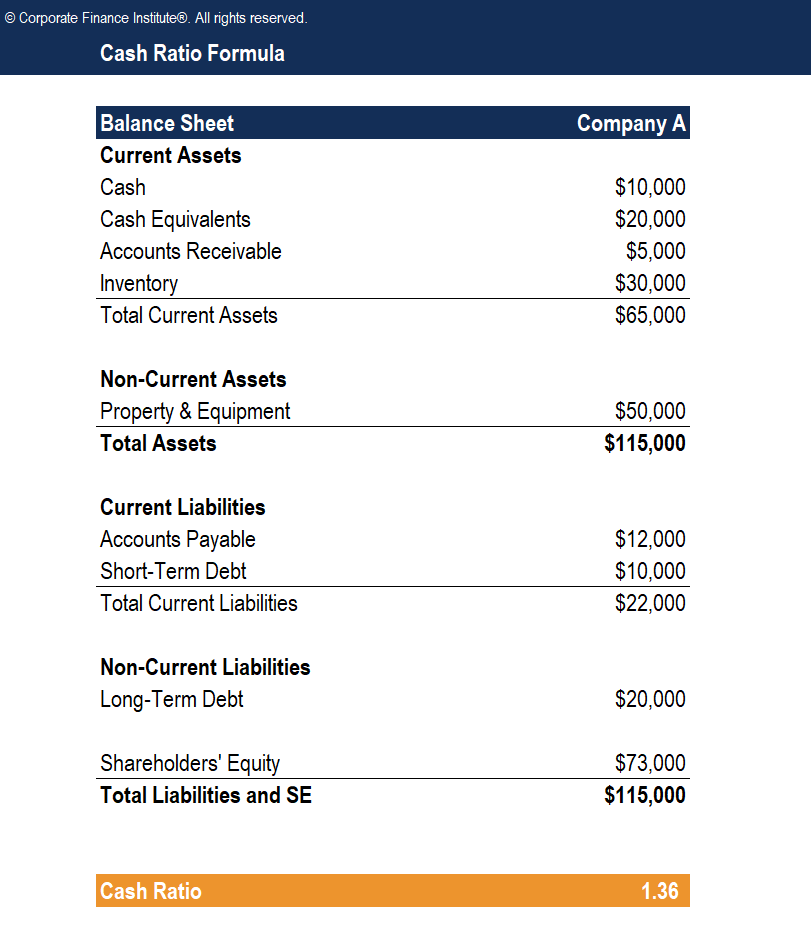

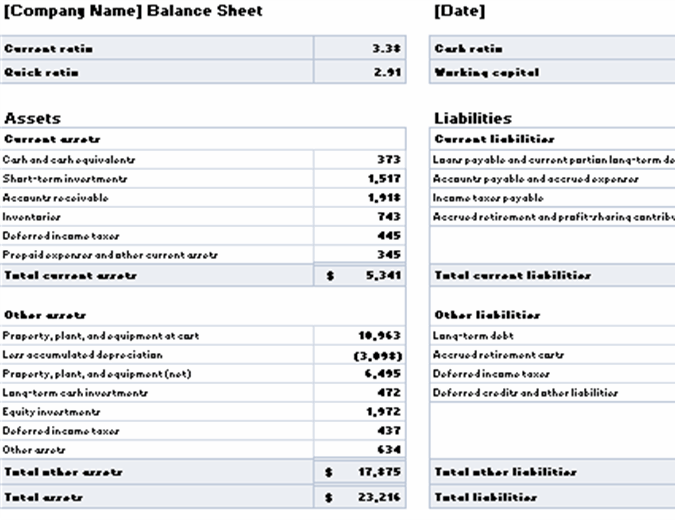

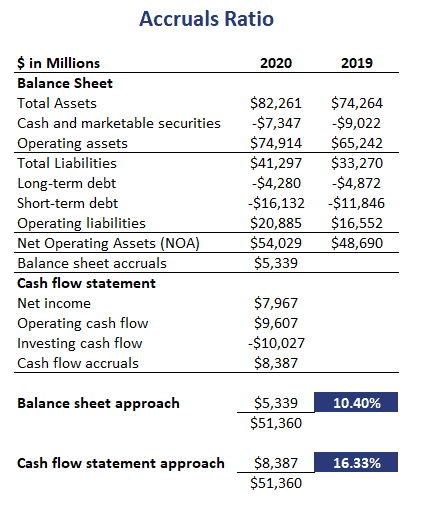

Balance sheet accrual ratio. To calculate the ratio Company A must take net income and subtract cash flows from operating and investing activities. Earnings Quality Red Flags. The balance sheet accruals number is simply the increase in NOA from one period to the next.

Since accrued expenses represent a companys obligation to make future cash payments they are shown on a companys balance sheet as current liabilities. The authors recommend to monitor and compare accruals levels and created 2 ratios for this. The balance sheet accruals ratio NYSE.

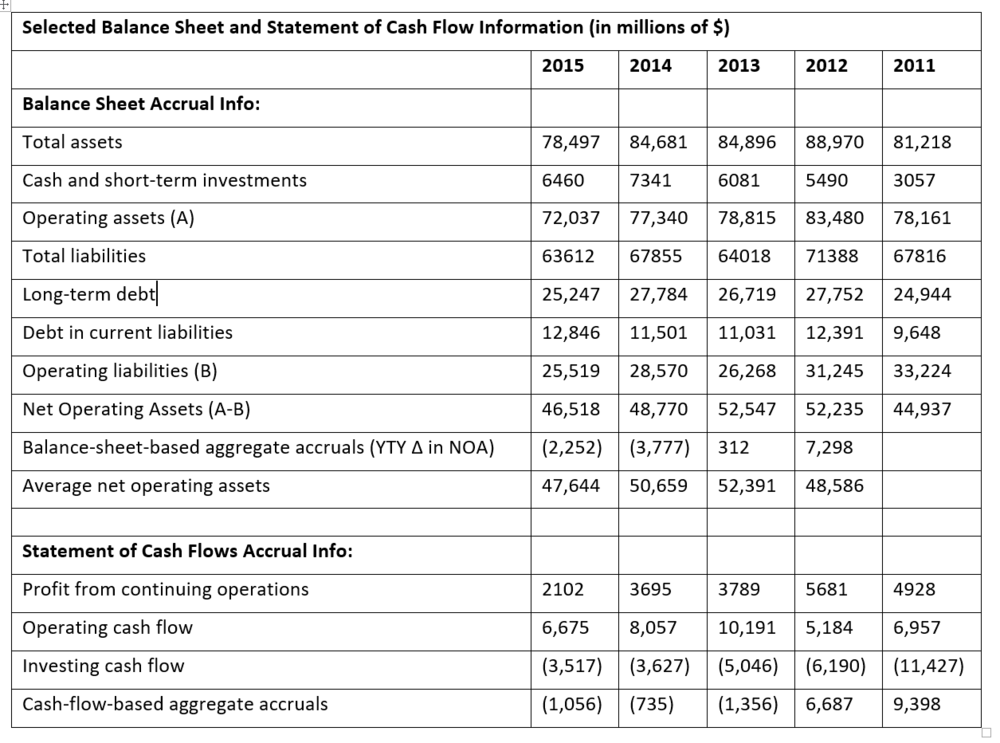

These ratios usually measure the strength of the company comparing to its peers in the same industry. This is measured on a TTM basis and earnings are diluted and normalised. The Balance Sheet Aggregate Accruals Ratio is determined by dividing that number by the average accruals.

The Balance Sheet Aggregate Accruals Ratio is determined by dividing that number by the average accruals. Balance Sheet Aggregated Accrual Ratio BS Accrual Ratio and Cash Flow Aggregated Accrual Ratio. The Accrual Ratio is a way to identify firms where Non-Cash or Accrual-Derived Earnings make up a significant proportion of Total Earnings.

The procedure is similar when calculating Cash Flow Aggregate Accruals as shown below. Given the nature of the accrued expenses they are recorded as Current Liabilities in the Balance Sheet. It therefore follows that NOA is the sum of all the accruals over the history of the firm in addition to.

Stockopedia explains Accrual Ratio. This number is divided by the net operating assets. In that case accruals are divided by the average NOA over the period.