Cool Deferred Tax Asset Journal Entry

A deferred tax asset is an item on the balance sheet that results from overpayment or advance payment of taxes.

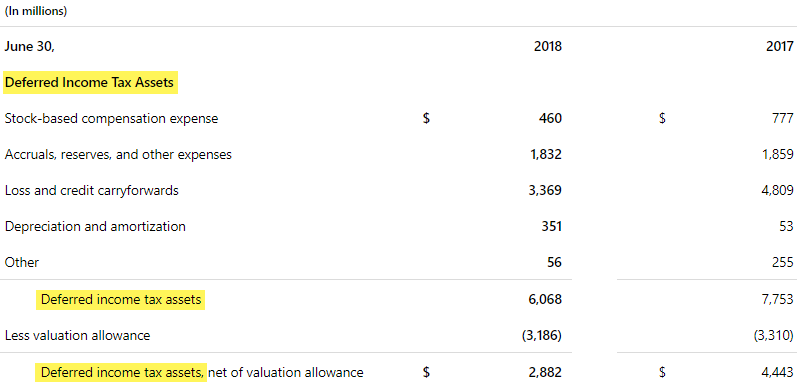

Deferred tax asset journal entry. Ts tax rate is 50. The tax valuation allowance is a contra asset meaning that its balance is subtracted from the deferred tax asset account to establish the balance sheet value for deferred tax assets. Deferred tax is created when the income as per books is less than the income as calculated by income tax rules.

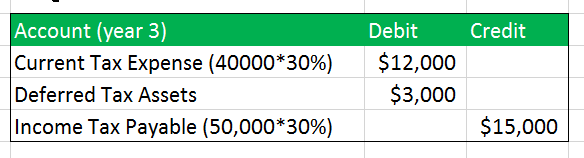

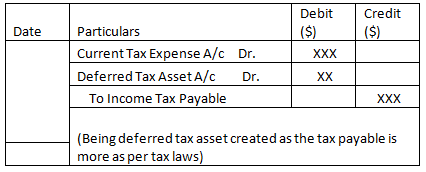

Refundable Tax Credit 120000. To P L ac Being deffered tax asset created for FY Journal Entry for Deffered Tax Liability. Current Tax Expense accounting profittax rate DR Income Tax Payable taxable incometax rate CR.

We have to create Deferred Tax liability Ac or Deferred Tax Asset Ac by debiting or crediting Profit Loss Ac respectively. A deferred tax asset represents the deductible temporary differences. Deferred tax assets in the balance sheet line item on the non-current assets which are recorded whenever the Company pays more tax.

Profit Loss Ac Dr. To Deferred tax liability To Income tax liability. My journal entries are.

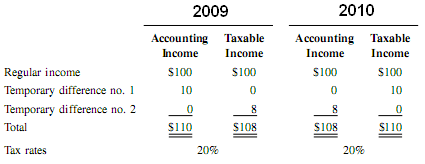

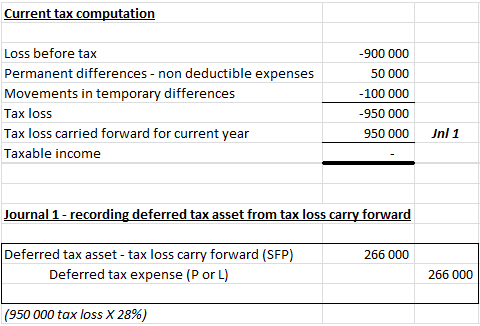

The book entries of deferred tax is very simple. When a company incurs a tax loss it can then carry forward the tax loss to reduce taxable income in future years. The effective tax rate and post-tax profit is the same in years 2 to 6 as it would have been had the company not made the loss in year 1.

For example income as per books is 5000 and income as per income tax laws is 6000 difference is due to different depreciation policies by income tax and company law. LesseeT Lessor L 5-year lease. P L ac dr.