Ace Example Of Micro Entity Balance Sheet

According to the govuk Micro-entities are very small companies.

Example of micro entity balance sheet. An annual turnover of more than 632000. Your company will be a micro-entity if it has any 2 of the following. Micro-entity FRSSE 2015 Set of Accounts.

The formats of balance sheet from which a micro-entity must choose for its annual accounts are set out in SI 2008409 Sch. Wondered if anyone would be willing to share an excel templateexample set of accounts or guidance re completing first set of company accounts for micro-entity under FRS 105. 12460 Cash Prepayments and accrued income.

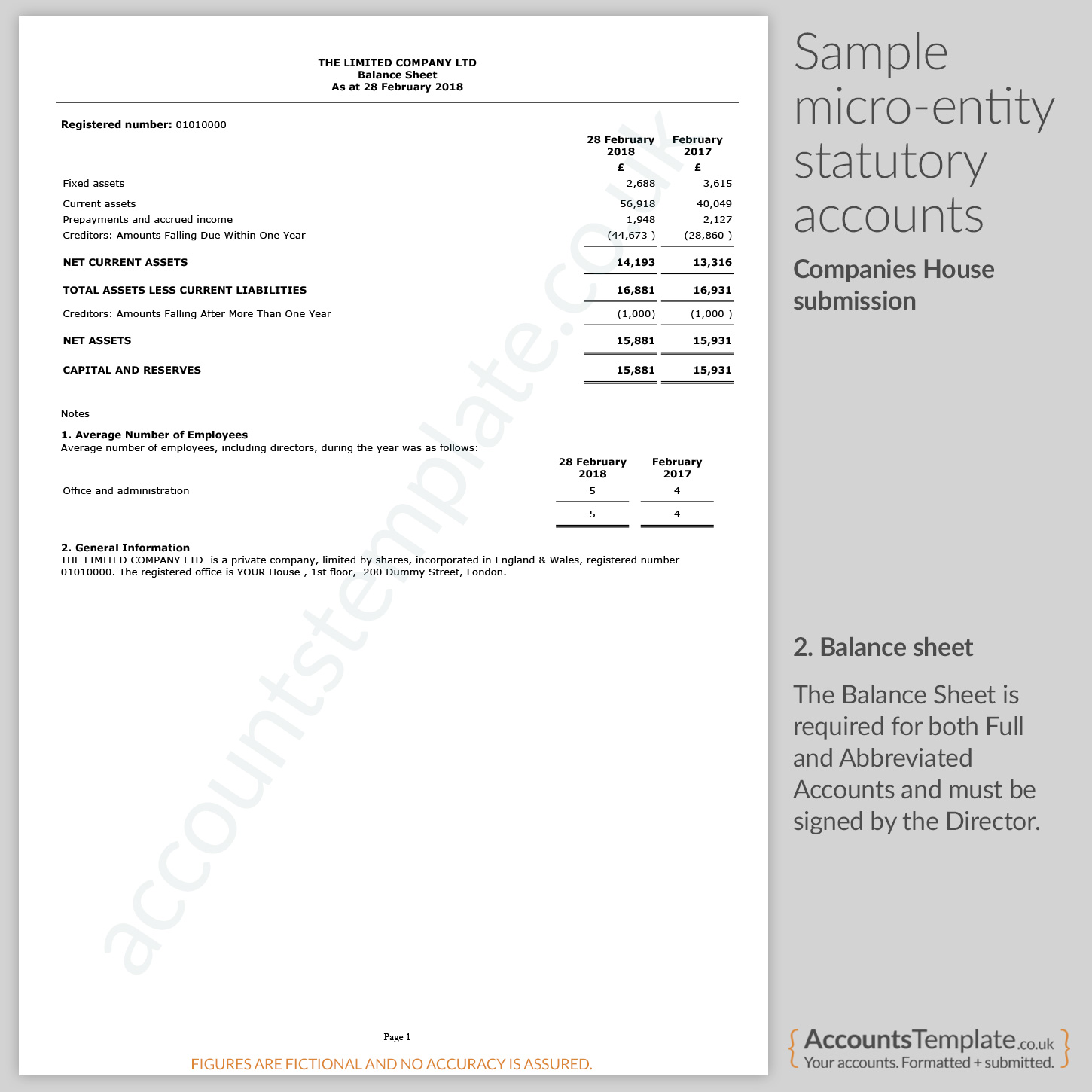

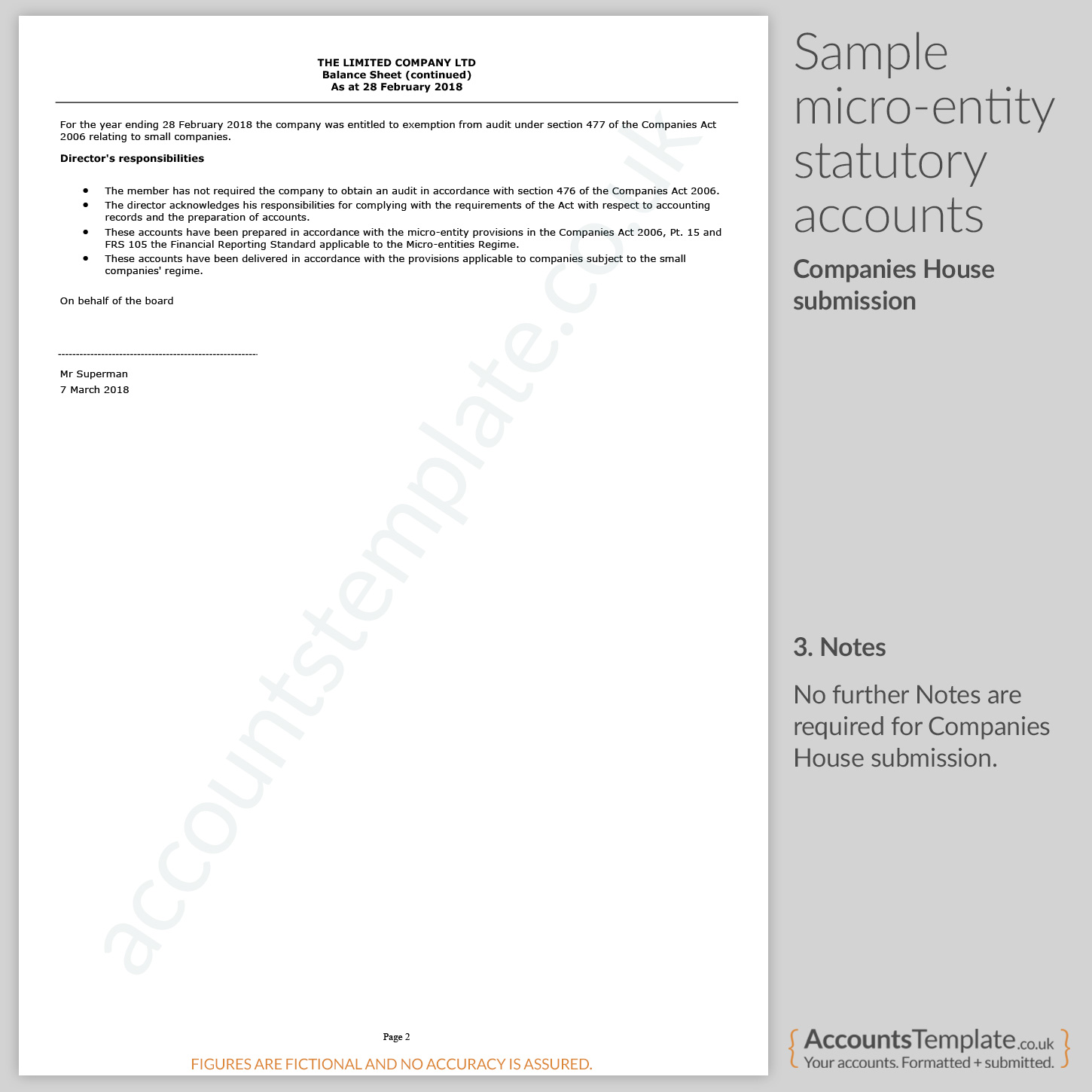

The balance sheet must contain a statement in a prominent position above the directors signature and printed name that the accounts have been prepared in accordance with the micro-entity. 99999999 2017 2016 Note Fixed assets Tangible assets 4 489233 492899 489233 492899 Current assets. You merely need the total fixed assets total debtors total creditors less than 12 months total creditors over 12 months and the net capital.

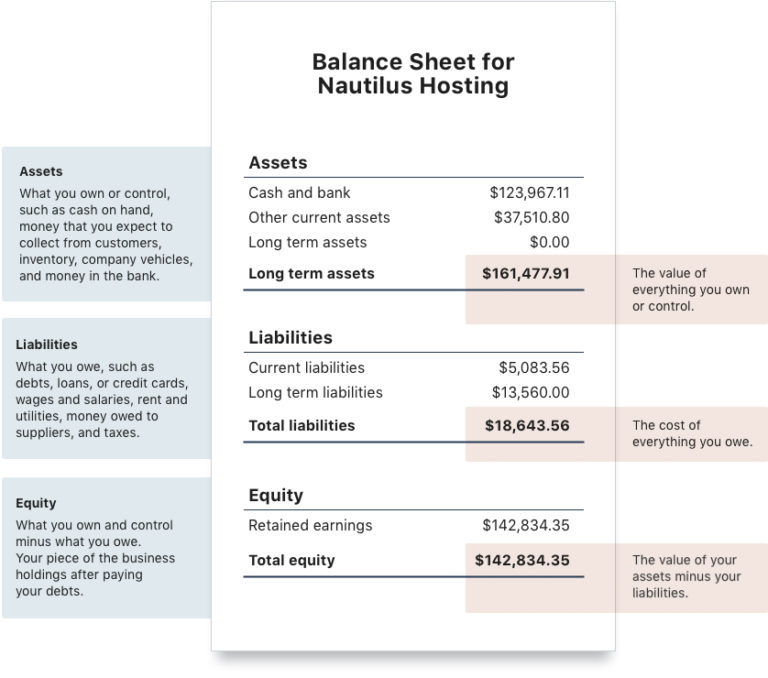

The Micro- entity Balance Sheet requires the following entries. For example a micro-entity with an investment property choosing to adopt the micro-entities regime would be required to measure the property at cost and not fair value. Amounts falling due within one year.

A company must not have more than one of the following. Micro-entities can file with Companies House only the abridged balance sheet with the required footnotes. A full set of micro-entity accounts includes the following elements.

Contingencies not included in the balance sheet The amount of advances and credits granted to members of the administrative. 10 employees or fewer. Accounting policies for a micro entity steve.