Fun Ias 7 Investing Activities

Cash is defined by IAS 7 as cash on hand and demand deposits.

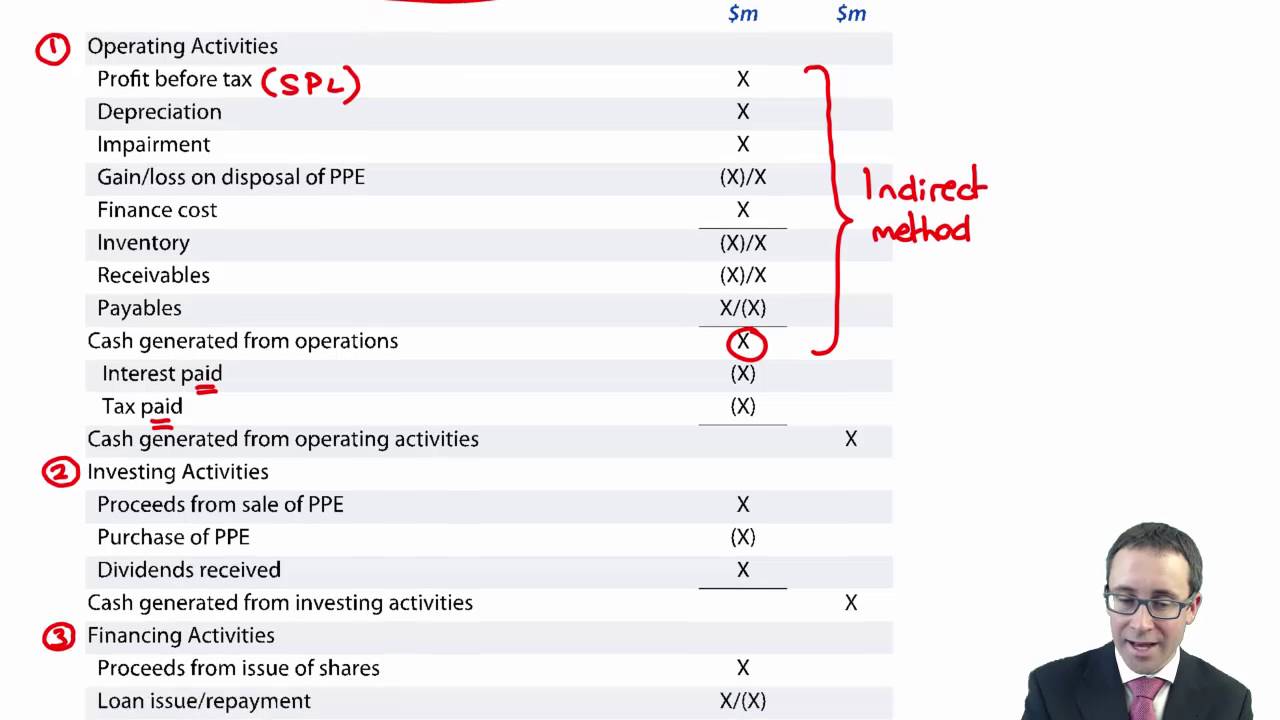

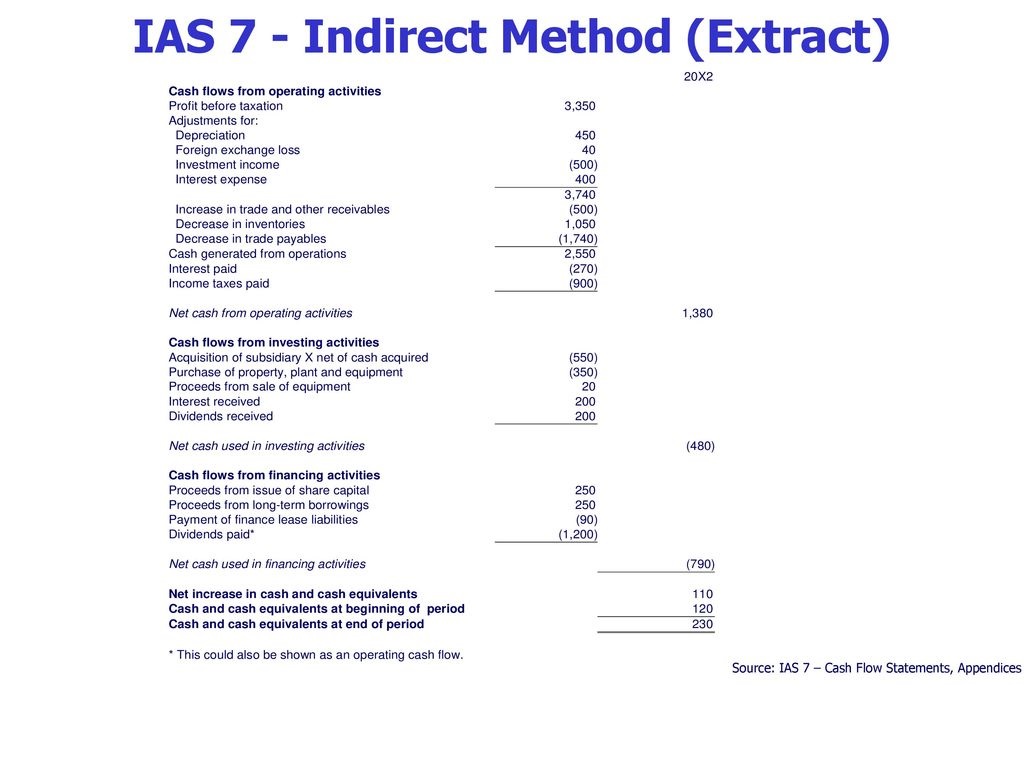

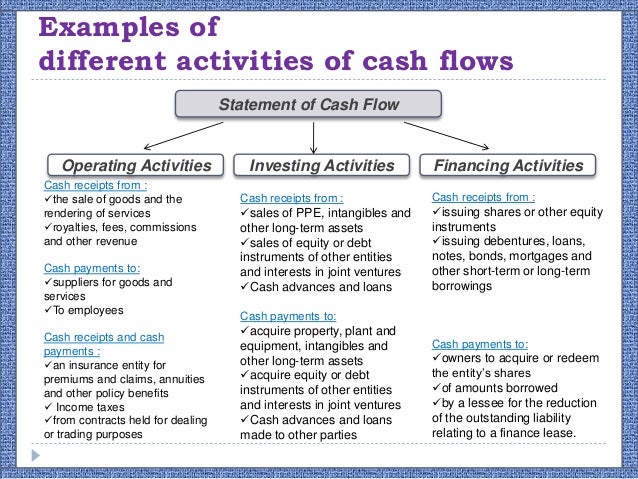

Ias 7 investing activities. Investing activities Definition. Cash equivalents are investments that are IAS 76-9. The separate presentation of cash flows from investing activities is important because such cash flows represent the extent to which disbursements were made for reasons of economic resources that will produce revenue and cash flow in future.

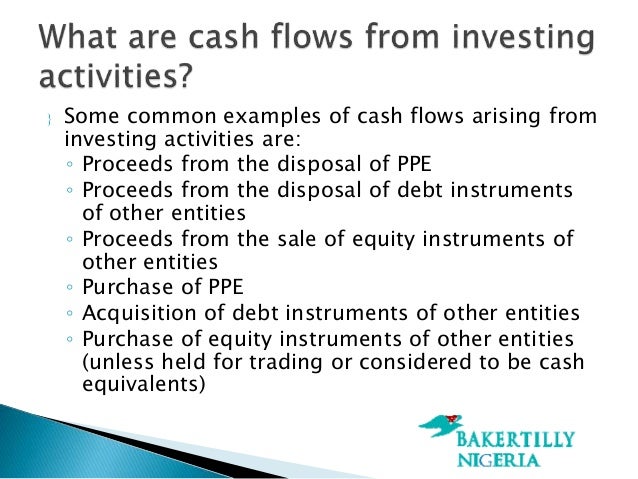

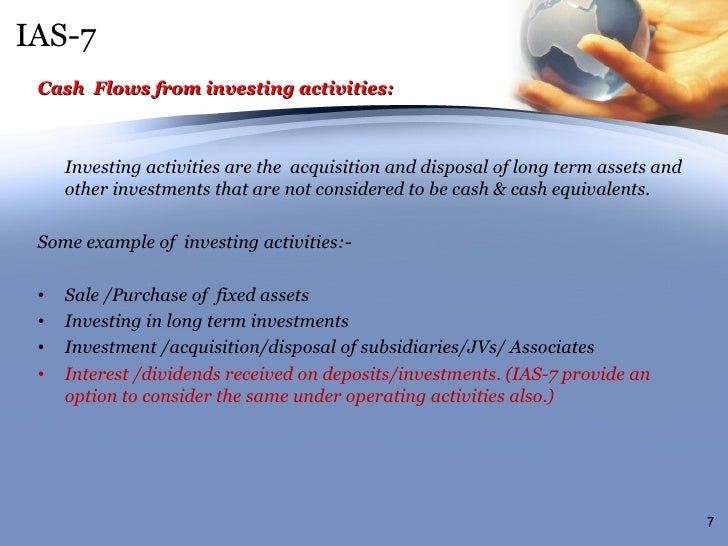

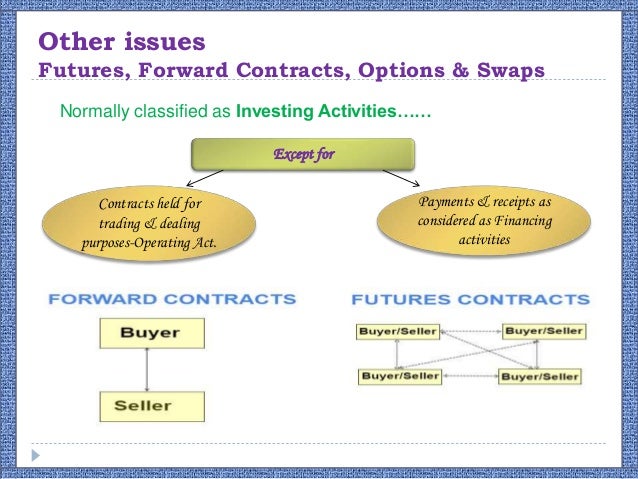

IAS 7 Investing activities CIMA F1 Financial Reporting. CIMA F1 lectures Download F1 notes. Investing activities are the acquisition and disposal of long-term assets and other investments not included in cash equivalents.

The activities which are undertaken by the entity for the purchase of long term assets and investments which are not the part of cash equivalents including the disposal of such long term assets and investments are termed as investing activities. Cash receipts and cash payments relating to non-current assets. Ad Trade With No Commissions low Spreads Enjoy 247 Support.

IAS 77 then notes that cash equivalents are held for the purpose of meeting short term cash commitments rather than for investment or other purposes. B the expectation that the resource will be returned to the provider of finance. Objective of IAS 7 Statement of Cash Flows IAS 7 requires an entity to present the information about changes in the cash and cash equivalents by a statement of cash flows these cash flows will be classified under operating investing and financing activities.

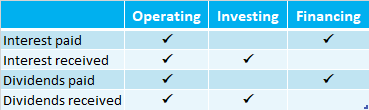

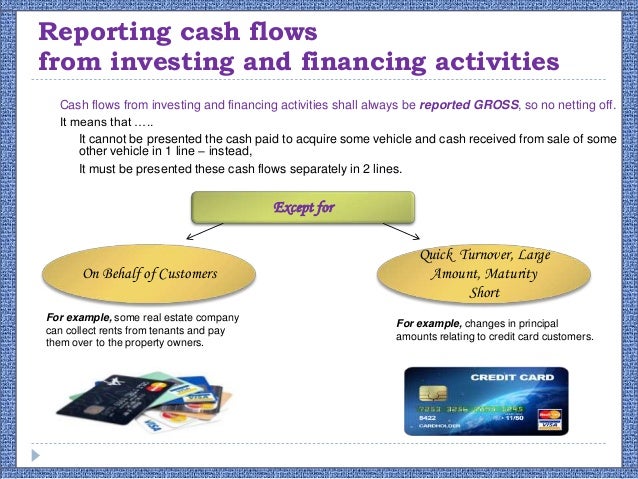

Under IAS 7 cash flows are classified into operating investing and financing activities in a manner which is most appropriate to its business IAS 710-11. Cash outflows to pay dividends. Investing activities are the acquisition and disposal of long-term assets and other investments not included in cash equivalents.

And c the expectation that the provider of finance will be appropriately compensated through a payment of a finance. Cash outflows from buying back equityshares. The aggregate cash flows arising from obtaining and losing control of subsidiaries or other businesses are presented as investing activities.