Best Net Income Balance Sheet Formula

To calculate income using the information on the balance sheet you need to calculate the companys total income for the given period of time example.

Net income balance sheet formula. So now we can see that the balance sheet equation says which is Total assets Total Liabilities Total. ROA Net income Total assets at the end of the period or Average assets for the period Net income is the bottom line of the income statement and total assets come from the balance sheet. Or if you really want to simplify things you can express the net income formula as.

In other words a balance sheet can show you what your company owns and how much it owes. ROAfrac text Net Income text. Assets Liabilities.

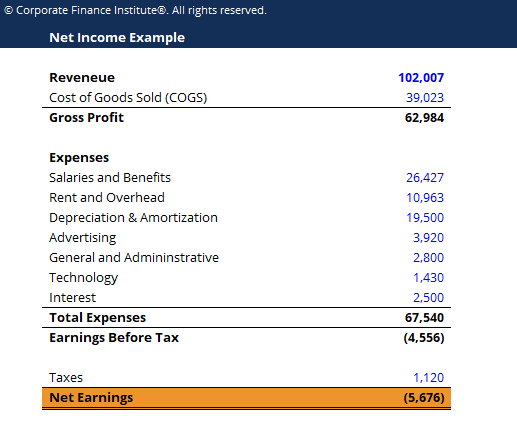

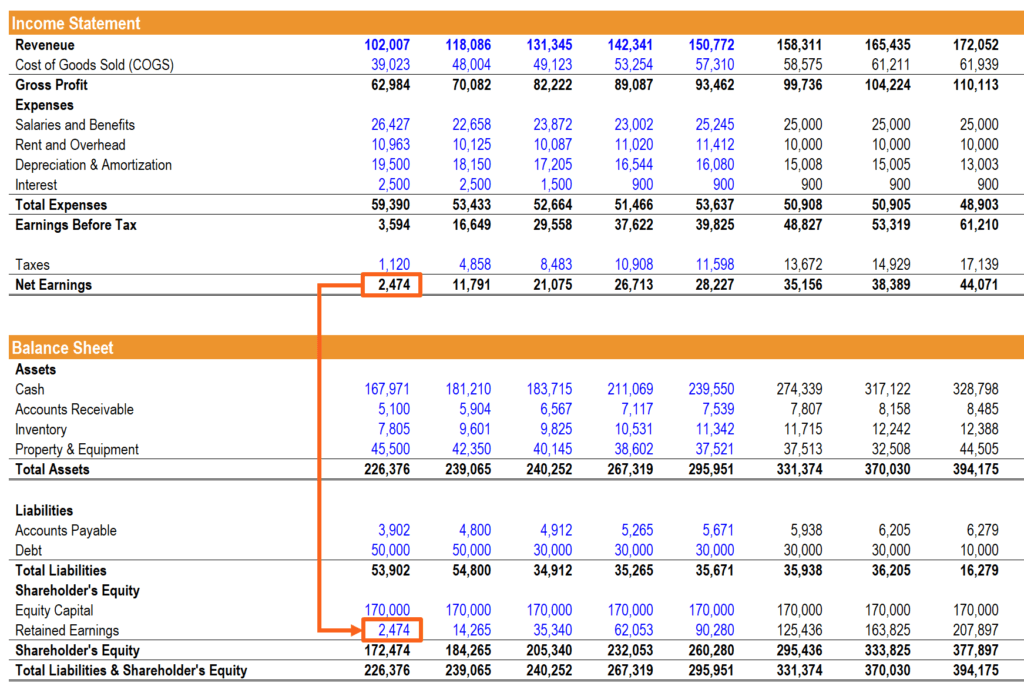

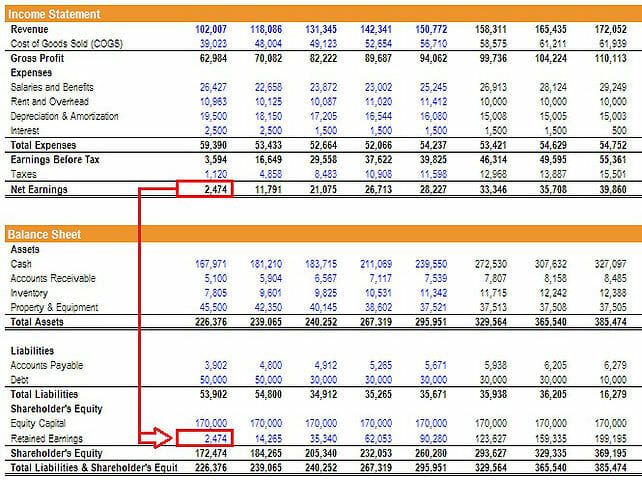

Net income flows into the balance sheet through retained earnings an equity account. Net IncomeThis equals total rental income minus total expenses adjusted for gainslosses and extraordinary items. In this example the amount of dividends paid by XYZ is unknown to us so using the information from the Balance Sheet and the Income Statement we can derive it remembering the formula Beginning RE Ending RE Net income -loss Dividends.

A year by adding up all the net sales including income from other resources. Net Income formula is used for the calculation of the net income of the Company. This is the formula for finding ending retained earnings.

Sometimes companies report return on tangible assets ROTA which excludes goodwill and other intangible assets. Total Assets 25000 25000 83500 30000 20000. However they are part of comprehensive income.

Total Assets is calculated as. Net income is the positive result of a companys revenues and gains minus its expenses and losses. Clearly the net income formula encapsulates all your revenues and expenses.

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

/phpdQXsCD-204ee8d463444c6c90f775fd179810f3.png)