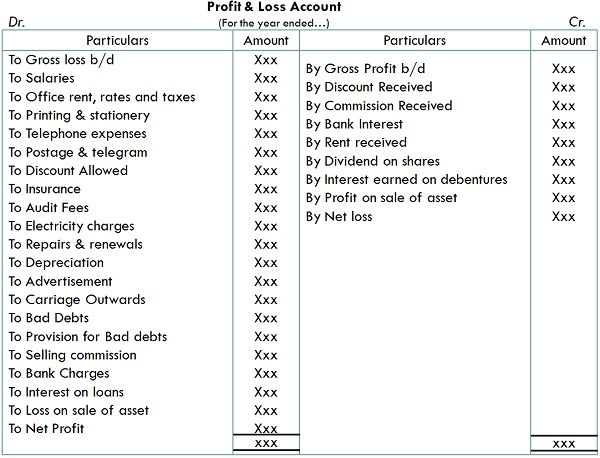

Simple Profit And Loss Account Items List

Profit and loss is prepared in form ledger.

Profit and loss account items list. Historically a primary financial statement showing the revenues earned in a period matched with the expenditures incurred in the same period to arrive at a figure of net profit or loss. What are the components of Profit and Loss Account. Then the Profit and Loss Account may be balanced and the balance is net profitnet loss to be transferred to Capital Account in case of sole trading or partnership firms.

PL or PL or PNL. Ground Rent Account. Customs Duty Account.

It is also useful for analyzing performance YOY. Following the net income in the profit and loss report is a very important part of the companys financial report analysis. Bad Debts Account.

Profit loss ac is popularly known as PL Ac. - Items relating to Debit Side. Following items are shown in debit side of profit and loss.

It is calculated by deducting indirect expenses from the Gross ProfitLossand adding indirect incomerevenue int the Gross ProfitLoss. A companys statement of profit and loss is portrayed over a period of time typically a month quarter or fiscal year. A profit and loss statement is calculated by totaling all of a businesss revenue sources and subtracting from that all the businesss expenses that are related to revenue.

The profit and loss statement also called an income statement details a companys financial performance for a specific period of time. The following items are shown in the credit side of the profit and loss account-Gross profit as per trading account. It is prepared to find out the Net Profitloss of the business for the particular accounting period.