Beautiful Profit And Loss Adjustment Account

It is found out from statement of fund from operation profit and loss adjustment account.

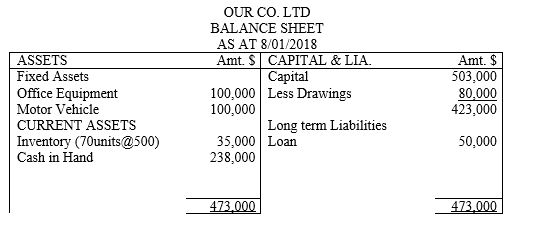

Profit and loss adjustment account. Net profit or loss of profit and loss account does not indicate actual funds earned or suffered during an accounting period. These amounts can arise on payment of a customer or vendor invoice. It is prepared after preparing schedule change in working capital.

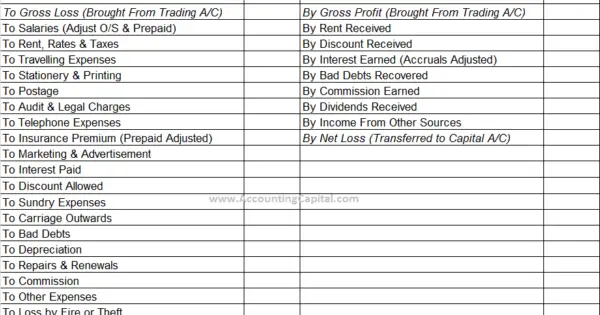

This account is the same as the second part of the account prepared in the direct. The Profit and Loss Account starts with the credit from the Trading Account in respect of gross profit or debit if there is gross loss. Fund from operation is the second step of fund flow statement.

The ledger account behind the adjustment causes problems for some candidates. SAP Program SAPF181 - Profit and Loss Adjustment. Credit profit and loss account and debit the income account.

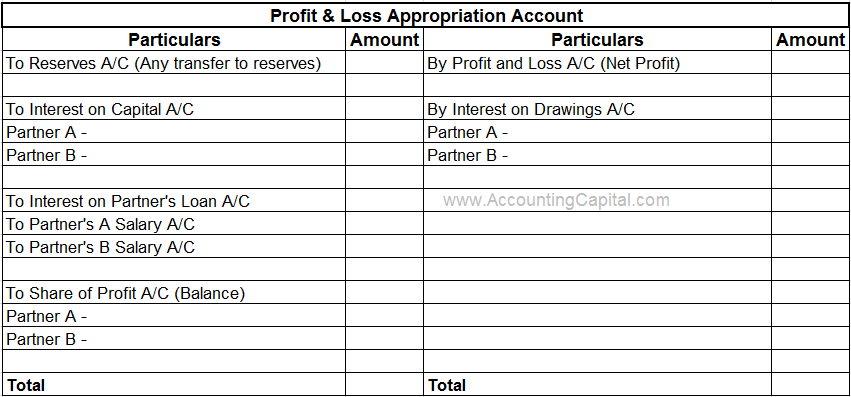

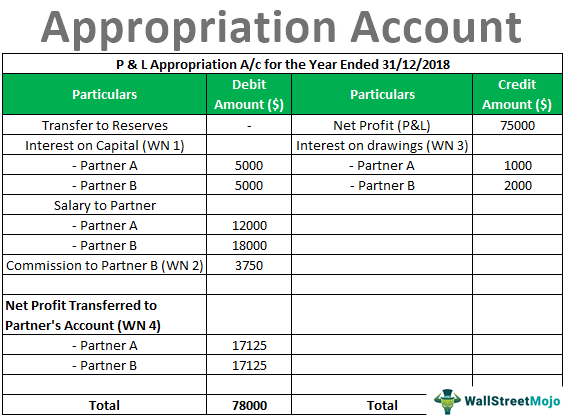

Rectification of Errors and Transfers. It starts with the net profitnet loss as per Profit and Loss Account. The three following financial statements are prepared for the preparation of final accounts.

This loss is abnormal loss in nature. The entry is the transfer from the statement of profit or loss for the closing inventory of the previous year figures invented. It shows gross profitloss of the business.

The Profit and Loss Adjustment Account is prepared because of the following two reasons. Pass necessary journal entries regarding the adjustment of a accumulate a profit or loss. This is how the inventory account will look at the time the trial balance is being prepared.