Matchless Skeletal Profit And Loss Statement

Sometimes its called an income statement.

Skeletal profit and loss statement. To derive net profit out of product sold indirect expenditure will be deducted. Following is the skeletal of net profit or loss statement. The single step profit and loss statement formula is.

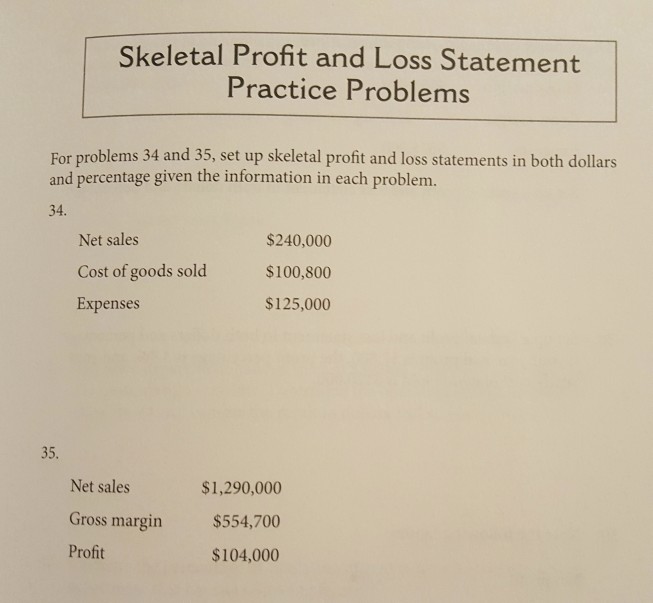

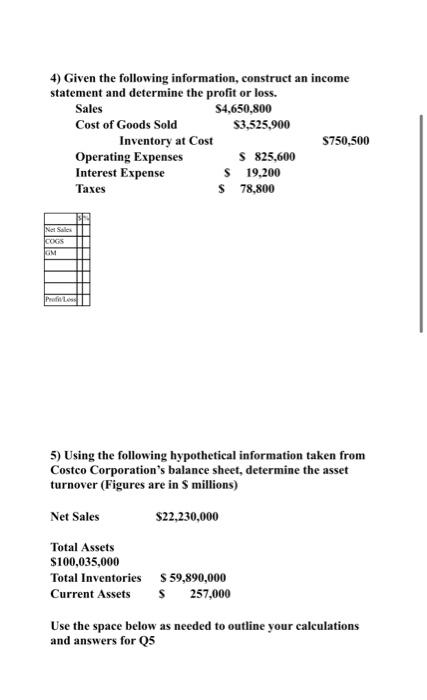

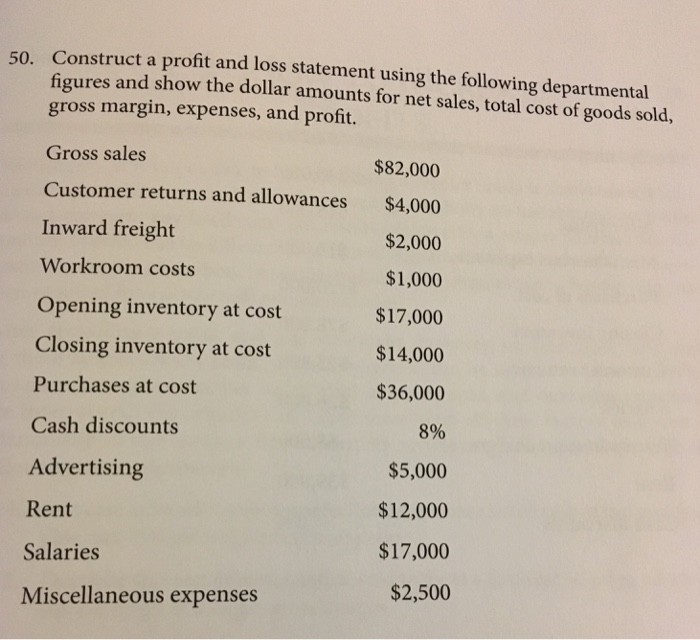

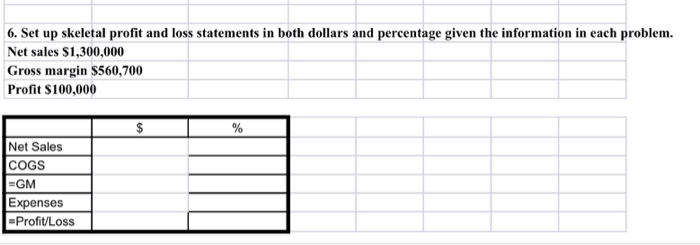

However the calculation of gross sales minus customer returns and allowance are not illustrated on the skeletal P L Statement format. The profit and loss PL statement is a financial statement that summarizes the revenues costs and expenses incurred during a specified period usually a fiscal quarter or year. Construct an operating statement from Gross Sales to Net Salesto Net Profit from the following data and computethe gross margin percentage.

Generally speaking if revenue is higher than expenses youll show a profit. Calculating the P L Components addresses the format construction and calculation of the Skeletal P L Statement. Setup a skeletal profit and loss statement with the following figuresCost of merch 5130 Expenses 317820 Profit 465 Include.

Use a skeletal statement format to calculate profitloss percent given. Calculate profit and loss percent. Profit and loss statements does not spell out all transactions in detail but it is a quick method to determine at any particular time a given departments profit or loss skeletal profit and loss statement shows the basic profit factors developed in detail so that every transaction is clearly seen includes additional info on stock levels.

It examines the relationship of Net Sales Cost of Goods Sold Gross Margin Operating Expenses and Operating Profit plus the interrelationships among the components. They are carefully reviewed by market analysts. Profit 465 Include all elements of the skeletal profit and lossstatement round up dollars to total amount extend percentages totwo decimal points.

Calculating the P L Components Part 2. Had the following profit and loss statement for the year ending 2009 50000000 Sales Cost of goods sold Gross Margin Marketing Expenses 10000000 40000000 Sales expenses 10000000 Promotion expenses 4000000 14000000 General and Administrative Expenses Managerial salaries and expenses for the marketing function 1000000 Indirect overhead 6000000. Net profit or loss skeletal profit and loss statement doesnt spell out in detailed transactions but expresses the statement in both and in dollars as a quick reference.