Simple The Unfavourable Balance Of Profit And Loss Account Should Be

If an investor lent your business some funds this would be classed as a loan or a purchase of equity and will not affect your PL but it will obviously place funds into your bank account.

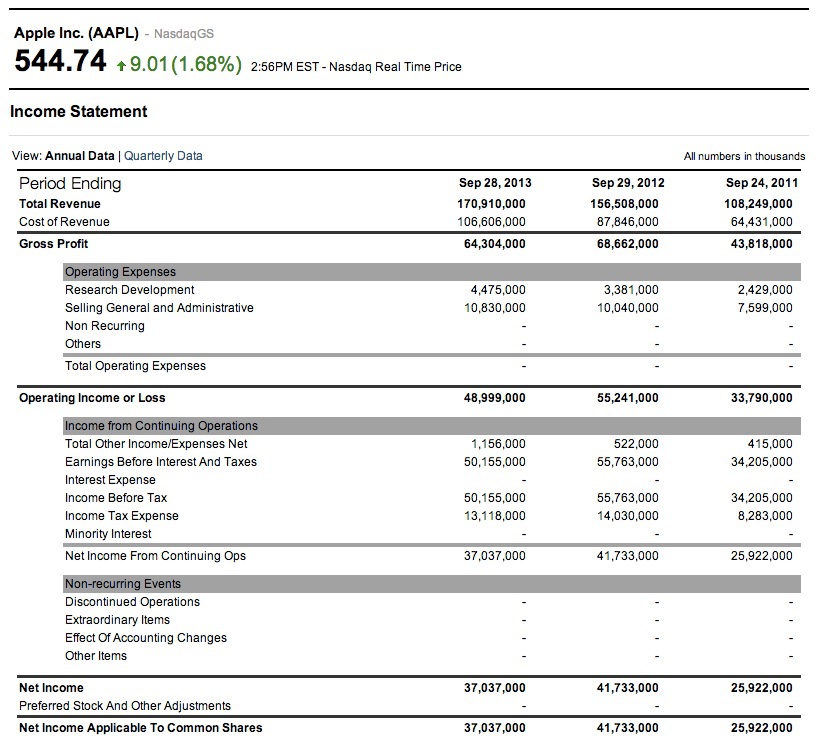

The unfavourable balance of profit and loss account should be. If the standard costs associated with the variance are in the goods that have been sold the debit balance in the variance account will be added to the Cost of Goods Sold an income statement expense. It doesnt show day-to-day transactions or the current profitability of the business. The unfavorable balance of Profit and Loss account should be A.

Every insurance company has to prepare Profit Loss account. 06112016 1243 AM Due on. Unless profit and loss account is prepared balance sheet can not be prepared.

The unfavorable balance of Profit and Loss account should be. D Subtracted from capital. A Added in liabilities b Subtracted from current assets c Subtracted from liabilities d Added in capital 16.

A Added in liabilities. Account which shows gross profit or gross loss of the business is. The unfavorable balance of Profit and Loss account should be.

Statement prepared to know profit or loss and financial position of the business are called. Without profit and loss account income of partners also can not be ascertained. The goal is not to have your profit equal your bank balance but a conversation at least annually with your accountant to determine why these amounts are different will identify areas where cash is being tied up and may.

D as on income in profit and loss account. Small businesses usually create several different types of financial reports including profit and loss accounts balance sheets and forecasting. The profit and loss PL account summarises a business trading transactions - income sales and expenditure - and the resulting profit or loss for a given period.

/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)