First Class Uk Deferred Tax Calculation Template

For those who have not emailed me directly I understand it will be available for download in the Excel zone if suitable.

Uk deferred tax calculation template. Eligible for 100 UK capital allowances in year of purchase Estimated UEL. The short answer is Yes. Deferred Tax Calculator is an excel template to calculating the deffered tax of the accounting accounts whether it is assets or income account.

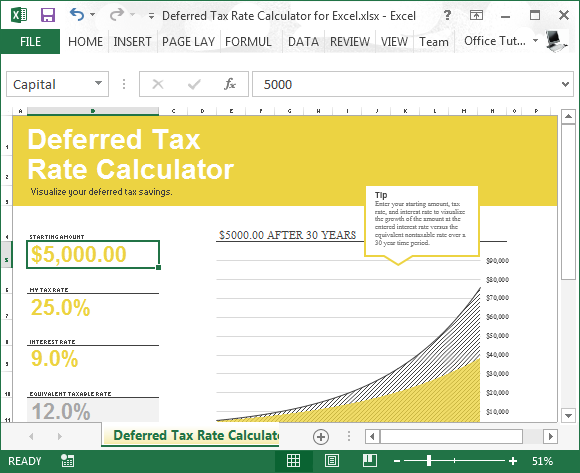

This excel templates file size is 62896484375 kb. By Accounting WEB. The Deferred Tax Rate Calculator makes finding both the equivalent taxable rate and equivalent non-taxable rate as simple as possible.

This must have happened if. Following a large number of requests by email a copy of my spreedsheet has been sent to John Stokdyk of AccountingWEB. Deferred tax asset is also recognised for fair value adjustments made in accounting for business combinations as usually such adjustments do not affect tax base of related assets and liabilities.

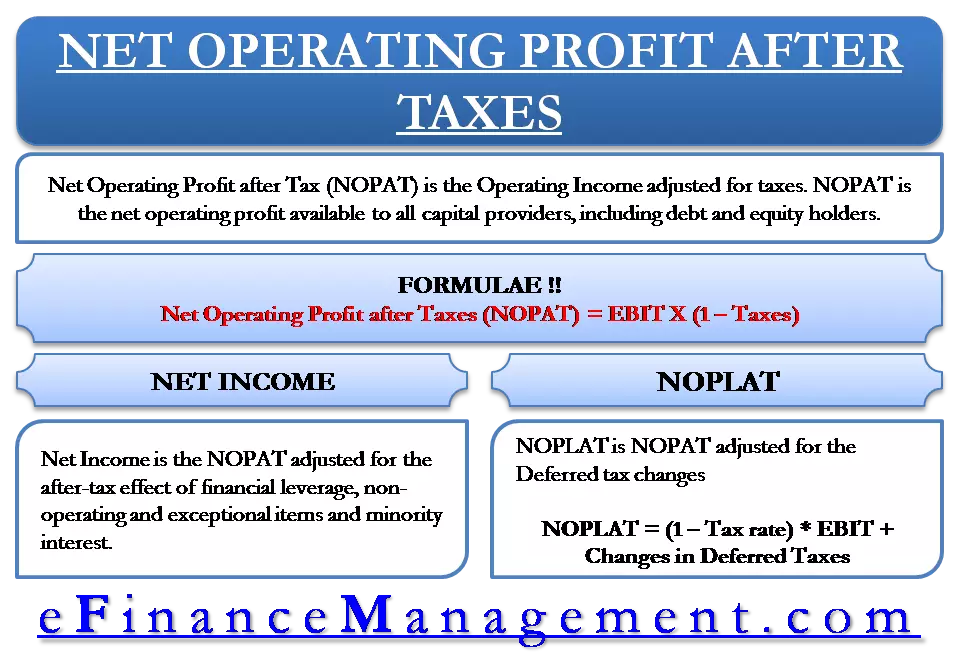

Ps income tax rate for all periods is 25. The revaluation gain is 8 000 000 recognised in the income statement. Or technically entity will recover it in the future and been delayed for the time being.

So the deferred tax charge is just a way of accounting for the timing differences due to the different corporation tax rules - and over time the corporation tax charged will be the same whether its calculated on the accounting profit 4400 per year or on the taxable profit 3200 in year 1. Similarly deferred tax asset simply means an asset recognition of which has been delayed. They purchased 2000 worth of equipment with the depreciation policy being 15 SL.

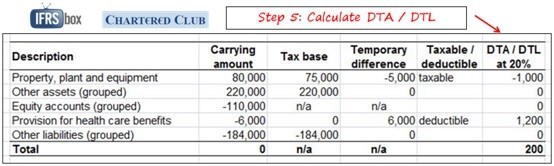

IAS 12 defines a deferred tax liability as being the amount of income tax payable in future periods in respect of taxable temporary differences. Remember deferred tax liability arises when accounting base tax base. Can P recognise a deferred tax asset.