Fine Beautiful Accretion Expense Definition

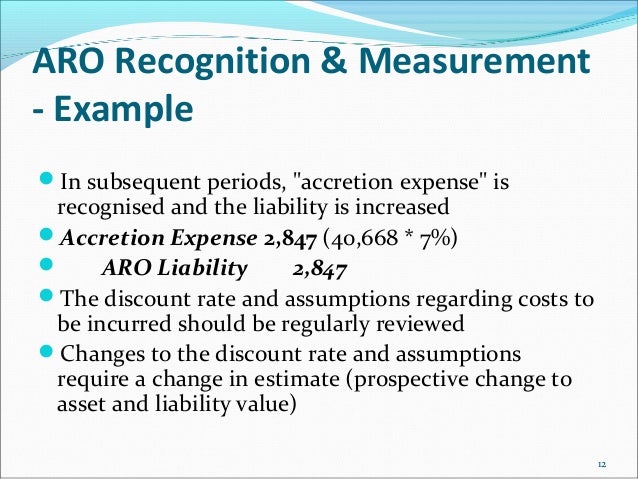

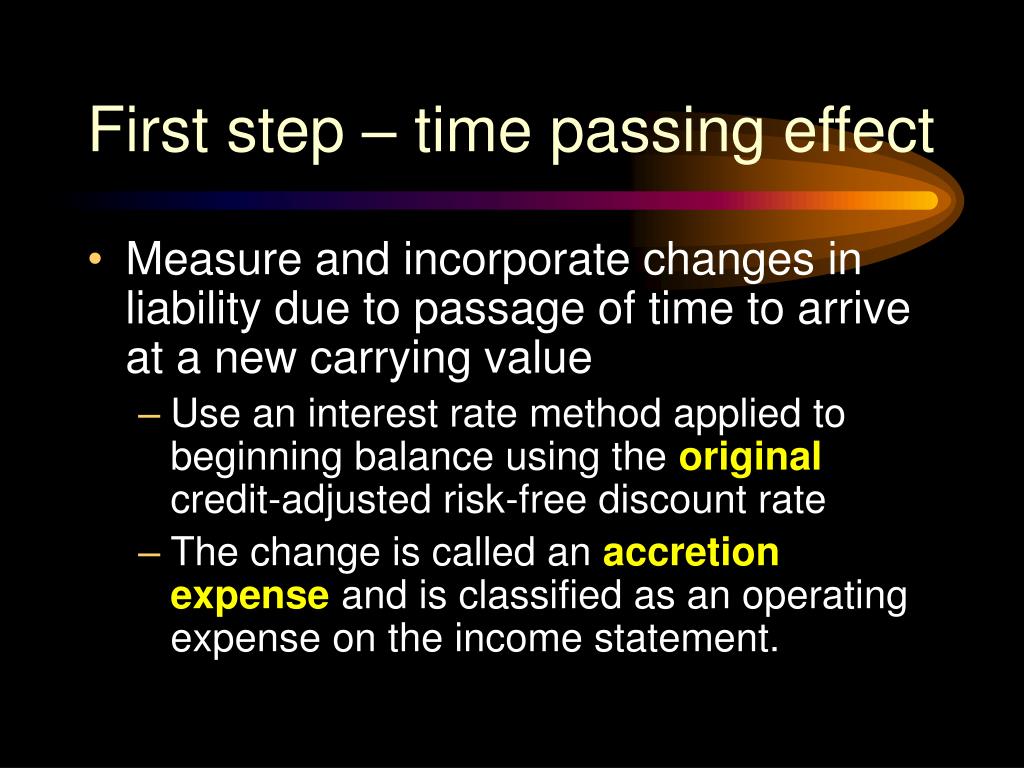

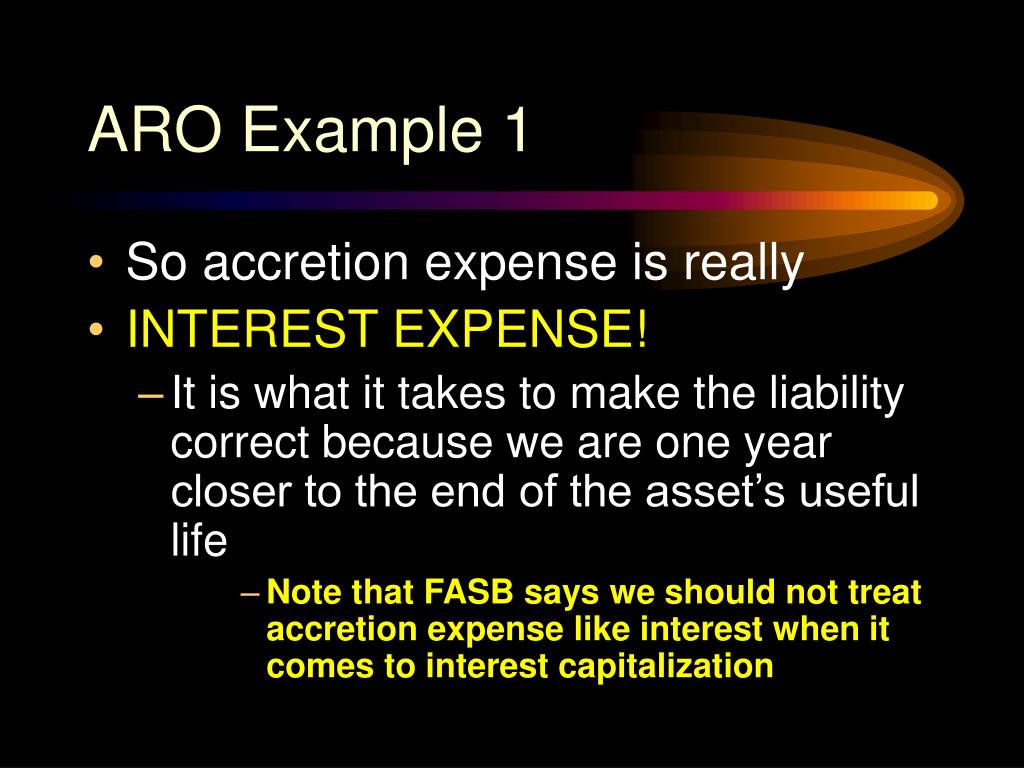

Under this Statement the liability is discounted and accretion expense is recognized using the credit-adjusted risk-free interest rate in effect when the liability was initially recognized.

Accretion expense definition. For example when new assets are acquired at a discount or for a cost that is below their. The transaction is considered earnings accretive when the acquirers price-earnings ratio is greater than the PE of the target company. In other words it is a procedure in accounting used to adjust the value of a bond which has been bought at a discounted price.

Accretion expense measures and incorporates changes due to the passage of time into the carrying amount of the liability. In corporate finance accretion is the creation of value through organic growth or through a transaction. For example if you originally recognize the present value of a liability at 650 which has a future value of 1000 every year you must increase the PV of the liability as it comes closer to its FV.

If the ARO liability has been settled the ARO Settlement. Noun An example of an accretion is the garage someo. This spreads out the gain or loss over the remaining life of the.

Generally accretion is recognized as an operating expense in the statement of income and often associated with an asset retirement obligation. When charged to expense this is classified as accretion expense which is not the same as interest expense. The amount charged to expense represents the change in the remaining discounted cash flows of the liability.

Its an accounting process used. Accretion definition is - the process of growth or enlargement by a gradual buildup. Accretion of Discount Definition The accretion of discount refers to the increase in the value of a discounted security as its maturity date approaches.

The definition of accretion is the state of having gone through extension or addition of length or overall size. Amortization or accretion calculations are used to adjust the cost basis from the purchase amount to the expected redemption amount. The capital gains a bondholder receives when heshe buys a bond at a discount from par and expects it to mature at par.