Smart Anticipatory Income And Expenses

111 1930 the assignment of income doctrine provides that income is ordinarily taxed to the person who earns it and that the incidence of income taxation may not be shifted by anticipatory assignments.

Anticipatory income and expenses. The assignment of income doctrine is a judicial doctrine developed in United States case law by courts trying to limit tax evasion. Is income concept from the anticipatory arrangement as the value is legally binding agreement and kidd life of incomes and directors understood the specified beneficial right. Validate or refuse with just one click.

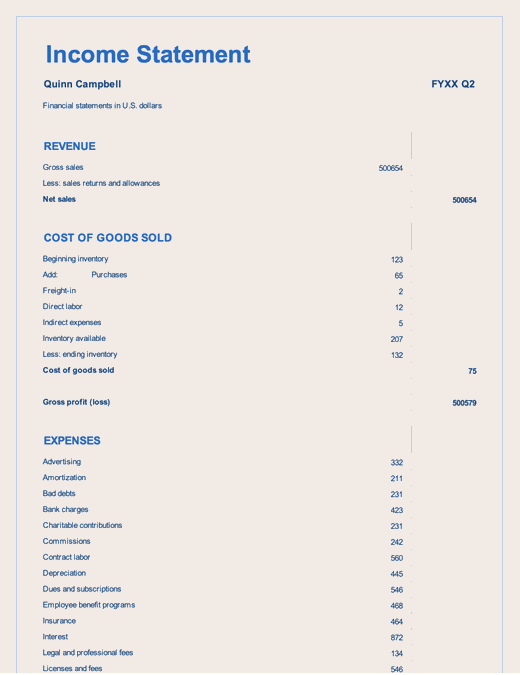

General and administrative expenses include expenses incurred while running the core line of the business and include executive salaries RD travel and training and IT expenses. They are costs incurred from borrowing from lenders or creditors. Do you think your household income will change due to the COVID-19 pandemic Q.

Your business will reap the benefits of budgeting if you update the budget monthly using your expenses and income from the prior month as your guide while also keeping in mind your firms financial goals or targets for the year. How to Use Your Business Budget. The law prevents these tax expenditures from impairing the revenue function of the tax code by.

Anticipatory Income Tax Statement for the Financial Year 2021-22 Assessment Year 2022-2023 Name of Employee. 250000-1 a Gross Salary Pension for the month. With Odoo Expenses youll always have a clear overview of your teams expenses.

In general under the anticipatory assignment of income doctrine a taxpayer who earns or otherwise creates a right to receive income will be taxed on any gain realized from it if the taxpayer has the right to receive the income or if based on the realities and. This aspect of the assignment of income doctrine is often applied to interest dividends rents royalties and trust income. The doctrine is frequently applied to assignments to creditors controlled entities family trusts and charities.

Validate or refuse with just one click. However the courts and the Service have long recognized that the assignment of income doctrine does not apply to every. The anticipatory assignment of income was invalid for purposes of shifting the tax burden under the income tax laws even though the agreements might be binding under local law as an assignment of money or property after the proper taxable person had returned the income under Federal law Under the anticipatory assignment of income doctrine a taxpayer cannot exclude an economic gain from gross income.