Best Companies Who Lends Loan On Projected Balance Sheet

The typical structure of a balance sheet for a bank is.

Companies who lends loan on projected balance sheet. Abbreviated notes of reasoning are listed under the column Changes Specific details of the rationale for the projected statements are provided as is required in the order in which they are presented in this section. You will need to make the loan repayments personally however the company can make repayments to you for the same amount if necessary thus paying back the directors loan. These loans are recorded as credits in the Directors Loan Account DLA and will be reported as current liabilities on the balance sheet when the company files its annual statutory accounts.

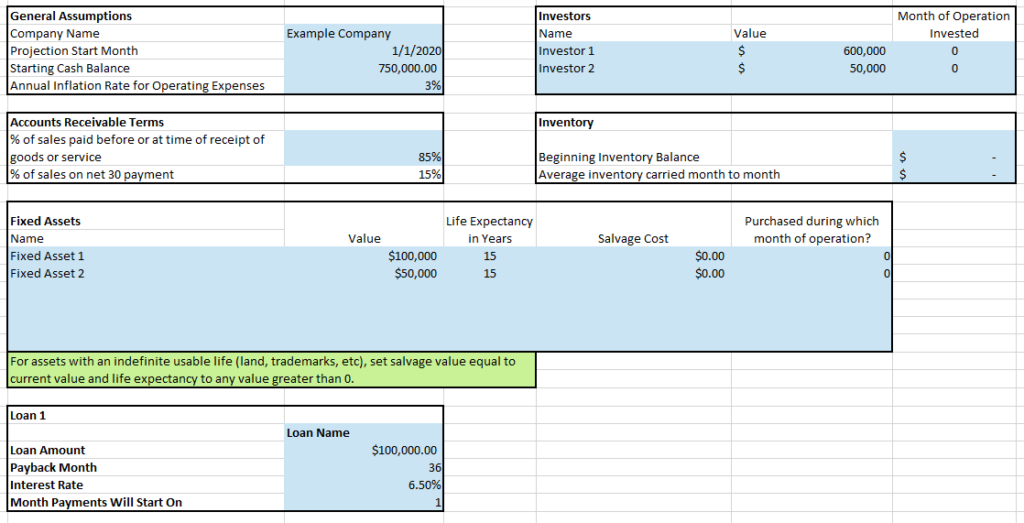

Small businesses forecast financial statements by looking at relevant historical data and using the information to make future predictions about the financial state of the company. You can lend the money from the personal loan to your company and this should be treated as a Directors Loan from you in the accounts. In match your wealth with your goals in life I explained the right philosophy you should have when thinking about your assets and liabilities.

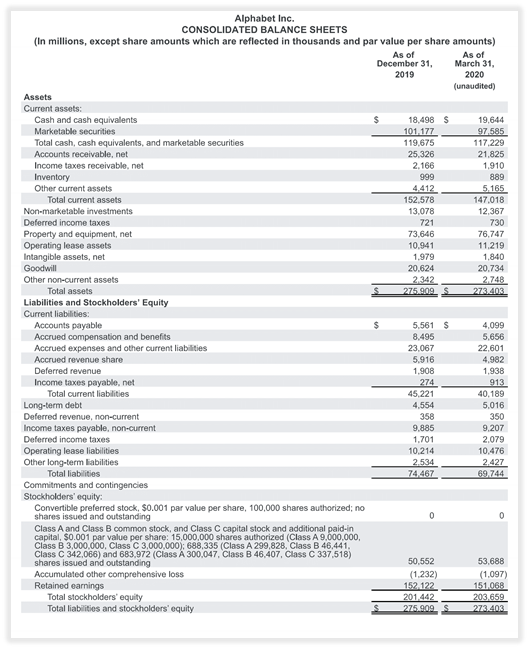

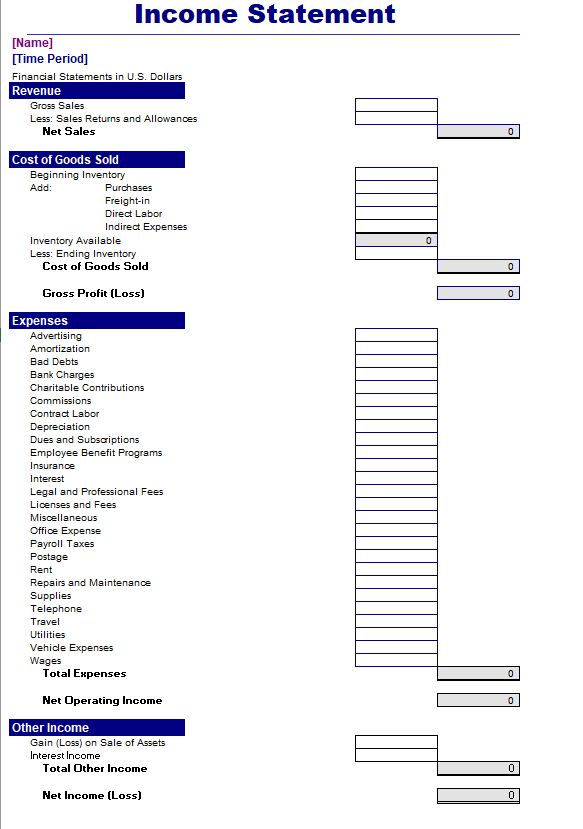

Ad Loan up to 90 of Your Credit Limit. Balance sheets list assets liabilities and owner equity typically in order from shortest- to longest-term assets and liabilities divided on either side of the balance sheet Financial Post. Income statements and business balance sheets for the past three years Projected balance sheets and income statements for two years Projected cash flow statements for at least the next 12 months Personal and business tax returns for the last three years A business plan depending upon the credit history of your business and the purpose for the loan.

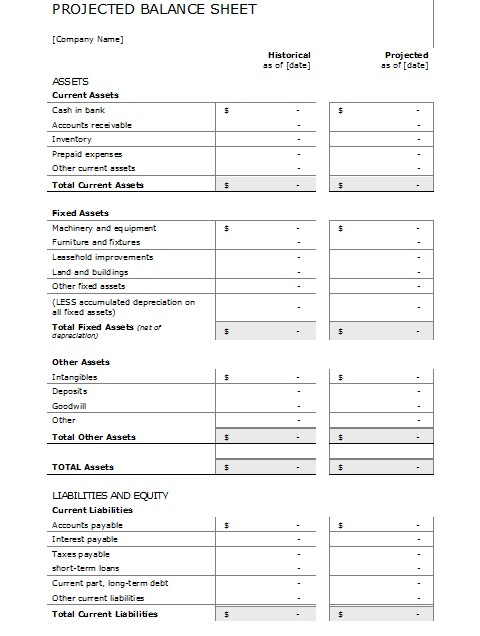

For example the money you spend to repay a loan or buy new assets doesnt show up in the Profit and Loss. It is important to keep a record of any loans directors make to the company whether they involve cash loans deferred salary payments or payment for products or services on the companys behalf. To begin forecasting a balance sheet youll first need to estimate your businesss net working capital.

The lifetime asset and liability of many of us. The first balance sheet shows that the owner has already invested 13500 into the business in the form of cash prepaid insurance and furniture and fixtures. Income statements balance sheets and cash flow statements.

For an existing business you can anticipate a request to produce. The above is simply an example however Xero has created free templates in Google Sheets that you can use to begin plugging your own numbers in. Forecast Net Working Capital.