First Class Aro Accounting Example

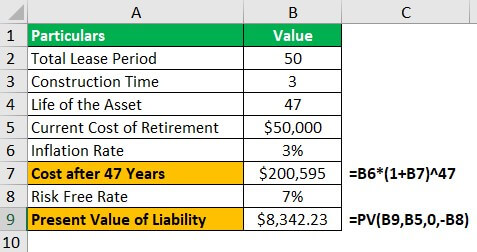

There are accounting principle-specific calculation parameters that are relevant on ARO level and that do not change during the ARO lifetime.

Aro accounting example. In FASBs words Statement no. Along with Advantages and Disadvantages. Here we discuss the Example and How does Asset Retirement Obligation Work.

An asset that may require decommissioning at a substantial cost to a government such as power plants nuclear reactors or sewage treatment plants. Typical examples of an ARO are when a store builds out the leased space to their specific layout or a business paints and updates a space for their branding. An asset retirement obligation ARO is a liability associated with the eventual retirement of a fixed asset.

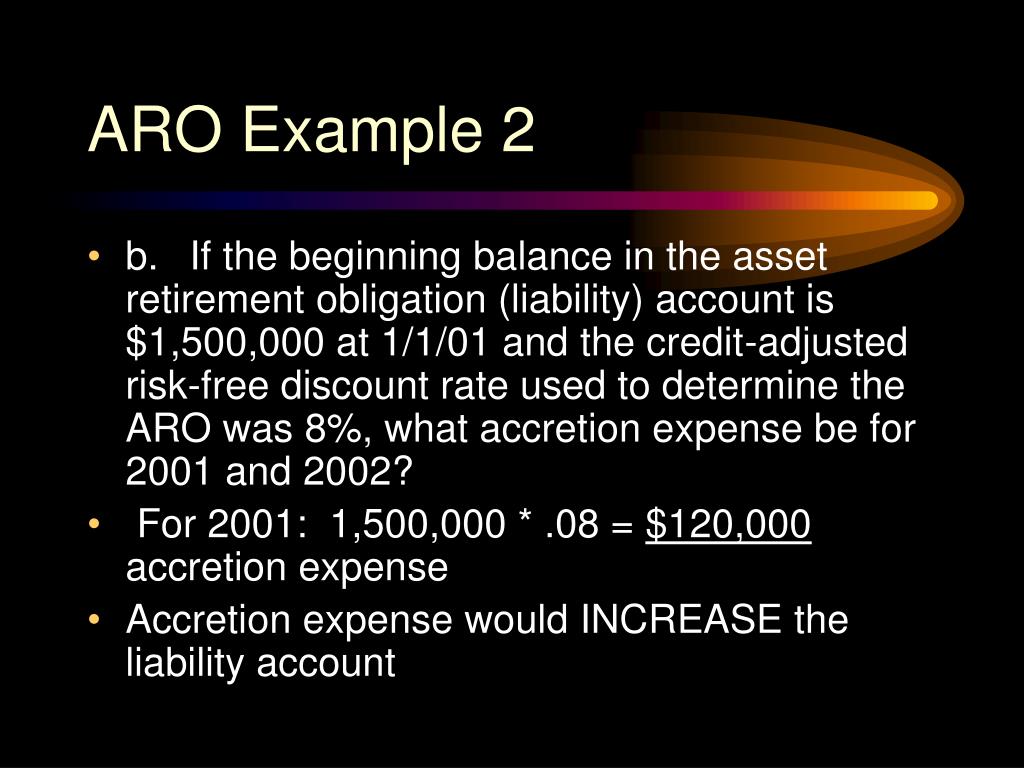

In accounting an asset retirement obligation ARO describes a legal obligation associated with the retirement of a tangible long-lived asset where a company will be responsible for removing. It is routine for lessees to have AROs associated with their real estate leases through. International Accounting Standards IAS Generally Accepted Accounting Principles GAAP and the German Commercial Code HGB.

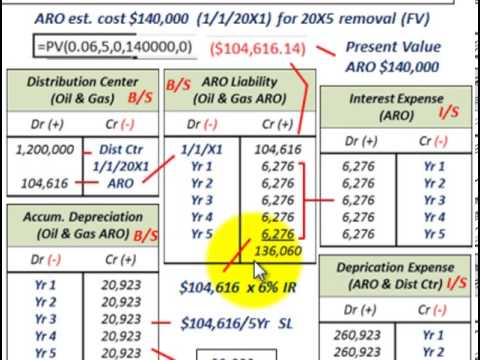

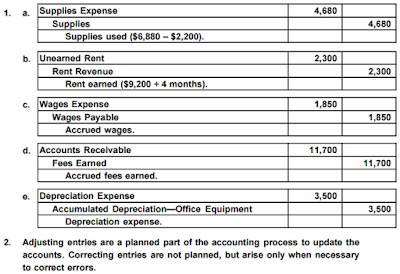

Accounting for asset retirement obligations Oil and gas accounting software Oil and gas ARO example 2. The new rules regarding the retirement of. Examples of accounting principles are.

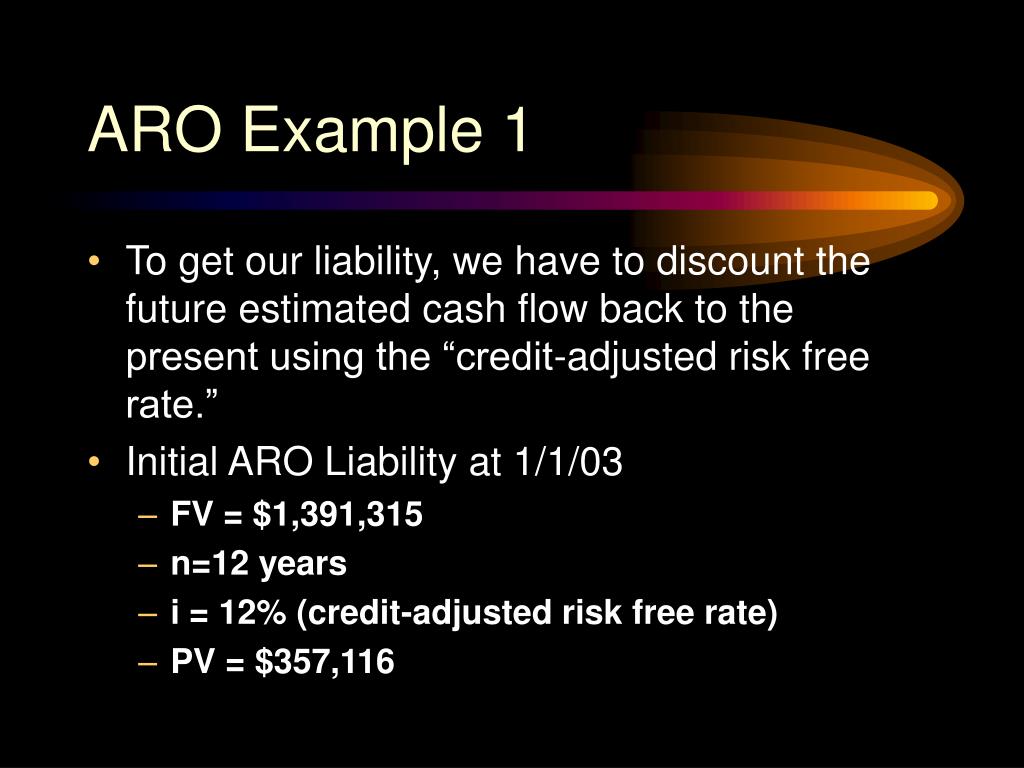

Decommissioning of nuclear reactors Removal and disposal of wind turbines in wind farms Dismantling and removal of sewage treatment plants. For example if a nuclear plant is retired in January but will take five months to remove all contaminated materials the ARO would be derecognized over the five months using a systematic method consistent with the remaining liability. For purposes of applying this Statement an ARO is a legally enforceable liability associated with the retirement of a tangible capital asset.

Landfills are a common ARO but they are already covered in the GASB Statement 18 Accounting for Municipal Solid Waste Landfill Closure and Postclosure Care Costs and the GASB Statement 83 Certain Asset Retirement Obligations does not change their current accounting and reporting. The current cost to remove the tanks is 15000. Related articles Asset Retirement Obligations ARO are commonly associated with industries such as oil and gas mining waste disposal or nuclear energy.