Spectacular Balance Sheet Gross Up

Items you own can be considered tangible assets such as land and equipment.

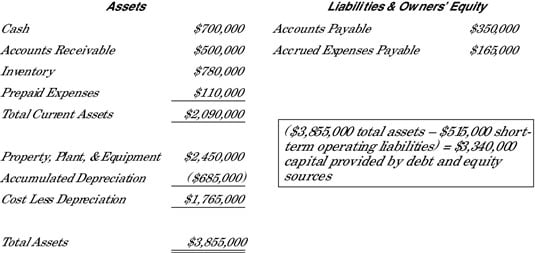

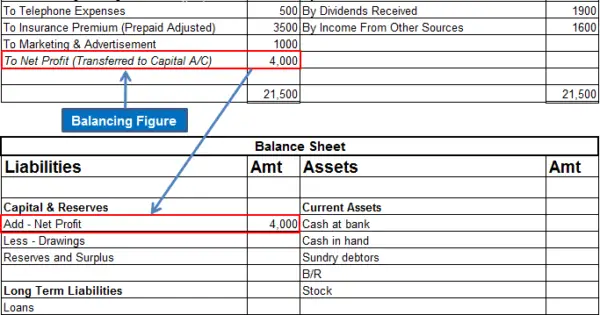

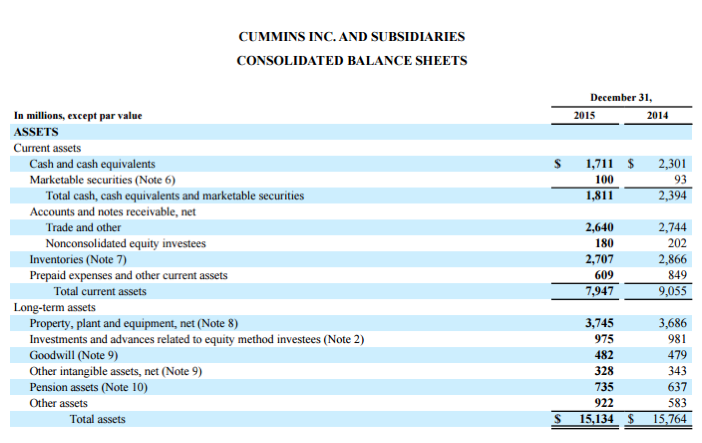

Balance sheet gross up. So now we can see that the balance sheet equation says which is Total assets Total Liabilities Total equitys shareholders and in this case it is 183500. The gross receivable figure is usually classified as a current asset on the balance sheet. A balance sheet reflects your companys overall financial situation at a particular moment in time.

These can be anything from cash to patents. It lists all of your businesss assets and liabilities. Gross Profit Gross Profit Gross profit is the direct profit left over after deducting the cost of goods sold or cost of sales from sales revenue.

The balance sheet is a snapshot of a businesss financial records at a given date. Working capital money needed to fund day-to-day operations. Gross amounts offset in the statement of financial position.

It calculates owners equity by subtracting total assets from total liabilities. The principal revenue-generating activities of an organization and other activities that are not investing or financing. Total Assets is calculated as.

Its used to calculate the gross profit margin. Your balance sheet shows what each asset is worth which is important if you want to raise money or sell your business. If you showed them separately in assets AND liabilities then this is what is referred to as a balance-sheet gross-up because the result is that Total Assets and Total Liabilities would be higher than if you had combined the net amount into one single asset or liability position.

Which will be on yours depends on what your business does and what it owns. Total Assets 183500. Balance sheets help current and potential investors better understand where their funding will go and what they can expect to receive in the future.