Formidable Retained Earnings Calculation Example

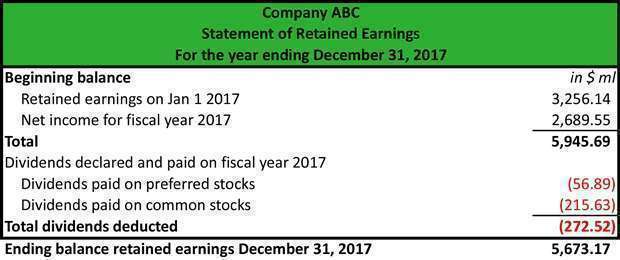

The following is a simple example of calculating retained earnings based on the balance sheet and income statement information.

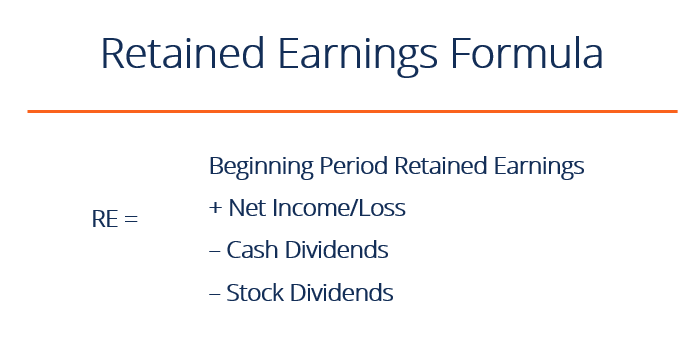

Retained earnings calculation example. Examples of these items include sales revenue cost of goods sold depreciation and other operating expenses. Retained earnings for the reporting period can be calculated by simply subtracting the dividends paid to shareholders of the company from its net income. The formula for calculating retained earnings is as follows.

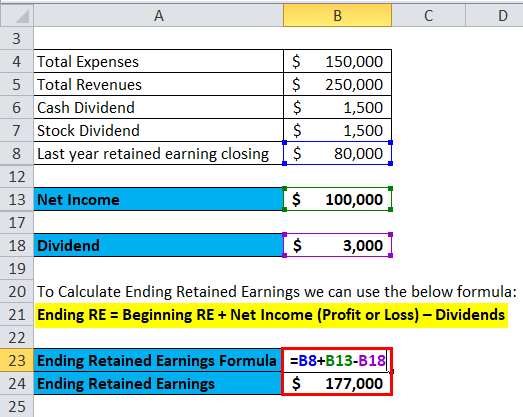

To calculate Retained Earnings the beginning Retained Earnings balance is added to the net income or loss and then dividend payouts are subtracted. Businesses that generate retained earnings over time are more valuable and have greater financial flexibility. Retained Earnings Formula Example 1 Suppose Jargriti Pvt Ltd wants to calculate the Retained earnings for this financial year end.

Example of Retained Earnings Calculation The following figures are taken from the income statement and balance sheet of Company A. Your retained earnings account on January 1 2020 will read 0 because you have no earnings to retain. As you can see in the retained earnings formula below one either adds the profit or subtracts the loss.

Below is the available information from the Balance sheet and income statement of Jagriti Pvt. Retained earnings are all the net income profits you have left after paying out dividends or distributions to ownersshareholders. When the company earns a profit they can either use the surplus for further business development or pay the shareholders or both.

Retained earnings RE beginning retained earnings net income or net loss cash dividends stock dividends. Naturally the same items that affect net income affect RE. The retained earnings formula is.

The first is the parents individual retained earnings and the second is the parents share in the subsidiarys post-acquisition retained earnings. How To Calculate Retained Earnings Formula Example and More Retained earnings is the amount that the business is left with after paying dividends to the shareholders. Usually such calculations are performed by an accountant this is an essential part of their work.