First Class Balance Sheet Is Prepared On The Basis Of Which Conce

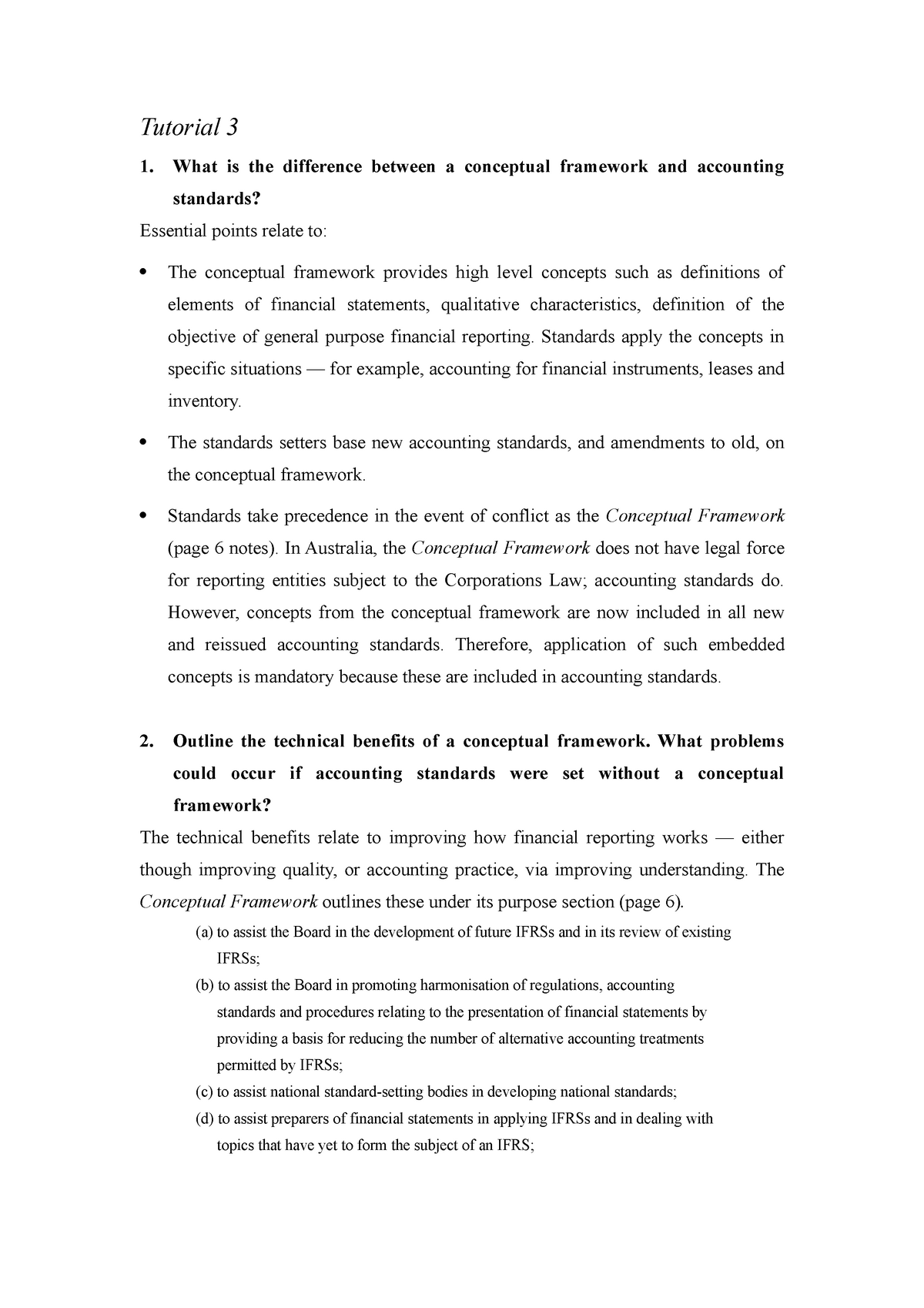

Statement of affairs is often confused with Balance Sheet as it also lists out assets and liabilities of the companyBalance Sheet exhibits the position of business at a given date.

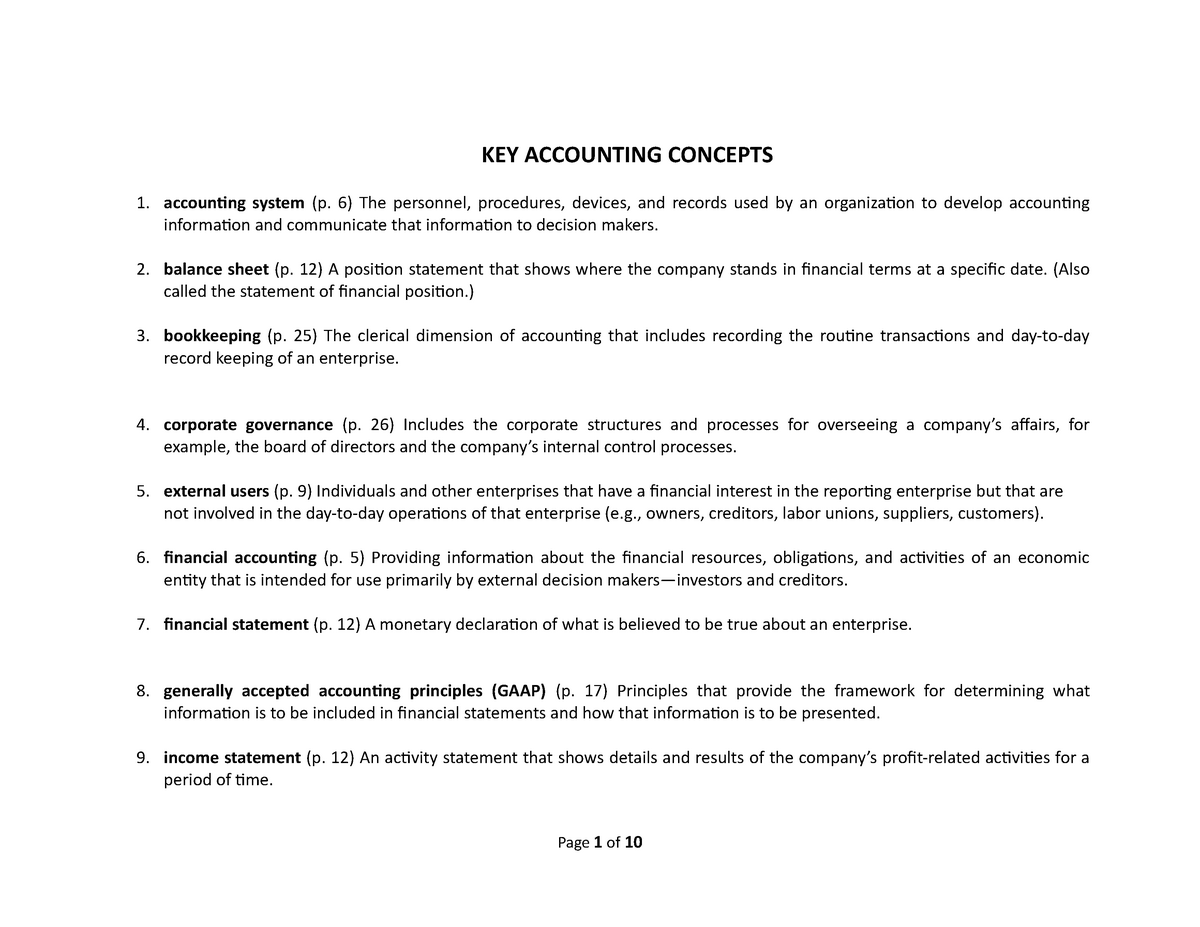

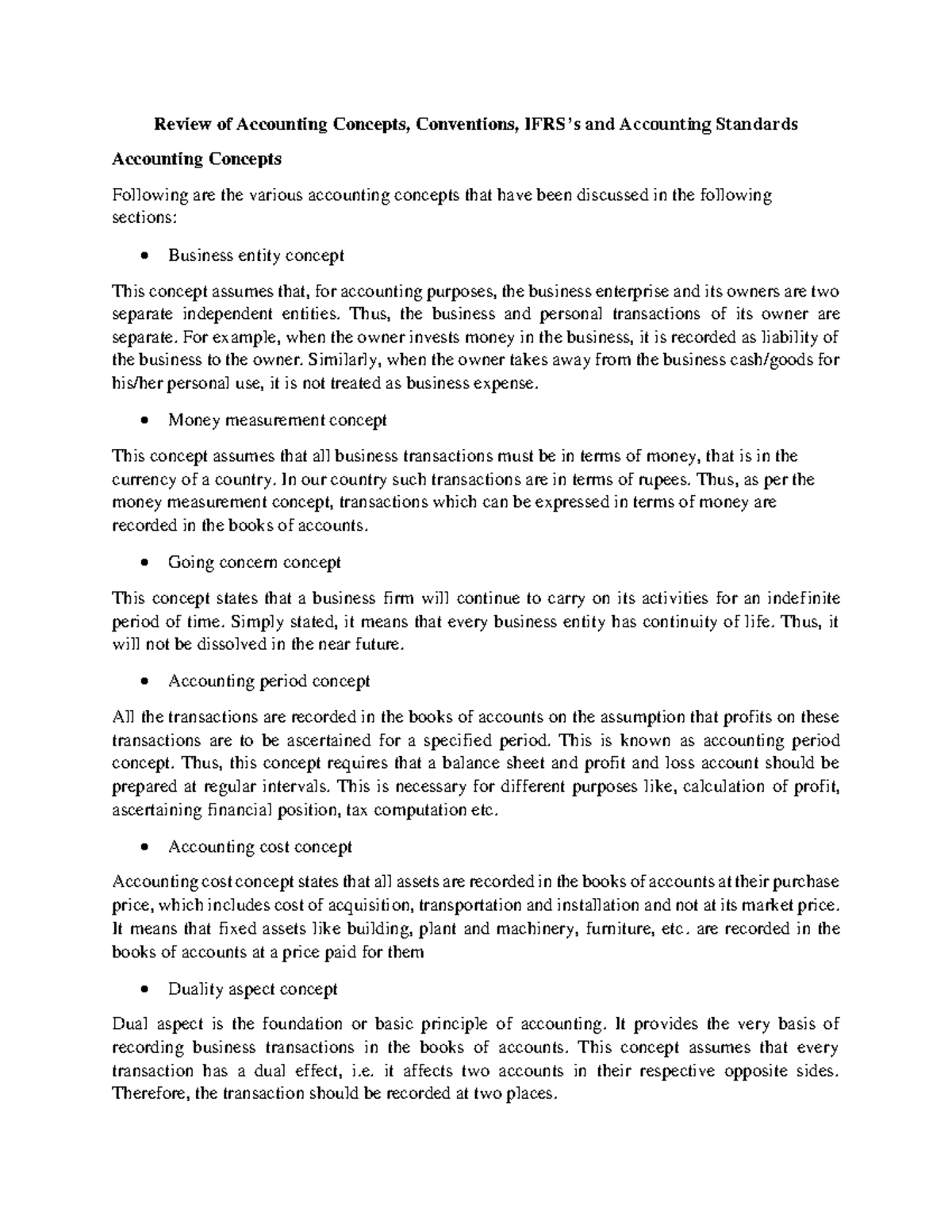

Balance sheet is prepared on the basis of which conce. The headings of the two sides are Assets and Liabilities. A corporations balance sheet reports its. This concept better represents the financial condition of a business than does the cash basis of accounting.

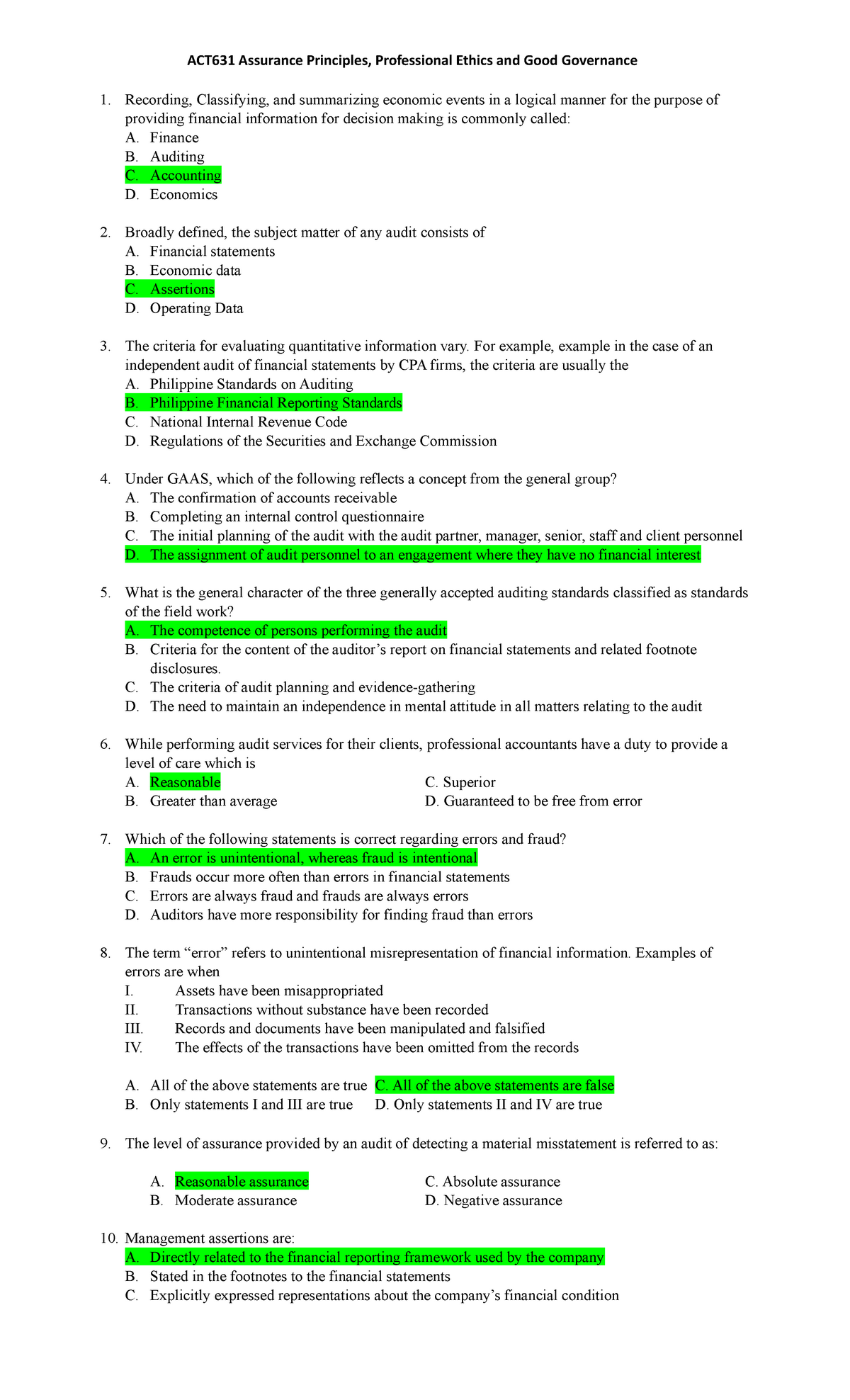

Assets resources that were acquired in past transactions Liabilities obligations and customer deposits. The assumption is that the fixed assets are not intended for re-sale. Such policies relate to inventory valuation ie closing stock depreciation etc.

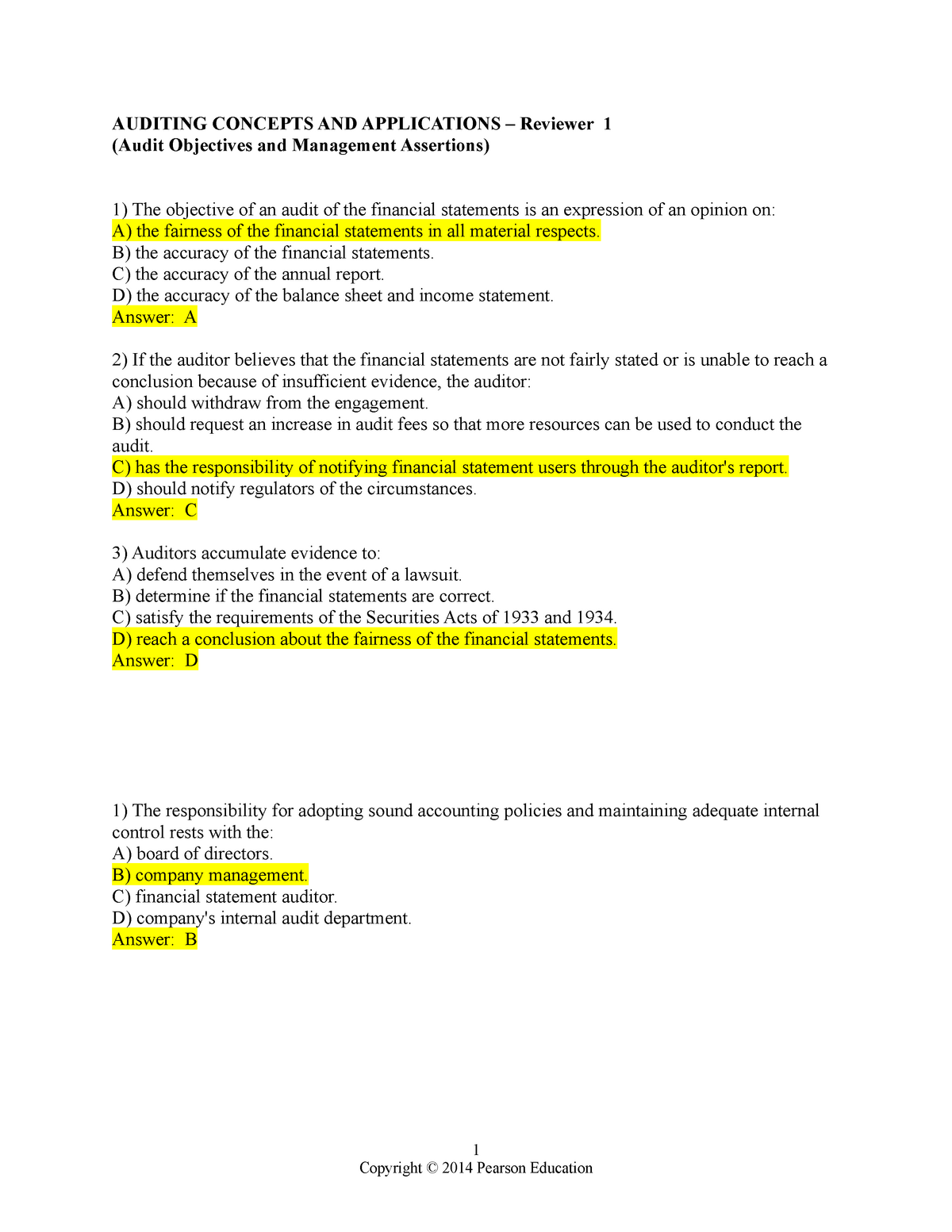

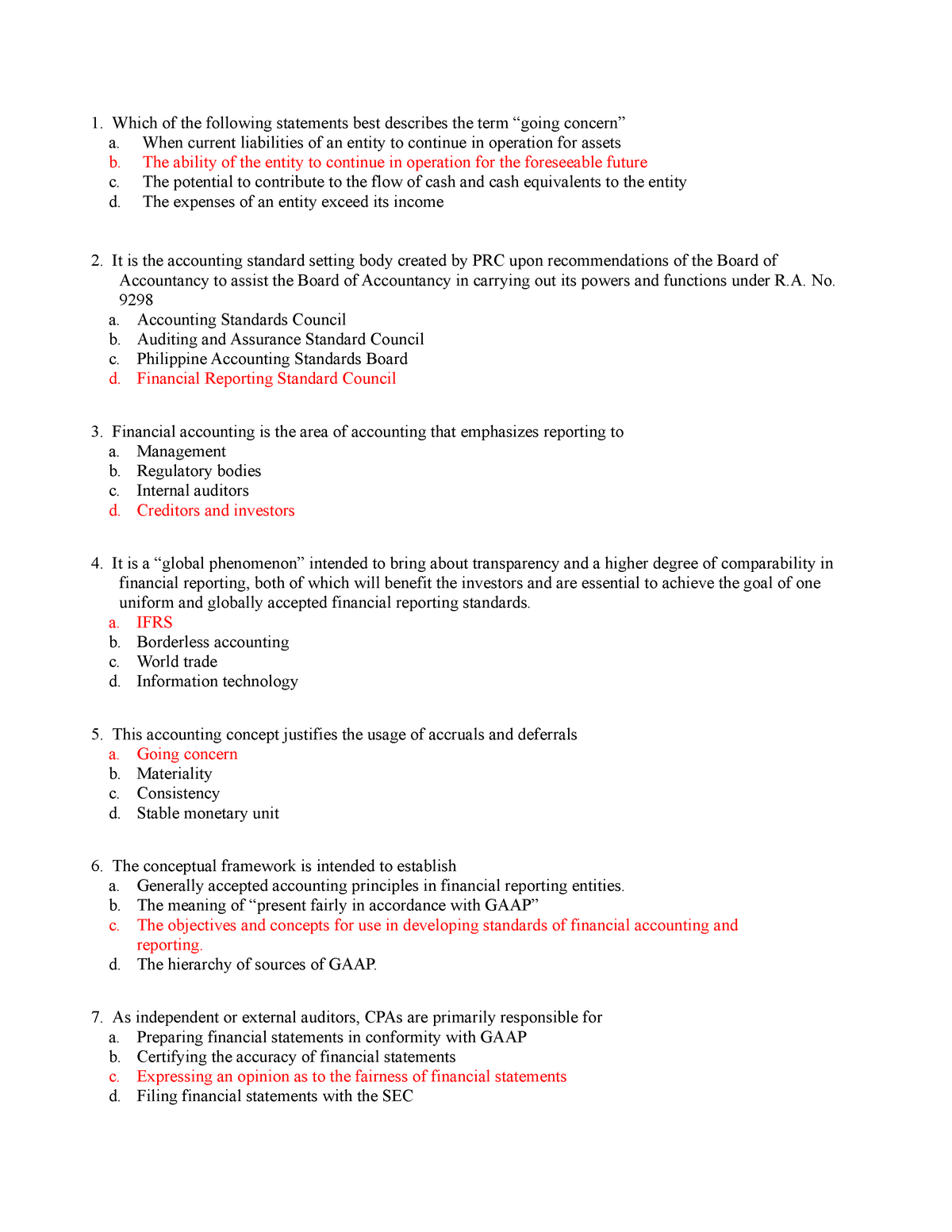

All these accounts are called as Ledger ACs or a Balance Sheet consists of various ledgers. Financial statements are prepared following the consistent accounting concepts principles procedures and also the legal environment in which the business organisations operate. The going concern assumption is the reason assets are generally presented in the balance sheet at cost rather that at fair market value.

Inventory may be valued using several methods like First-in-First Out FIFO Last-in-First-Out LIFO weighted average cost etc. The important features of balance sheet are as under. The book value reported in the balance sheet is therefore also an estimated value.

Hence a balance sheet is prepared on the basis of ledger accounts. It is a summary of what the business owns assets and owes liabilities. A balance sheet is prepared based on certain accounting policies.

Balance sheets are usually prepared at the close of an accounting period such as month-end quarter-end or year-end. Financial statements are prepared with the assumption that the entity will continue to exist in the future unless otherwise stated. The balance sheet discloses financial position of the business.