Spectacular Aro Accounting Journal Entries

Journal entry to record the write-off of accounts receivable.

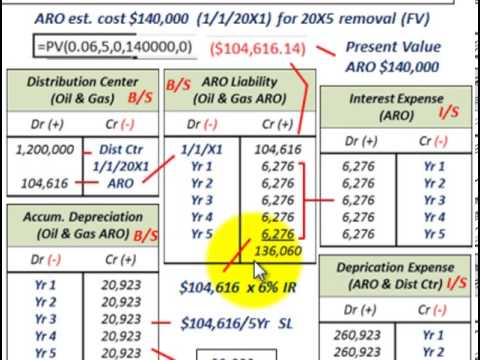

Aro accounting journal entries. The accounting records are aggregated into the general ledger or the journal entries may be recorded in a variety of sub-ledger. As the name suggest it is a liability which is created from the very first day when the related asset is recored. An asset retirement obligation ARO is a liability associated with the eventual retirement of a fixed asset.

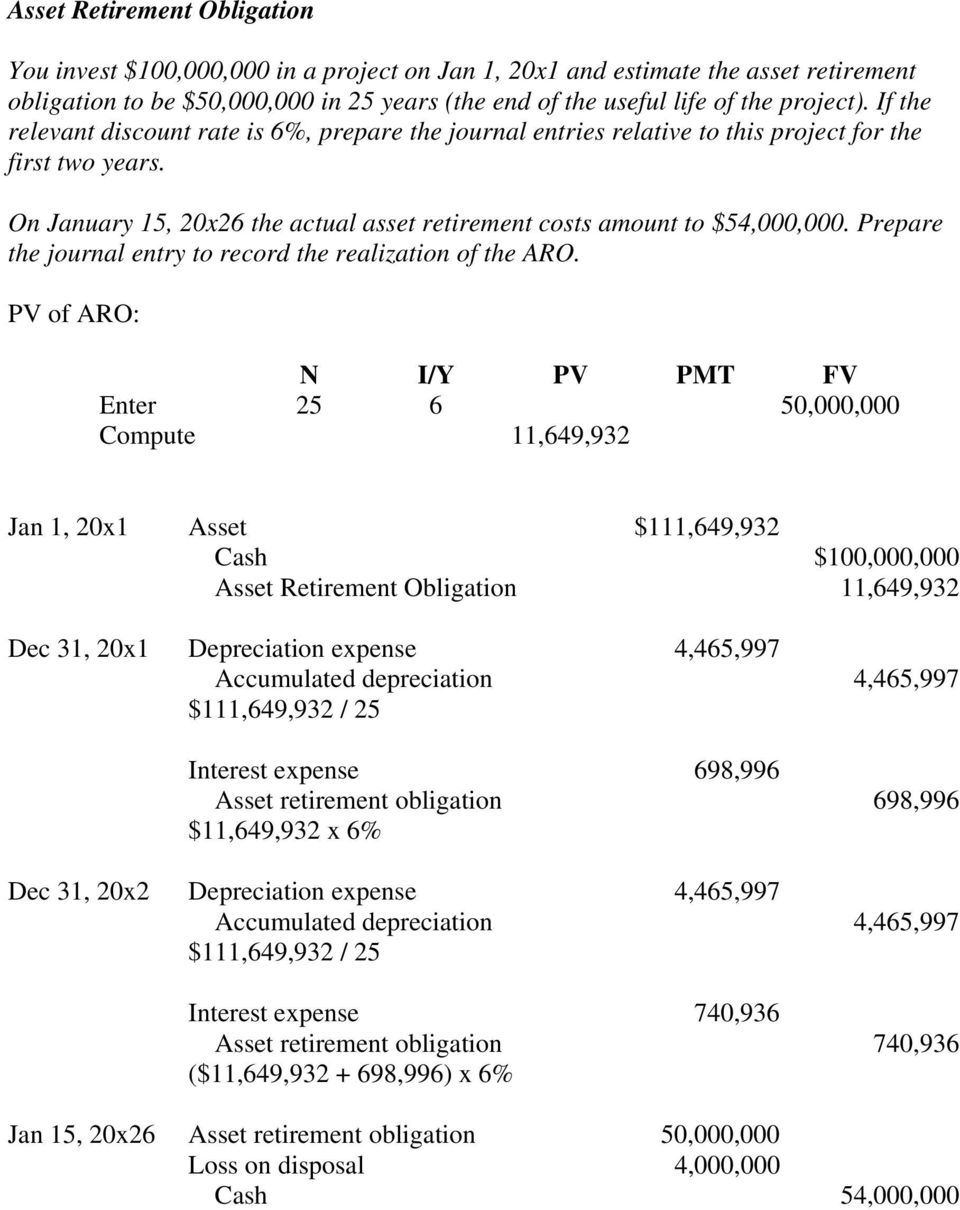

The journal entry to record this cost would be a debit to accretion expense offset by a credit to the ARO liability. The journal entry is therefore. Asset Retirement Obligation Accounting Journal Entries.

The cumulative effect of the change in accounting principle is dependent on whether companies have recognized and depreciated estimated retirement costs prior to adopting SFAS 143. AROQuery calculates the ARO liability balance at each reporting date as well as periodic accretion expense from a few simple inputs such as the estimated settlement cost settlement date and associated rates ie. Net book value of zero less the 422500 retirement liability whereas depreciation accounting results in a negativeand counter-intuitivenet asset balance exhibit 3.

Credit-adjusted risk-free rate inflation rate market risk. 1 The Retirement Accounting Entry Template for Asset Retirement Obligation ARO contains Distribution Type ARO Liability AL and Distribution Type ARO Settlement AS. Property 20000 Calculated as 15000 accumulated depreciation plus the 4250 calculated loss net salvage of 750 less the cost of the.

Some examples specific to the oil and gas industry include oil well plugging and. Related articles Asset Retirement Obligations ARO are commonly associated with industries such as oil and gas mining waste disposal or nuclear energy. Exhibit 1 discloses the result of these calculations and the journal entry for the adoption of SFAS 143 on January 1 2003.

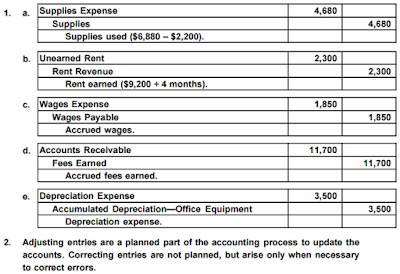

A business should recognize the fair value of an ARO when it incurs the liability and if it can make a reasonable estimate of the fair value of the ARO. In accounting an asset retirement obligation ARO describes a legal obligation associated with the retirement of a tangible long-lived asset where a company will be responsible for removing. This appendix contains a comprehensive list of every journal entry that an accountant is likely to deal with.