Peerless Balance Sheet Of A Partnership Firm In India

Formulas are not feeded in this its just a Simple format.

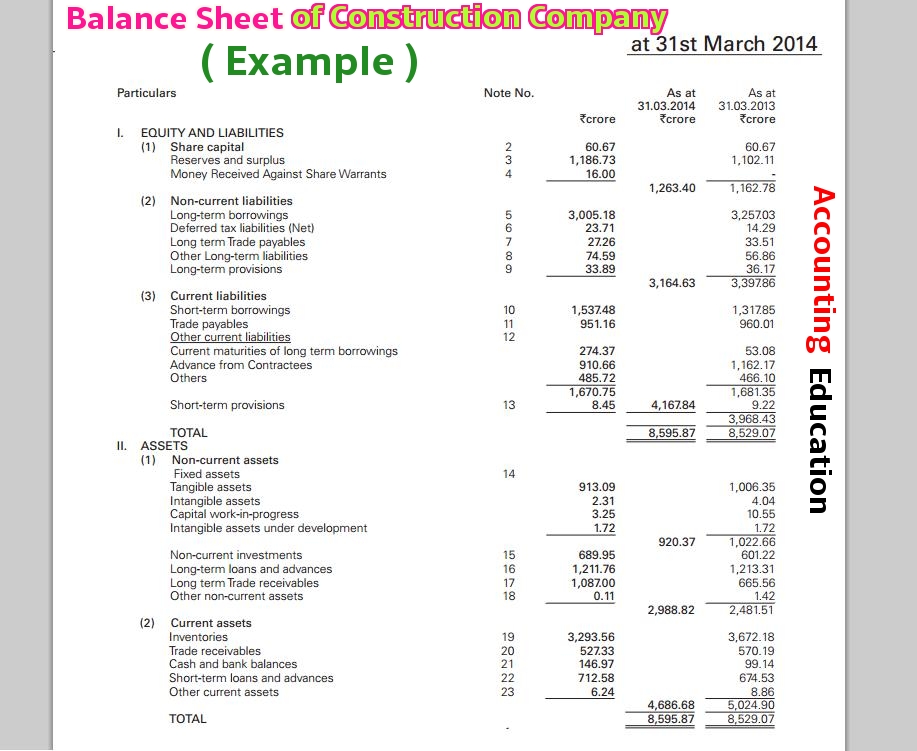

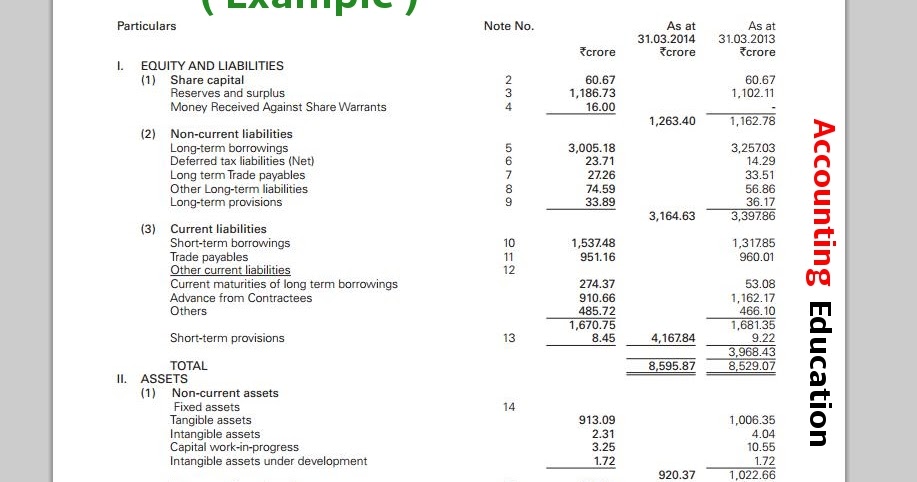

Balance sheet of a partnership firm in india. Partners Share of Profit Loss in LLP 155254 - PARTNERS CAPITAL ACCOUNT 135254 20000 NOTE 3 RESERVES SURPLUS Deficit from Statement of Profit Loss As per last Balance Sheet. Balance sheet is prepared annually or at the end of the financial year. The balance sheet of the firm as on 31st December 201 3 is as below.

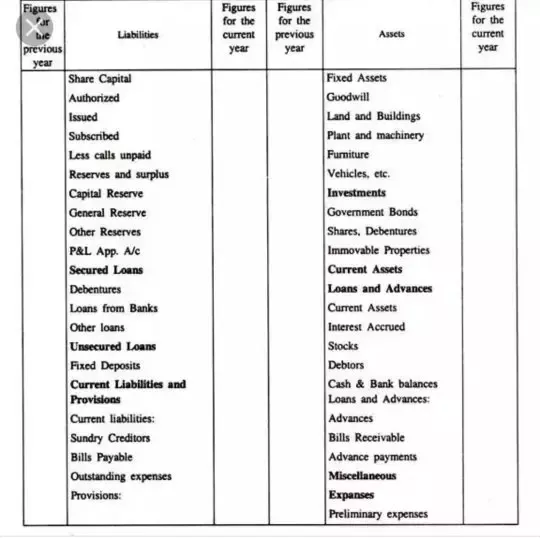

We will illustrate the required journal entries to be made for closing the books of a firm with the example given below. By using the Vyapars balance sheet formats you can enter the records of your fixed assets that your business owns list up all the liabilities in any formand thereby devise the net worth of your company. A and B share profit and loss equally.

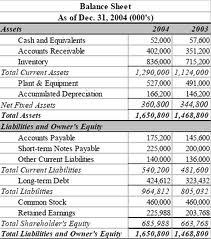

This is my new Excel file which contain Trading Profit Loss ac and Balance Sheet format in excel with annextures also. 8 000 is to be accrued. 31 20X1 Liabilities Assets Sundry Creditors 20000 Plant and Machinery 40000 Fasts Loan 10000 Patents 6000 General Reserve 10000 Stock 25000 Capitals.

Under Income Tax Act a partnership firm is defined under Section 223 i which takes the meaning of the Firm from the Indian Partnership Act 1932. A s Capital 15000 Factory Building 24160 B s Capital 7500 Plant Machinery 16275. The balances shown in balance sheet are shown as opening balances in next financial year.

On the balance of the book profit 60 of book profit. Balance Sheet format With Trial Balance fill trial Balance Auto made Balance Sheet as per Company Schedule and Regular Format Simple Format both. You can modify according to.

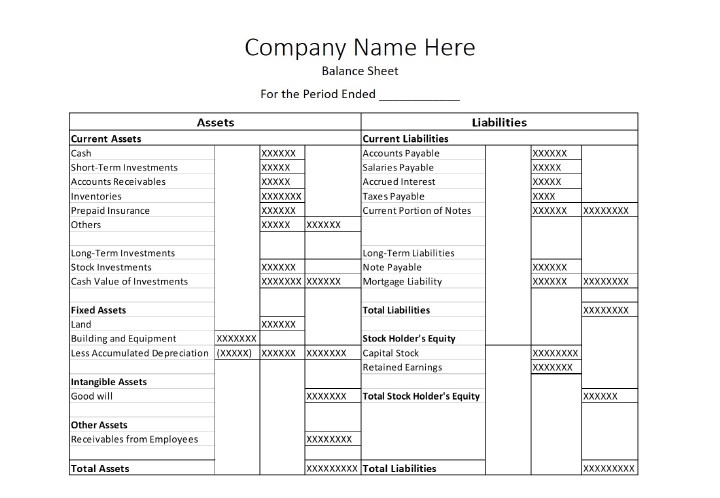

Balance sheet provides the result by following a formula Total assets Total liabilities Equity. Balance Sheet of the new firm. Let we explain liquidity of a business for you that is acknowledged as the ability of a business or company to pay debts in a timely manner as well as to check financial strength of the business.