Neat Bank Indebteness Increase

In March 2021 non-financial sector indebtedness stood at 7532 billion of which 3463 billion referred to the public sector and 4069 billion to the private sector the central bank says.

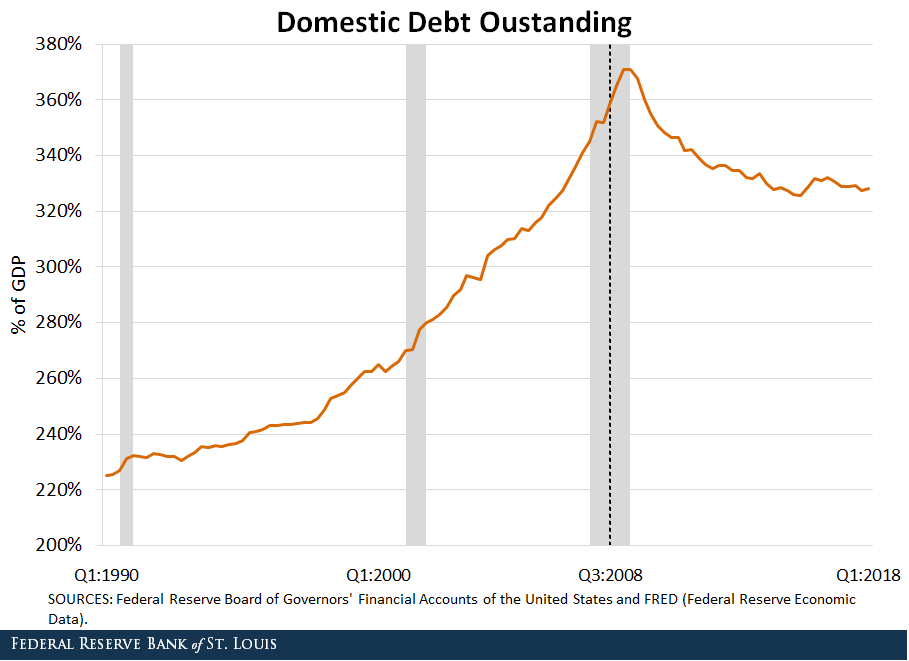

Bank indebteness increase. Reserve requirements which determine what level of reserves a bank is legally required to hold. The increase in household indebtedness and loosening of terms on new loans drive up the need for new macro-prudential tools. Bank Indebtedness means the Borrowers Indebtedness up to a maximum aggregate principal amount of 5300000000 under the following agreements as amended restated supplemented extended refinanced replaced or otherwise modified from time to time.

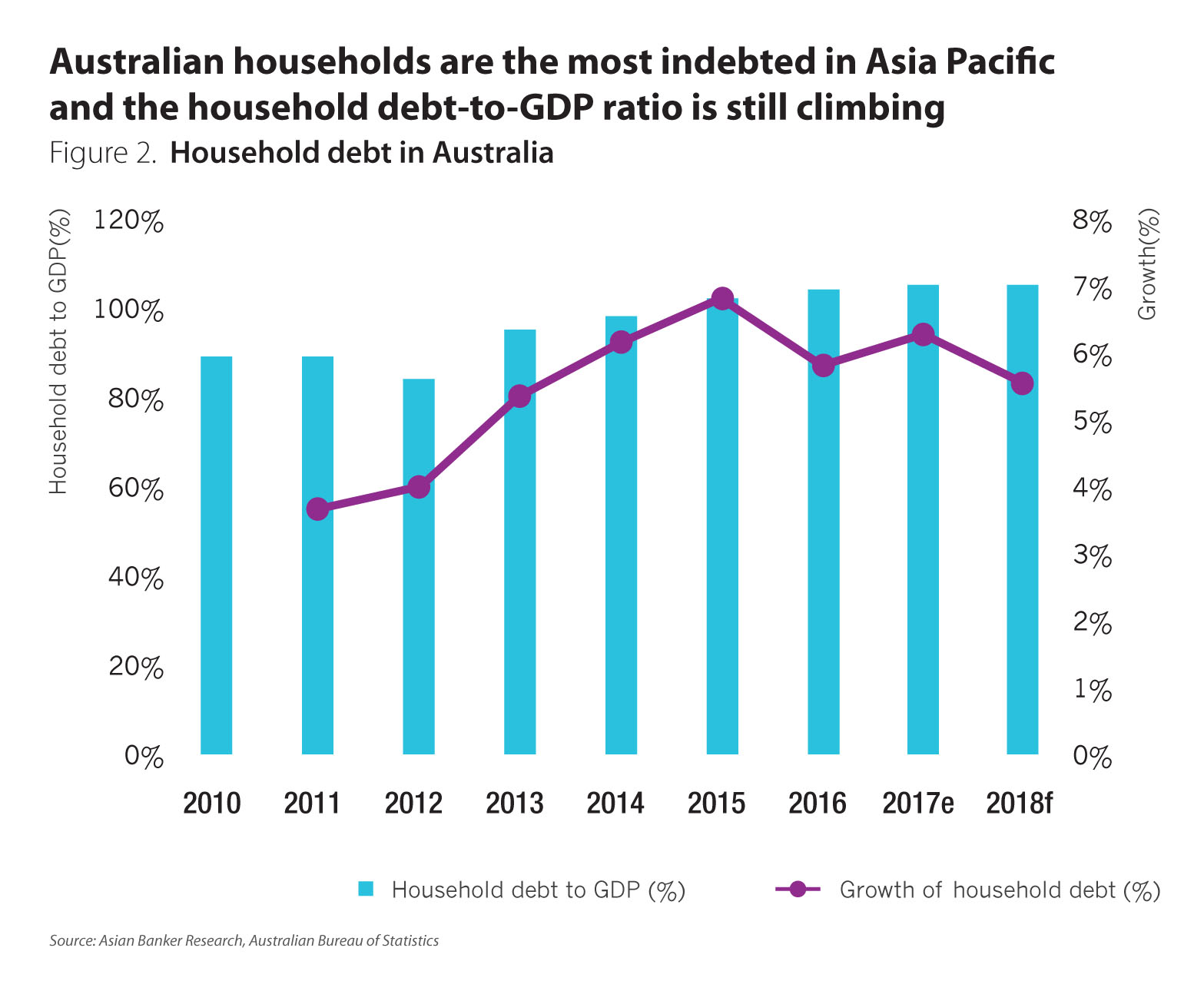

Before COVID Australian banks raised more than 100 billion a year in wholesale funding from foreign and local investors but the banks debt issuance slowed dramatically in the pandemic as. The increase recorded in recent years has only filled part of the gap. Bank Indebtedness means any and all amounts payable under or in respect of the Credit Agreement and any Refinancing Indebtedness with respect thereto as amended from time to time including principal premium if any interest including interest accruing on or after the filing of any petition in bankruptcy or for reorganization relating to the Company whether or not a claim for post-filing interest.

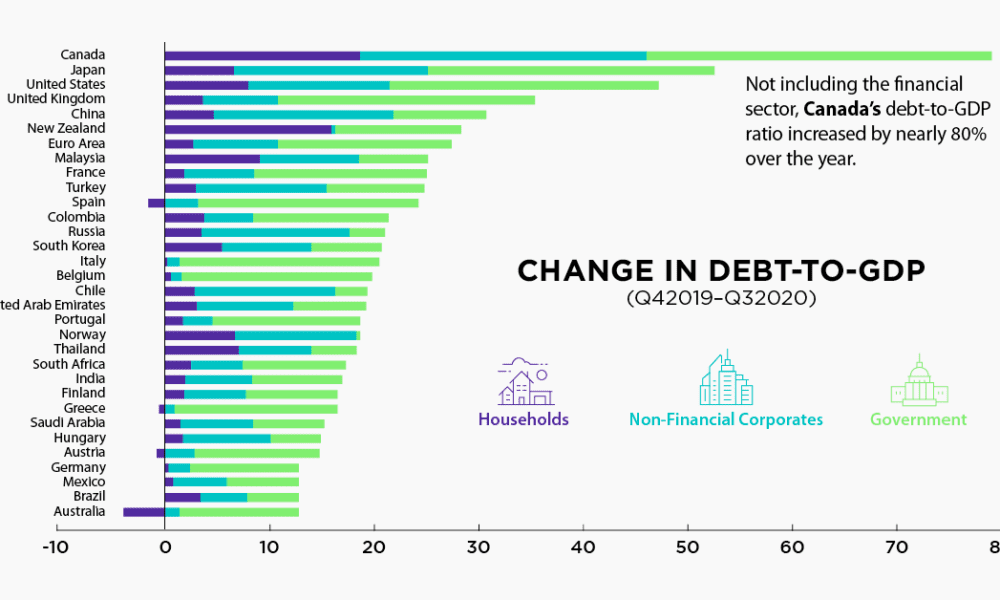

Clocks by ColdplayPlease subscribe so more people see thisJoin my discord at httpsdiscordggXN2saw4. Staff Analytical Note 2021-4 English Mikael Khan Olga Bilyk Matthew Ackman. At the start of the COVID19 pandemic Canada was facing two significant and interrelated financial vulnerabilities.

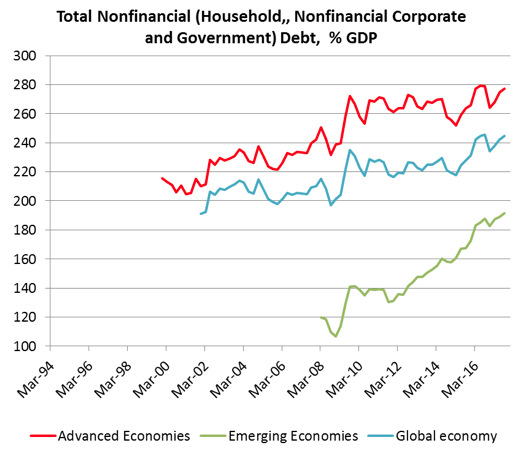

Give rise to concern for several reasons. Open market operations which involves buying and selling government bonds with banks. In June the monthly CPI increase is forecast to drop to 05 from 06 in May and 08 in April.

A central bank has three traditional tools to conduct monetary policy. Compared with February 2021 non-financial sector indebtedness increased by 18 billion. Update on housing market imbalances and household indebtedness.

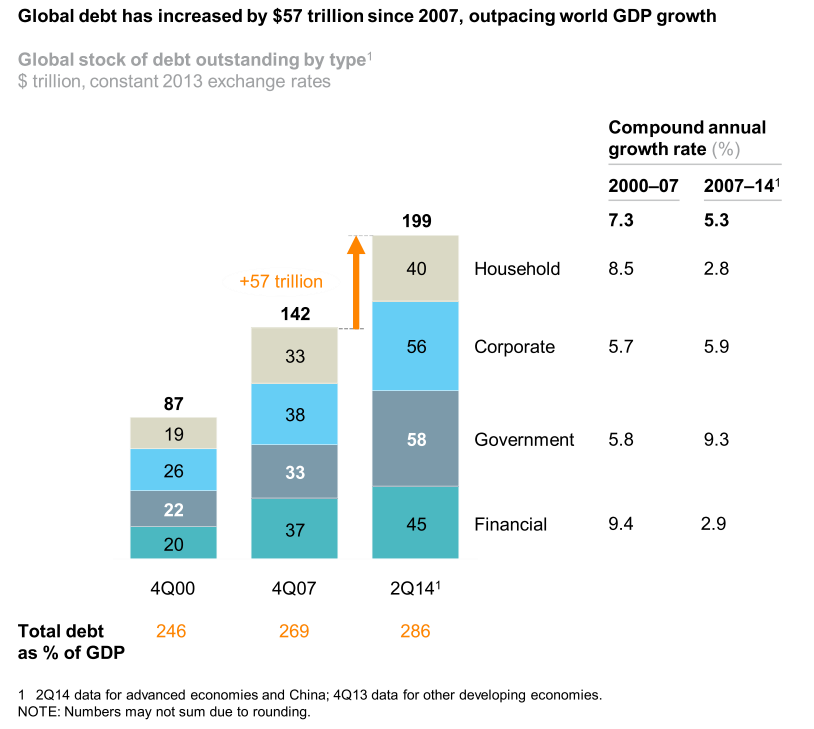

Total interest earned was 575 billion in green for the bank from their loans and all investments and cash positions. The first three debt waves ended with financial crises in many emerging and developing economies. CENTRAL BANK OF CYPRUS 6 Household and Non-Financial Corporations Indebtedness Report April 2017 1.

:max_bytes(150000):strip_icc()/DEBTEQUITYFINALJPEG-098e44fb157a41cf827e1637b4866845.jpg)