Breathtaking C Corp Balance Sheet

Paid-in capital treasury stock and retained earnings.

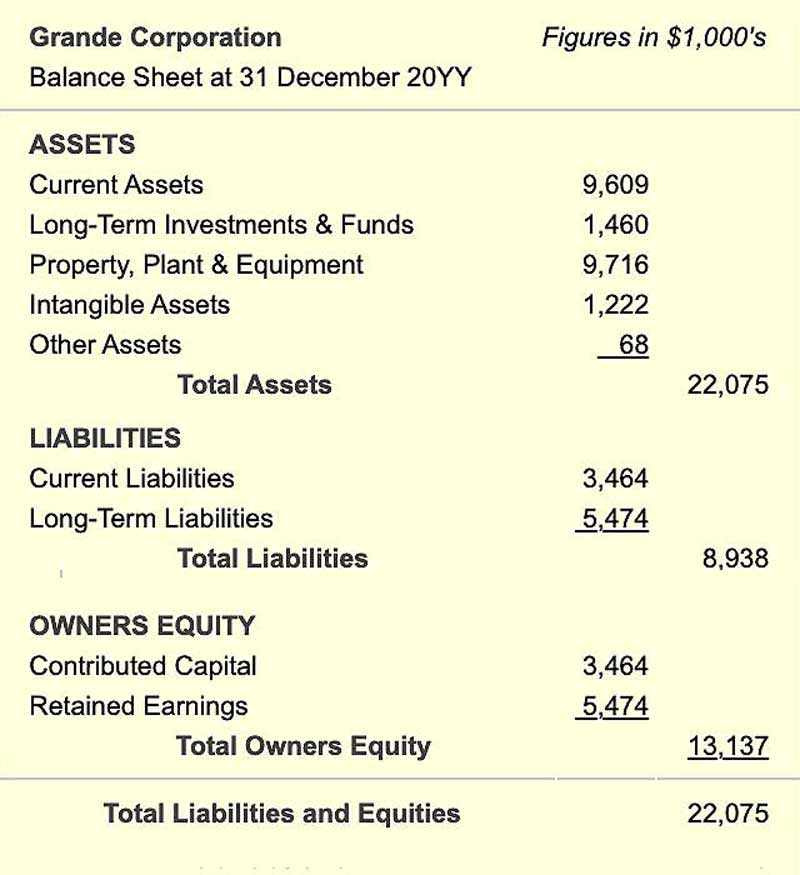

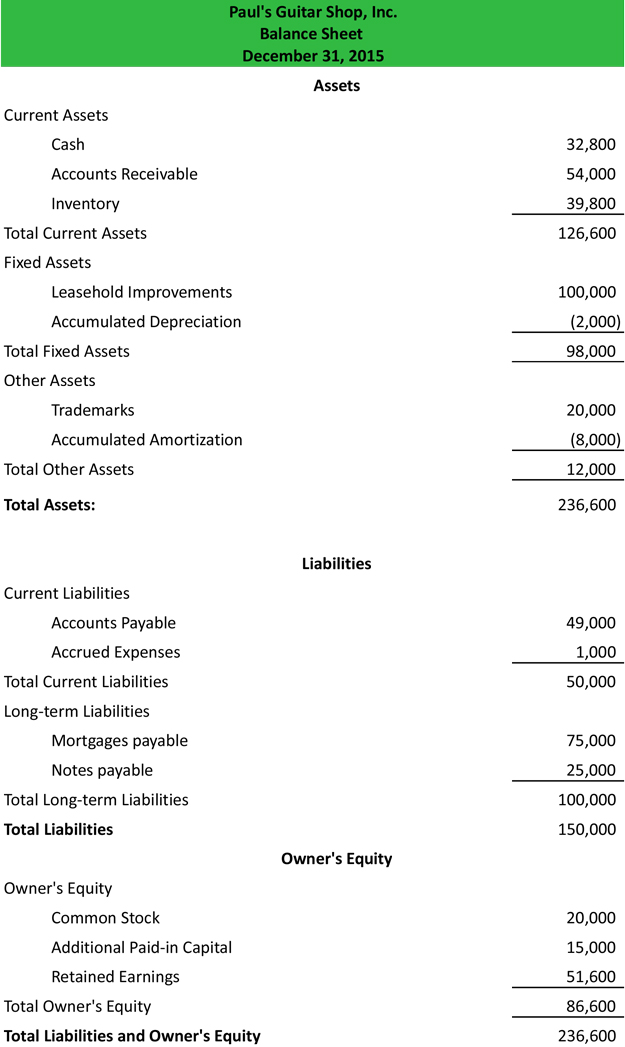

C corp balance sheet. The balance sheet should be zeroed out. The balance sheet lets you know exactly what things of value a company controls assets and who owns those assets. These financial statements are the responsibility of.

Do I do a Balance Sheet for C-Corp. Get the annual and quarterly balance sheet of TRULIEVE CANNABIS CORP TCNNF including details of assets liabilities and shareholders equity. This system of double taxation is precisely the reason why many people choose S corporation status as S Corporations pay no tax on their own at the corporate level.

Step two Input your S-corps cash balance in the asset section. The equity section of the balance sheet for a corporation shows the claim these shareholders have to the net assets of the business. Increase Corporate Income Tax Payable current liability on your balance sheet Cr.

The Balance Sheet Schedule L is required when the Gross Receipts are greater than 250000. By knowing the role that each of these sections plays and how each one relates to the others youll be able to get a good sense of a companys finances. - C NHTC including details of assets liabilities and shareholders equity.

Yes Per Page 21 of the IRS Instructions linked to below Corporations with total receipts page 1 line 1a plus lines 4 through 10 and total assets at the end of the tax year less than 250000 are not required to complete Schedules L M-1 and M-2 if the Yes box on Schedule K question 13 is checked. Enter the Balance Sheet and if applicable reconcile any losses. Revisiting our friend Phil from last time you can see the balance sheet for his business The Parachute Palace below.

A balance sheet is divided into three main sections. The distributions have been made and when I enter those on Sch M-2 it ends up with a negative balance of 10K on line 8 and is exactly equal to the amount of common stock. Please refer to your bank statements in order to list the amount of money your corporation has as of each date on record.

/phpdQXsCD-204ee8d463444c6c90f775fd179810f3.png)

/phpdQXsCD-204ee8d463444c6c90f775fd179810f3.png)