Wonderful Credit Side Of Profit And Loss Account

The following items usually appear on the debit and credit side of a Profit and Loss Account.

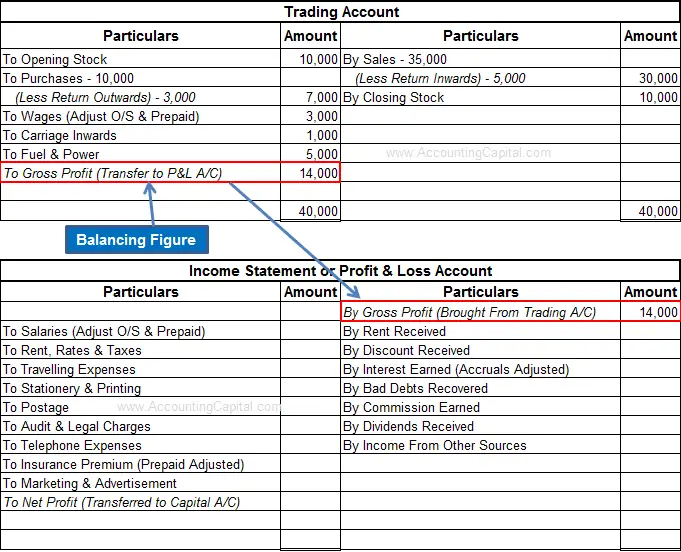

Credit side of profit and loss account. If credit side is more than the total of the debit side the difference between the two totals is the net profit. A net profit is a Credit in the Profit and loss account. The profit and loss account is opened by recording the gross profit on the credit side or gross loss on the debit side.

The liabilities and owners equity or stockholders equity are presented on the right side or credit side. A profit and loss account records all the incomes and expenses that have taken place in the year. The business will generate incomes other than from its main activity.

A business will incur many other expenses in addition to the direct expenses. On the debit side. Following is the list.

Incomes and Gains are shown on the credit side of the Profit Loss Account. This account starts from the result of trading account gross profit or gross loss. If the owner withdraws some cash for personal use the asset Cash will decrease through a credit and the owners equity will decrease.

Gross Loss Transferred from Trading Account All Indirect Expenses. The credit is initially recorded in a revenue account but revenue accounts are temporary accounts that cause owners equity to increase. All indirect expenses are transferred on the debit side of this account and all indirect revenues on credit side.

What is the Profit and Loss Account. For earning the net profit a businessman has to incur many more expenses in addition to the direct expenses. The Profit and Loss Account of a business enterprise is prepared for an accounting period.