Best Change In Accounting Principle Footnote Disclosure Example

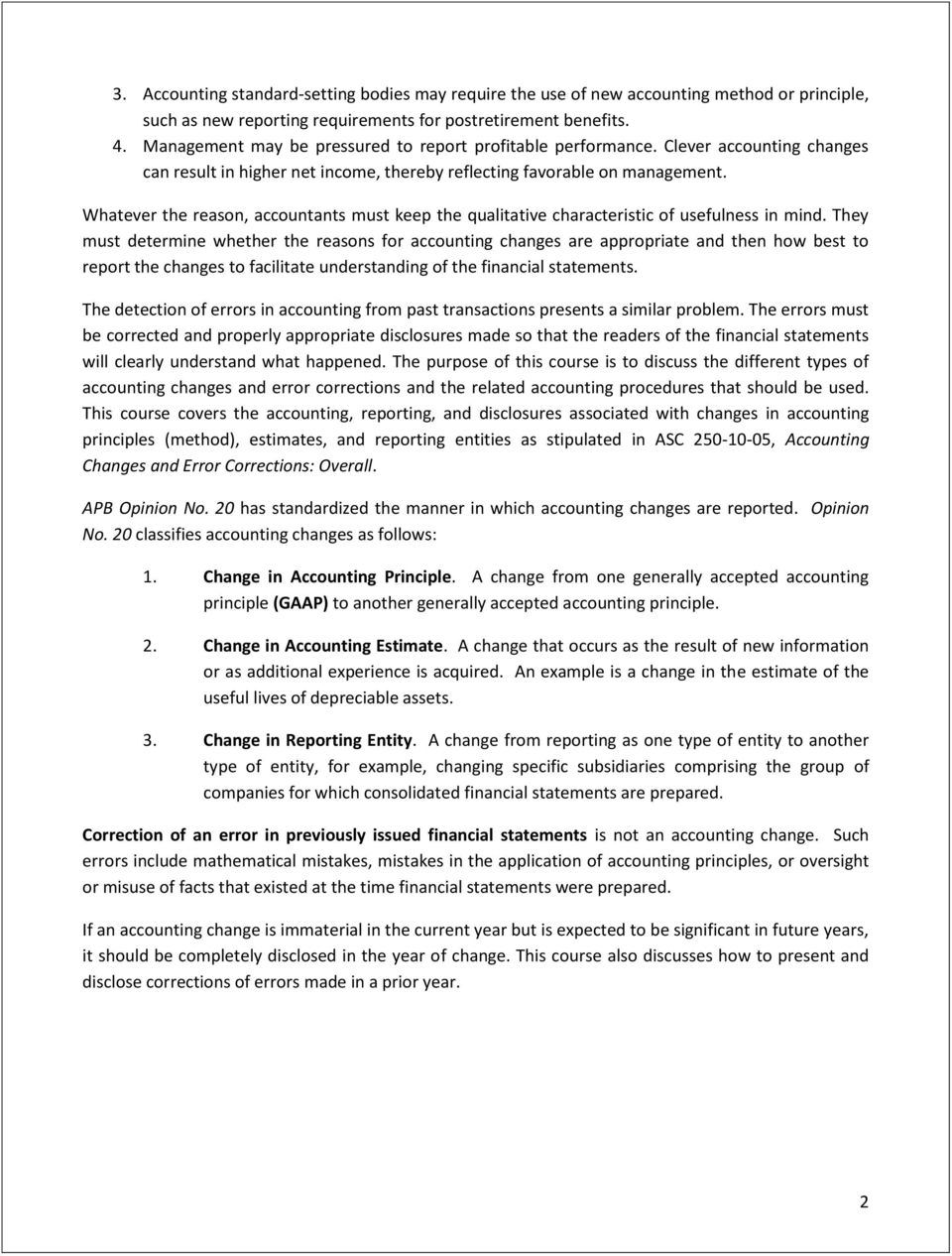

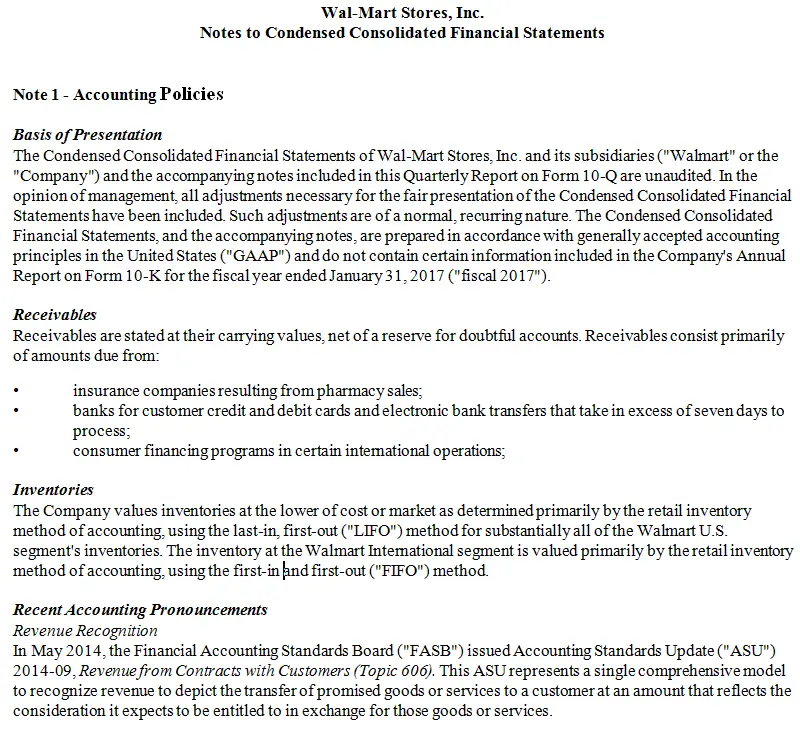

An example of a change in accounting principles occurs when a company changes its system of inventory valuation perhaps moving from LIFO to FIFO.

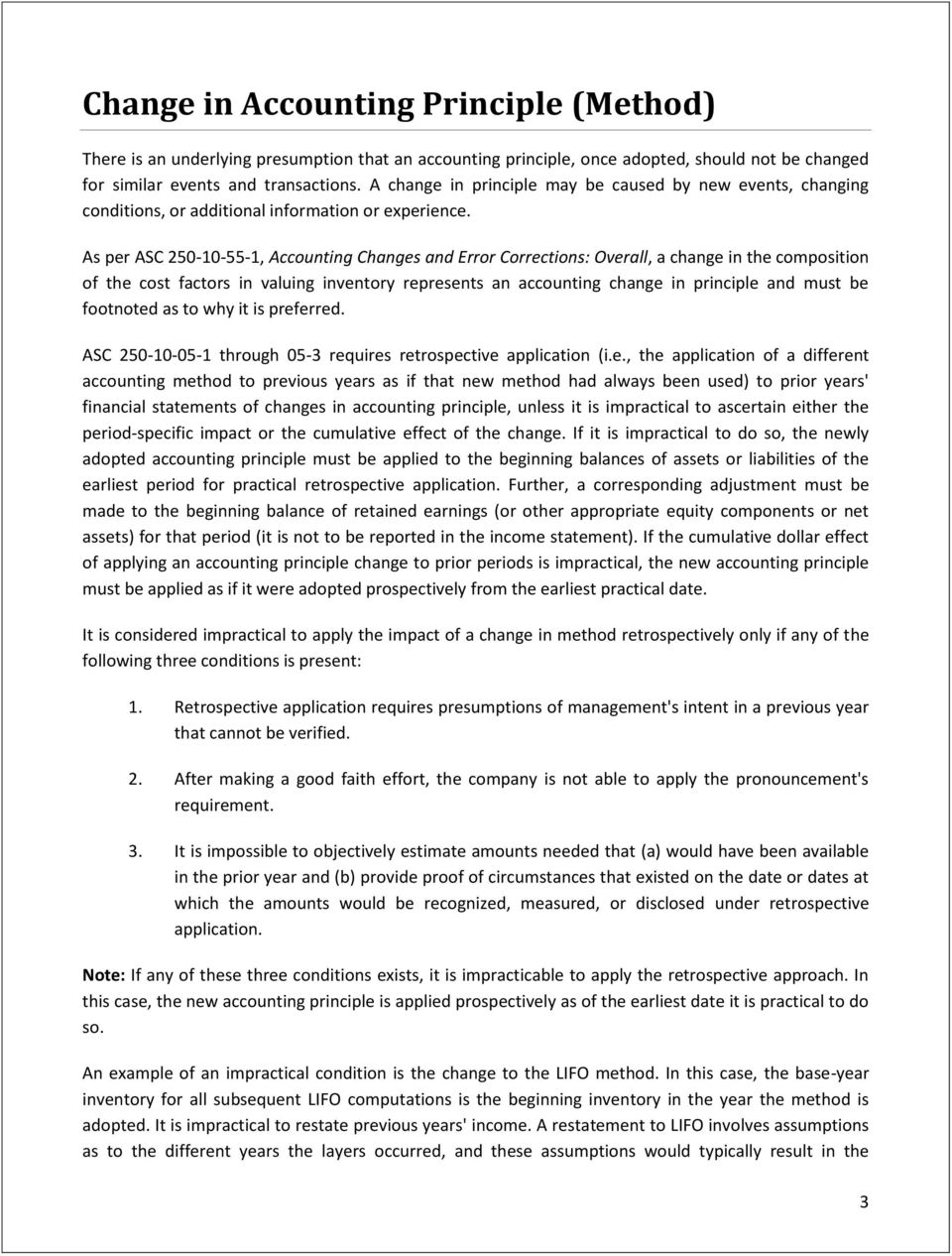

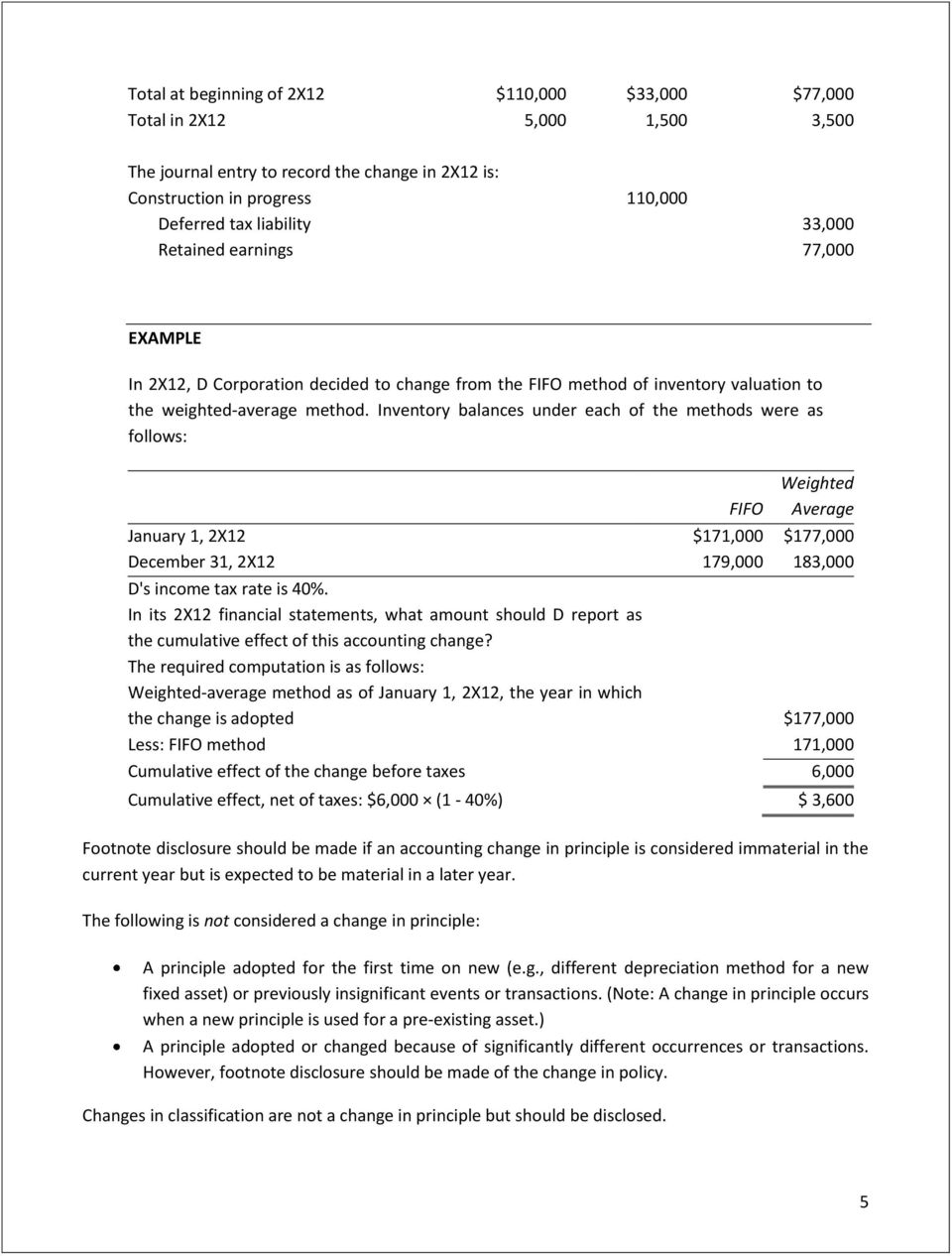

Change in accounting principle footnote disclosure example. Any change from FIFO to weighted average method and vice versa. Change in Accounting Principle Ref. The cost flow assumption for eg.

Thus if a change is made to the financial statements it may impact a number of disclosures in the footnotes that must be altered by hand. ABC LTD until now has valued inventory using LIFO method. Changes due to business combinations Cumulative catch-up adjustments to revenue that affect the corresponding contract asset or contract liability including adjustments arising from a change in the measure of progress a change in an estimate of the transaction price including any changes in the assessment of whether an estimate of variable consideration is constrained or a contract modification Impairment of a contract asset A change.

It effectively required such disclosure when for example an authoritative accounting pronouncement that was not yet effective would require a significant retroactive adjustment or when the mandated accounting change might likely trigger a debt default due to a covenant violation thus exposing the entity to an acceleration of the due date. This publication provides an example of the disclosure requirements in Accounting Standards Update ASU 2016-13 Financial Instruments Credit Losses Topic 326. The accounting standards allow for the consolidation of information in overlapping footnotes which keeps the disclosures from becoming inordinately long repetitive and difficult to update.

Example CECL Disclosures June 2019. For changes in accounting principle other than the implementation of a new pronouncement the Board tentatively decided to propose that in addition to the quantitative effect on beginning balances that is proposed to be disclosed as part of the reconciliation disclosure discussed previously disclosures for this category include. A the nature of the change in accounting principle including a description of the line items affected and b the reason for the change in accounting principle.

Therefore management of the company intends to use FIFO method for the valuation of the companys stock. Illustrative in nature The sample disclosures in this set of illustrative financial statements should not be considered to be the only acceptable form of presentation. If the principal place of business is different from the registered office the former should be disclosed.

Indirect effects of a change in method are recognized in the year of change. In deciding whether a particular accounting policy shall be disclosed management considers whether disclosure will assist users in understanding how transactions other events and conditions are reflected in the reported financial performance and financial position. Examples are altering profit-sharing or royalty payments arising from an accounting change.