Top Notch Change In Tax Rate Deferred Tax Note

Impact of Tax Rate Changes on a Companys Financial Statements and Ratios.

Change in tax rate deferred tax note. Amortisation of development. Deferred tax calculation changes. Related to the recovery via buildings sale.

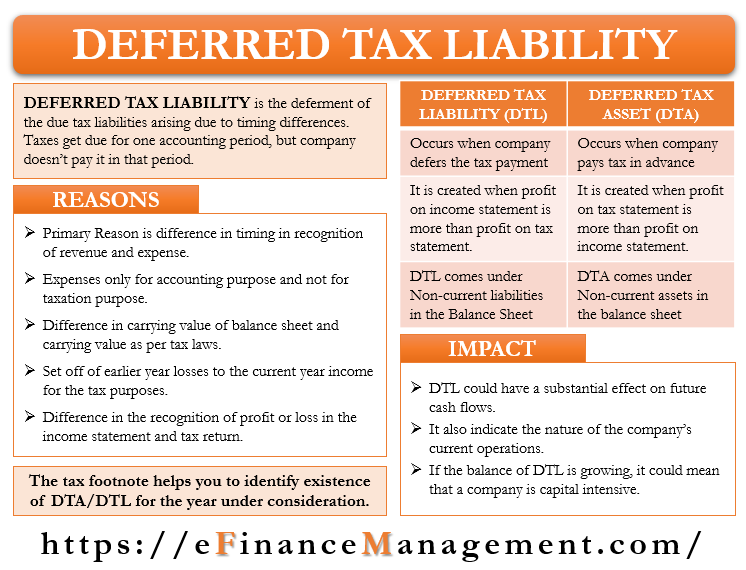

The accounting for changes in an assets tax base due to revaluation or indexation of that tax base the treatment of deferred tax on gains and losses relating to an available-for-sale financial asset. In this case the deferred tax is. The Deferred Tax Liability recognized at the end of year 1 will now be reversed.

When preparing accounts for a company where there is a material effect of the change in corporation tax rates on the deferred tax asset in this case 28 to 27 I know that it is meant to be disclosed separately. This is a reminder of the impact of the reduction of corporation tax rates from 2017 to 2020 will have on the recognition of current and deferred tax in company accounts. Note that over the period of three years the income tax expense tax payable and the total depreciation are same for both income statement and tax returns.

Changes in tax laws and rates may affect recorded deferred tax assets and liabilities and our effective tax rate in the future. Deferred tax liability will be recognised on taxable temporary difference which is taxable temporary difference multiplied by tax rate. This is a deferred tax liability.

A change in tax rate that is substantively enacted in an interim period is analogous to a tax credit granted in relation to a one-off event. The group expects a reduction in future tax rates following a recent announcement that the rate of tax in that country is to reduce to 40. This will reduce our future current tax charge accordingly.

Deferred tax assets and liabilities are measured at the tax rates that are expected to apply to the period when the asset is realised or the liability is settled based on tax rateslaws that have been enacted or substantively enacted by the end of the reporting period. In January 20X4 country X made significant changes to its tax laws including certain changes that were retroactive to our 20X3 tax year. However what is the correct practice to calculate the number - do you simply take the opening deferred tax asset recalculate it at.

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)