Breathtaking What Is A Tax Basis Balance Sheet

Tax basis balance sheets have become increasingly important as there has been a shift of financial statement audit focus.

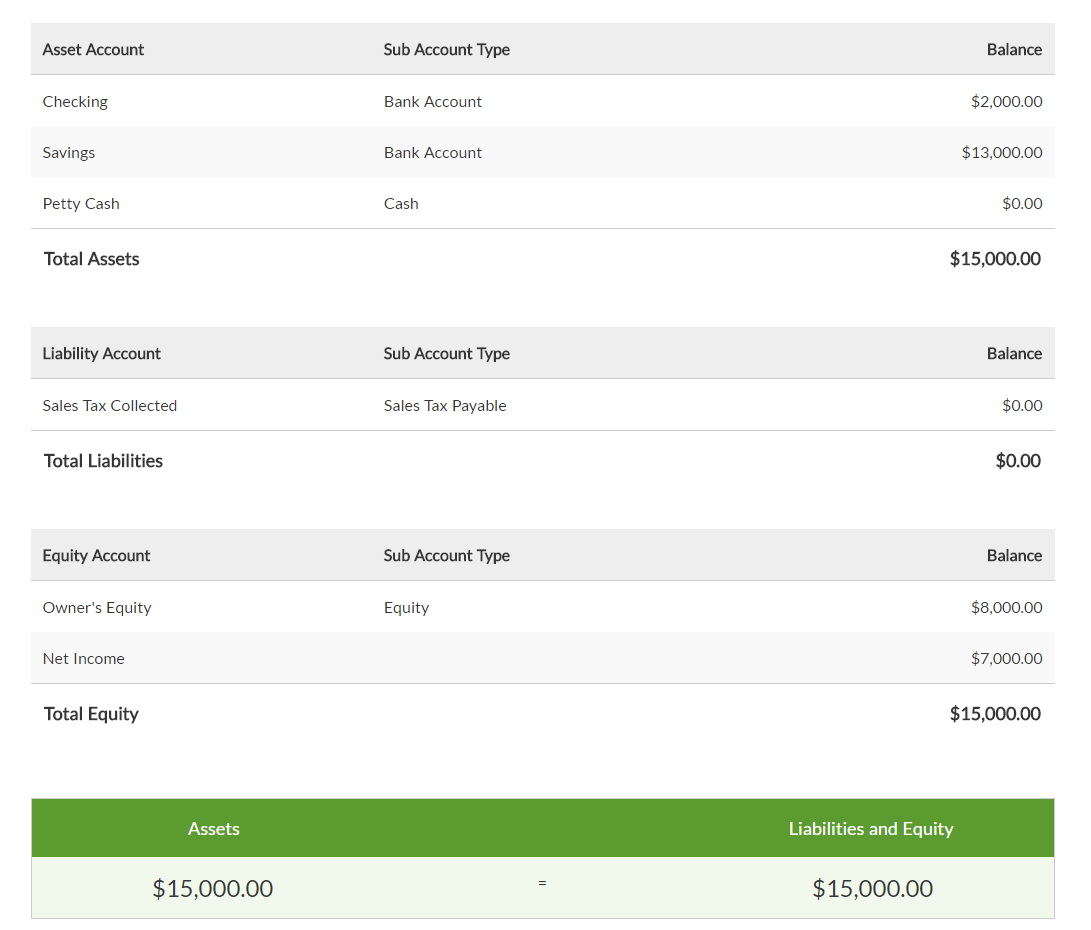

What is a tax basis balance sheet. A balance sheet is a financial statement that reports a companys assets liabilities and shareholders equity. The balance sheet should balance. Tax basis is the carrying cost of an asset on a companys tax balance sheet and is analogous to book value on a companys accounting balance sheet.

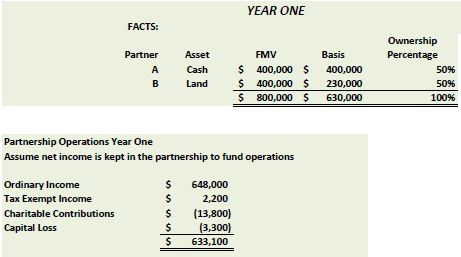

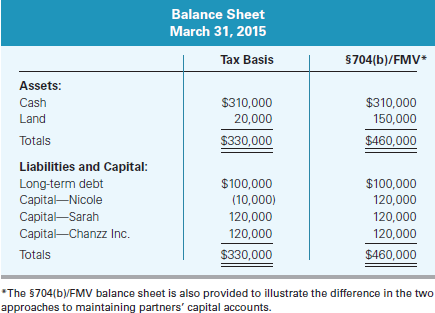

Tax basis method not previously used. Mortgage debt Capital-Kevan Capital-Jerry. Here is a cash basis accounting balance sheet example.

You should be able to reconcile the tax basis of the To explain the tax basis you can think of the balance sheet at the partnership SPV. A balance sheet reports a companys assets liabilities and shareholder equity at a specific point in time. At the end of the year accountants make adjusting entries and prepare the adjusted trial balance -- a listing of all the accounts in the general ledger and their balances.

The Form 1065 balance sheet and the partners capital accounts have been maintained on GAAP. In a tax basis balance sheet the liabilities of a company are reported at their true current value assuming the business paid for the liability immediately. The Tax Basis Balance Sheet can be used to enter adjustments and the actual tax basis of assetsliabilities based on the return as filed.

Tax Basis Balance Sheet Variance. This means that there are no accounts receivable or accounts payable to record on the balance sheet since they are not noticed until such time as they are paid by customers or paid by the company respectively. A firm records the value of assets such as buildings machinery and equipment on its balance sheet at the acquisition price also known as the cost basis or book value.

The tax basis balance sheet is based on the tax return filing. For the tax year 2020 the partners capital accounts must be shown on a tax basis. In most cases assets are initially recorded at acquisition cost for both book and tax purposes.