Stunning Deferred Tax Worksheet Example Australia

Discover learning games guided lessons and other interactive activities for children.

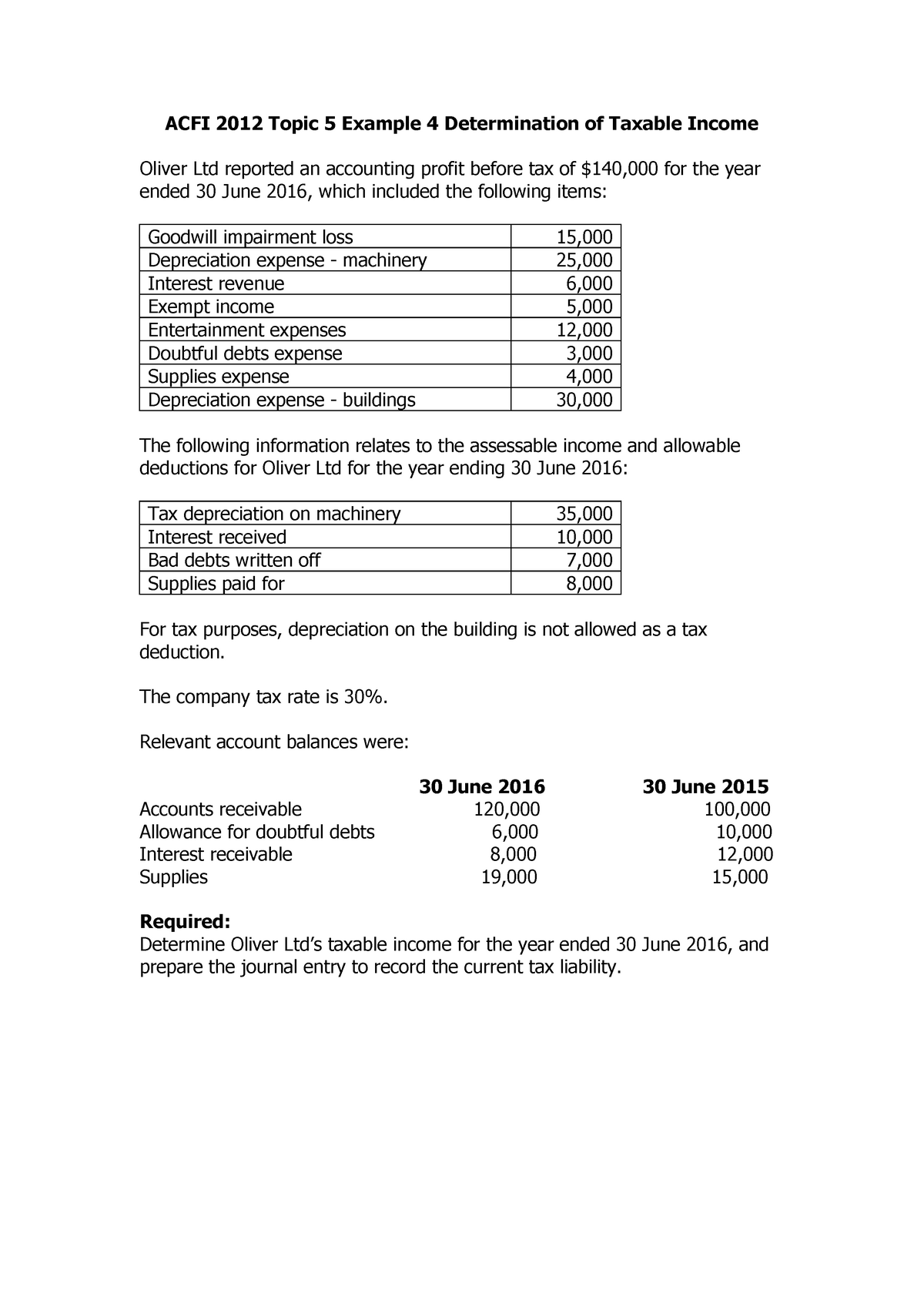

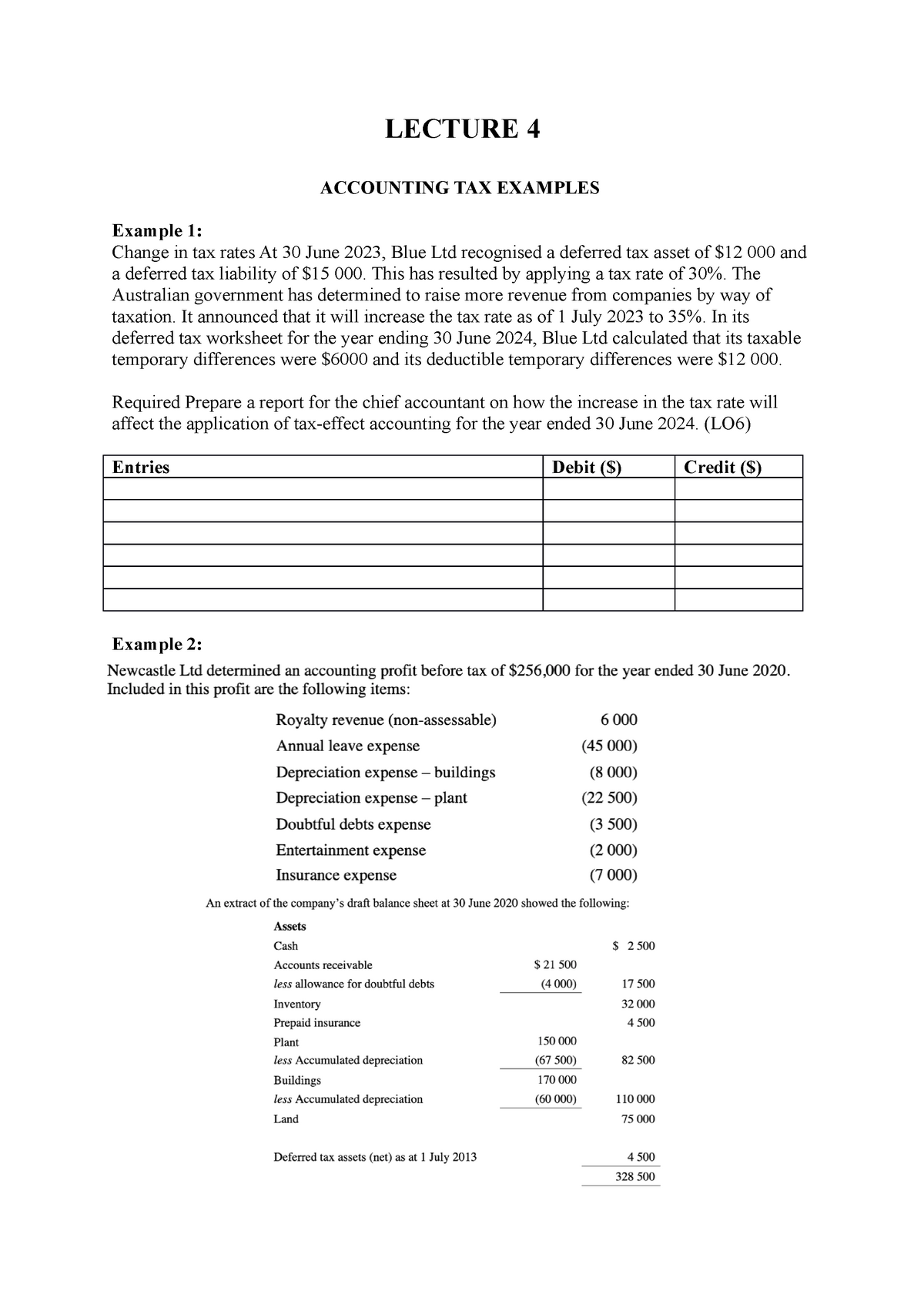

Deferred tax worksheet example australia. Within financial statements non-current assets with a limited economic life are subject to depreciation. For example book depreciation shown at X Depreciation expenses item 6 includes amounts for assets used in RD activities. Discover learning games guided lessons and other interactive activities for children.

Example of final instalment being less than the maximum amount. The carrying amount of an asset is higher than its tax base or. Items where the CA TB have been omitted from worksheet eg cash payables loan 2.

FRS12IAS12 requires several steps in determining deferred tax information first is the construction of a tax balance sheet that involved the determination of tax base for each asset and liability recognised in the accounting balance sheet in order. P expects to collect full 1000 ie. AASB 112 does not permit the recognition of a DTL relating to goodwill.

Ps income tax rate for all. They arise where the effect of a particular transaction on the current year is that taxable income will be less than the accounting profit before tax. DEFERRED TAXATION ACCOUNTING A SIMPLE EXAMPLE Assume.

The maximum amount it can defer is the lesser of. 3150 that is the amount of the final instalment. Deductible temporary differences DTDs tax rate deferred tax asset TTDs result from increases in taxable income in future reporting period ie.

The carrying amount of a liability is lower than its tax base. However within tax computations non-current assets are subject to capital allowances also known as tax depreciation at rates set within the relevant tax legislation. What is future taxable profit for the recognition test.

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)