Neat Deferred Tax Worksheet Example

Comprehension Worksheet For Year 2.

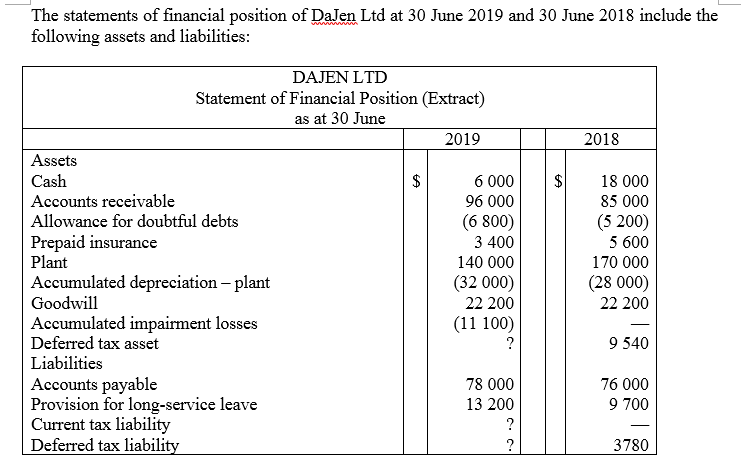

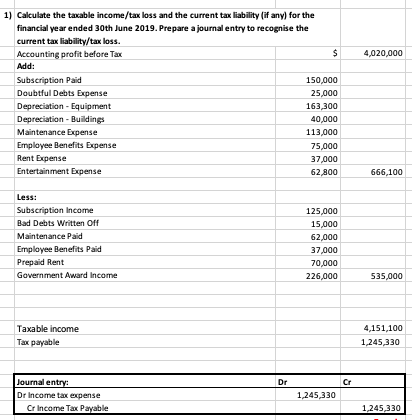

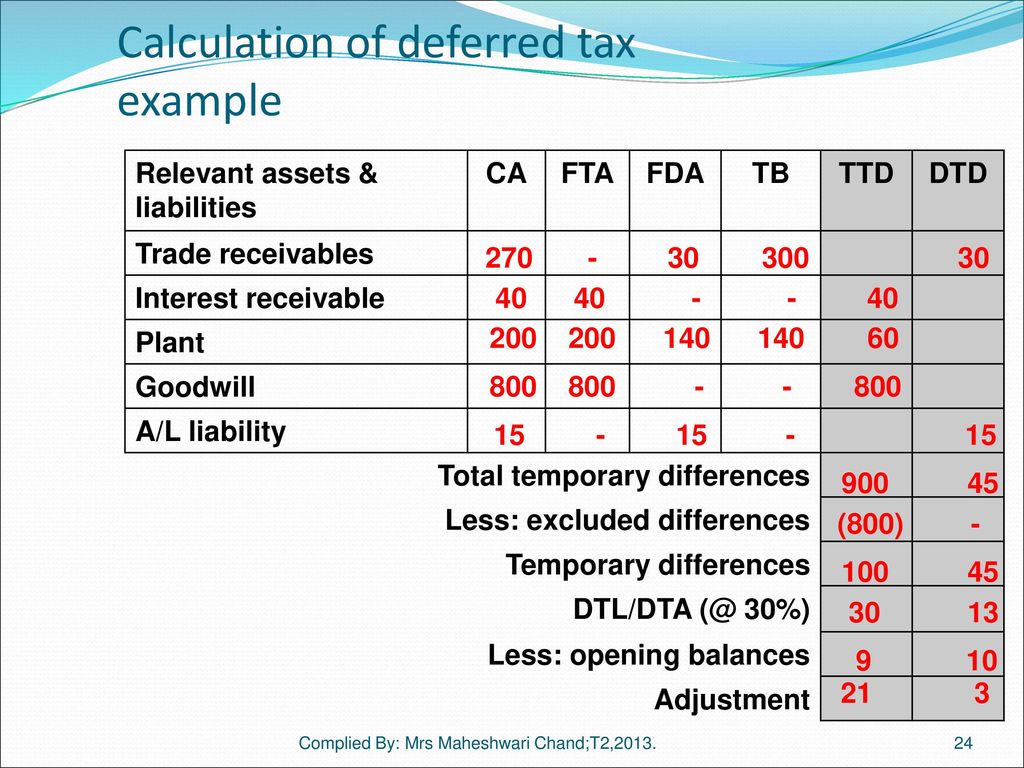

Deferred tax worksheet example. A completed example tax worksheet is labeled Table 3. Differences in revenue recognition give rise to deferred tax liability. Im very proud to publish the first guest post ever in this website written by Professor Robin Joyce FCCA who will explain you in a detail how to understand deferred taxation and how to tackle it in a logical way.

Consider a company with a 30 tax rate that sells a product worth 10000 but receives payments from its customer on an. FORM 8824 WORKSHEET Worksheet 1 Tax Deferred Exchanges Under IRC 1031 Date Closed Taxpayer Exchange Property Replacement Property Form 8824 Line 15 Cash and Other Property Received and Net Debt Relief Net cash received line 21 1 Net debt relief line 30 2 Less net cash paid line 22 3 Total to Form 8824 Line 15 not less than zero 4. The seller allows the buyer to make.

Deferred tax is a topic that is consistently tested in Paper F7 Financial Reporting and is often tested in further detail in Paper P2 Corporate Reporting. Net profit after tax is not distorted by timing differences between accounting and tax depreciation. In 2017 XY Internet Co.

Received 20000 from its clients for internet service in advance. P expects to collect full 1000 ie. AASB 112 does not permit the recognition of a DTL relating to goodwill.

P buys debt instrument. Calculation of deferred tax. These income tax rates will vary for different farm businesses.

A deferred tax liability keeps into account the fact that the company in the future will pay more income tax because of the transaction that has happened in the current time period for example installment sale receivable Installment Sale Receivable An installment sale is a revenue recognition method. The TTD arising is referred to as an excluded temporary difference 3. What is future taxable profit for the recognition test.