Out Of This World Gstr 3b Format In Excel With Formula

August 16 2017 0 Comments.

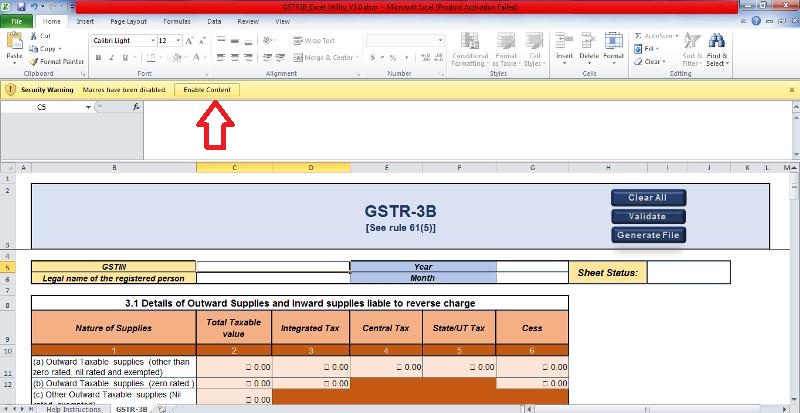

Gstr 3b format in excel with formula. Though it sounds easy task but one should be aware of the Excel formulas for this. You only need to. Any Incorrect information in GST Annual Return can attract tax demands interest and penalties along with long term litigation that follow years later.

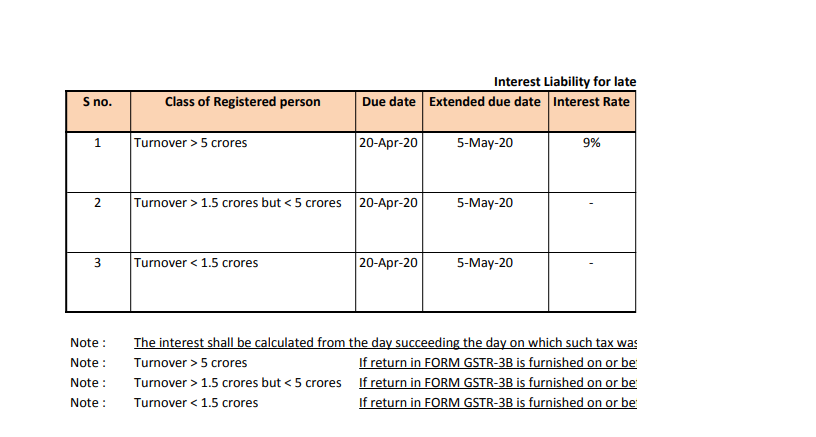

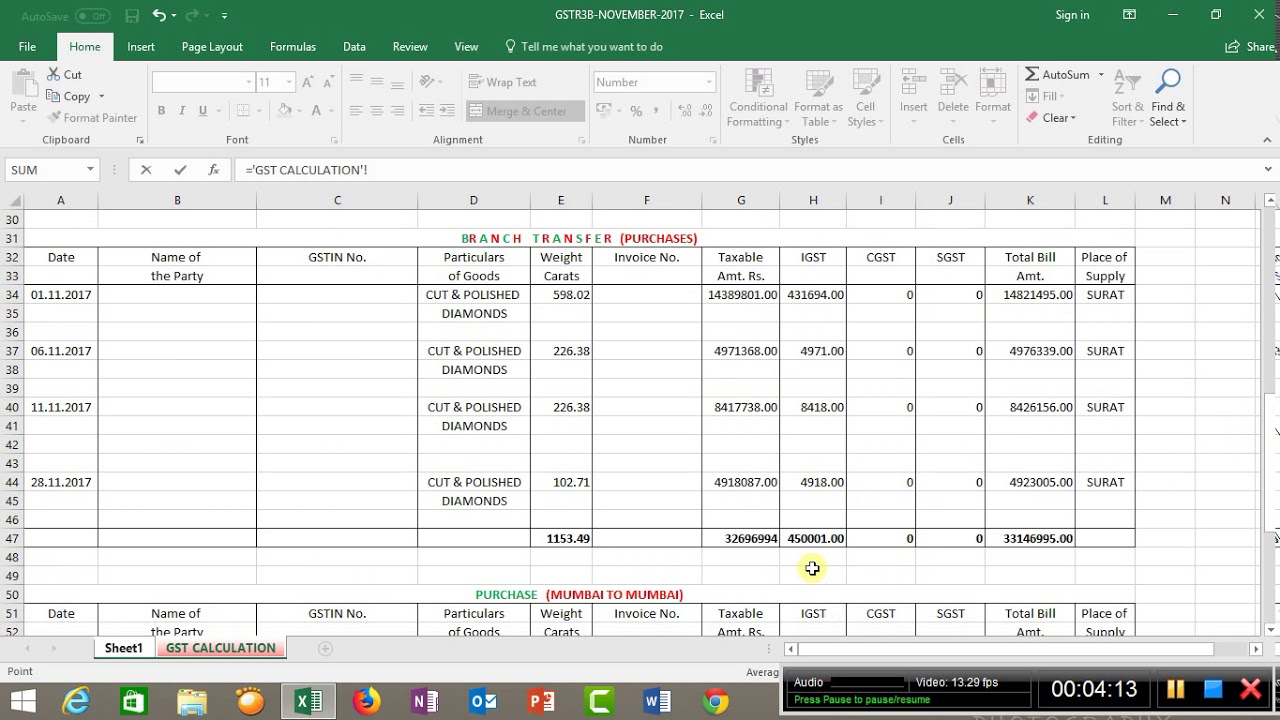

For this you must have data of GSTR 3B and GSTR 2A in the excel format. Calculate Gst Excel Spreadsheet Interest Calculation. It can be modified according to convenience.

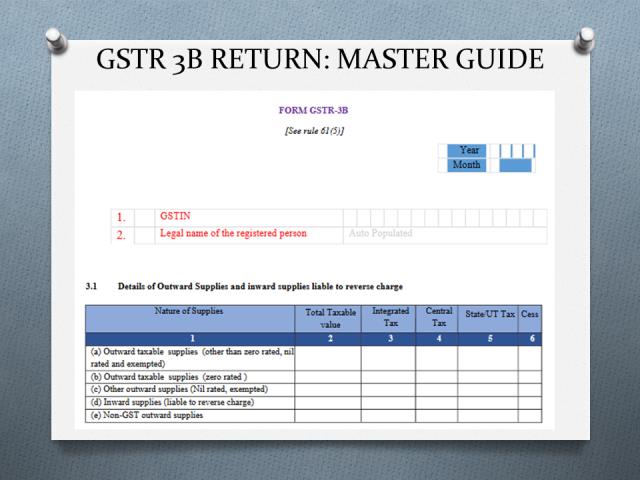

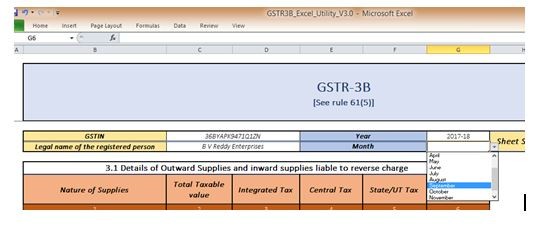

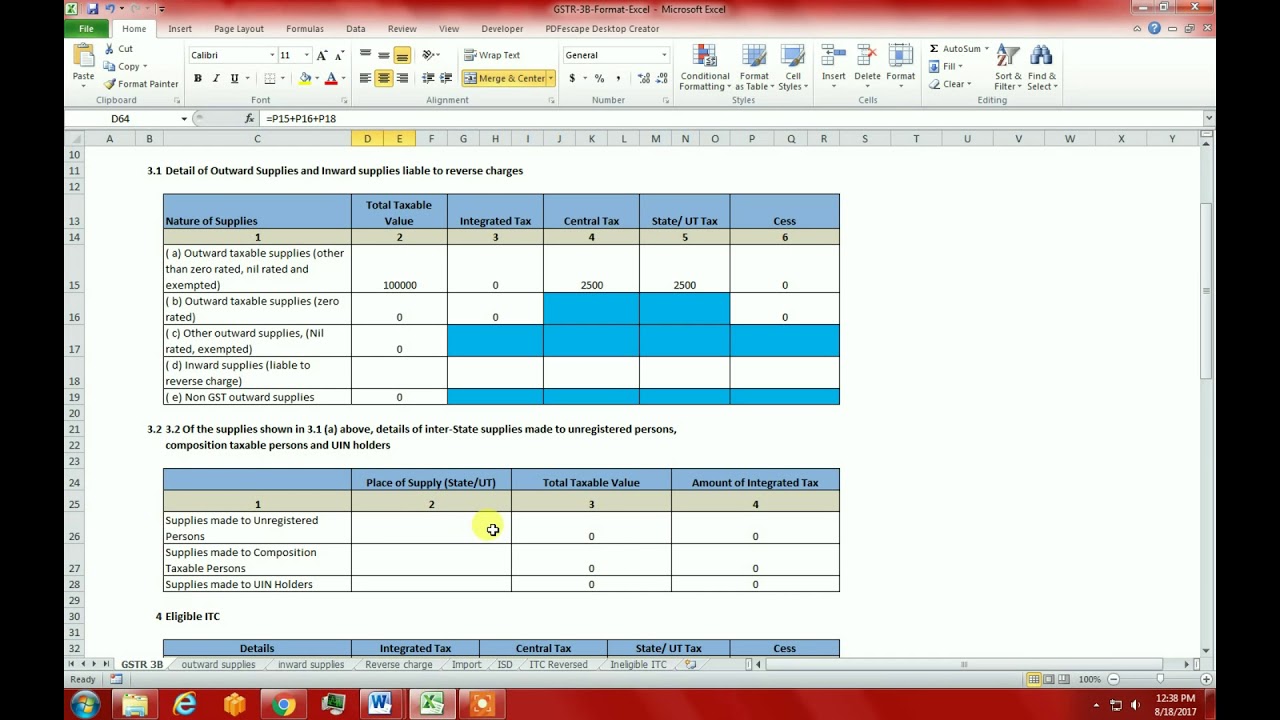

Easily file GSTR-3B for multiple clients Deadline for filing July 2017 GSTR-3B is 20th August If you need to file GSTR-3B for multiple clients you should get the data from them and upload into ClearTax before the 20th To make this process easier we have provided a zip file containing Excel. Legal name of the registered person Auto Populated 31 Details of Outward Supplies and inward supplies liable to reverse charge Nature of Supplies Total Taxable value Integrated Tax Central Tax StateUT Tax Cess 1. This Computation may be used as base data before uploading the data on the GST portal.

In case of an upward revision of liabilities one will be liable to pay differential. GSTR 2A is system generated and it is downloaded from portal. Business.

Gstr 3b format in excel with formula. RTS Professional Study - gstr 3b format in excel with formula. Fully Automatically Calculation Only Input Outward Enter And Directly Results.

CLICK ON GSTR-3B-Format-Excel TO DOWNLOAD FORM GSTR 3B Form GSTR-3B See Rule 615 Year Month 1 GSTIN 2 Legal name of the registered person 31 Detail of Outward Supplies and Inward supplies liable to reverse charges Nature of Supplies Total Taxable Value Integrated Tax Central Tax State UT Tax Cess 1 2 3 4 5. Banking RBI. GSTR 9 Annual Return does not allow for any revision after filing.

.jpg)