Unique Final Comment Balance Sheet

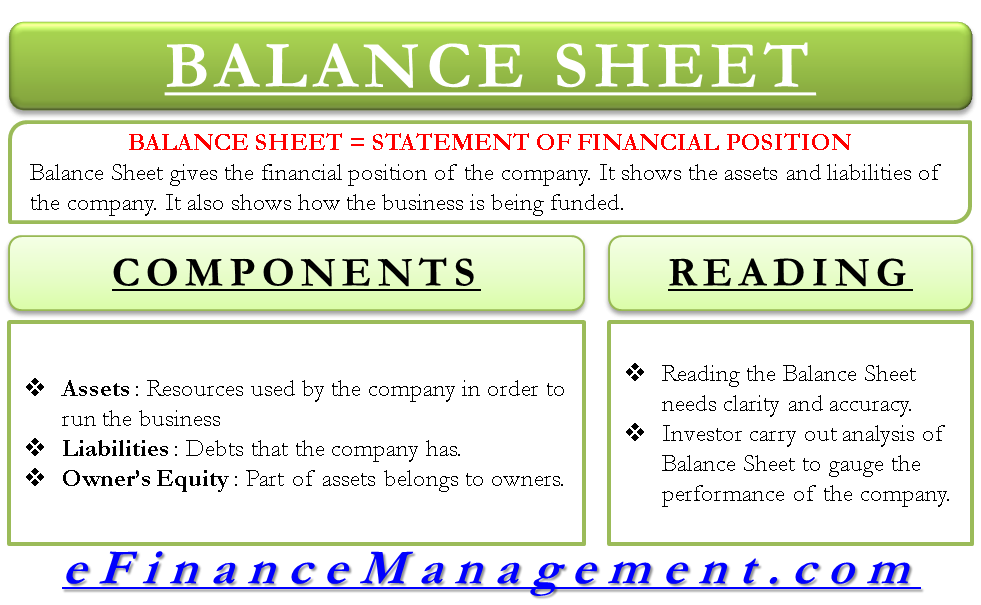

The required financial statements are income statement statement of owner Equity balance sheet and cash flow statement.

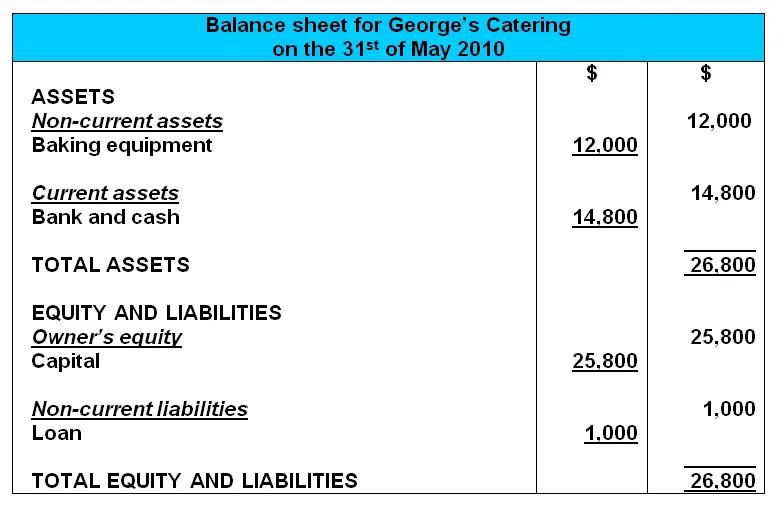

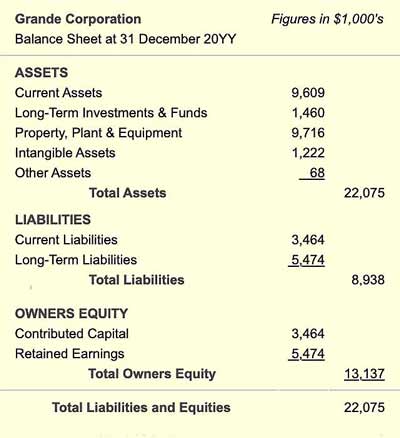

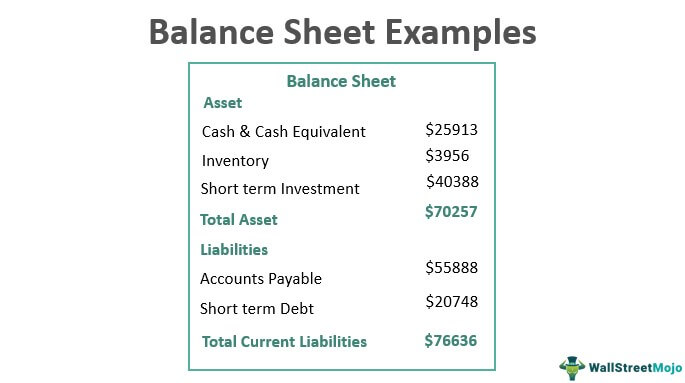

Final comment balance sheet. If youre using formulas to calculate financial ratios you may see terms in the equations not listed on the balance sheet. Using above information prepare an income and expenditure account for the year ended 2018 and a balance sheet as on December 31 2018. Assets are listed on.

Final Statement of Accounts or Final Accounts is the final result of all financial activities in a nutshell. Final accounts are containing financial information about an organization. Record debit items on expense side of P and L account or assets side in balance sheet.

Cost Of Goods Sold On Balance Sheet Trial To Final Accounts A big part of running a business is managing the funds. Comments relating to the balance sheet are based on figures after exceptional items. You need to make sure that your companys cash inflows are timely and enough to cover your cash outflows.

Sundry Debtors include an item of Rs 250 for goods supplied to the proprietor and an item of Rs 600 due from a customer who has become insolvent. Guide to Financial Statement Analysis. Make a list of trial balance items and adjustments.

The distributions have been made and when I enter those on Sch M-2 it ends up with a negative balance of 10K on line 8 and is exactly equal to the amount of common stock. The common size balance sheet shows the makeup of a companys various assets and liabilities through the presentation of percentages in addition to absolute dollar values. Final Accounts is prepared at the end of a financial year to ascertain the profitloss of the organisation and to exhibit the condition of the organisation in monetary terms.

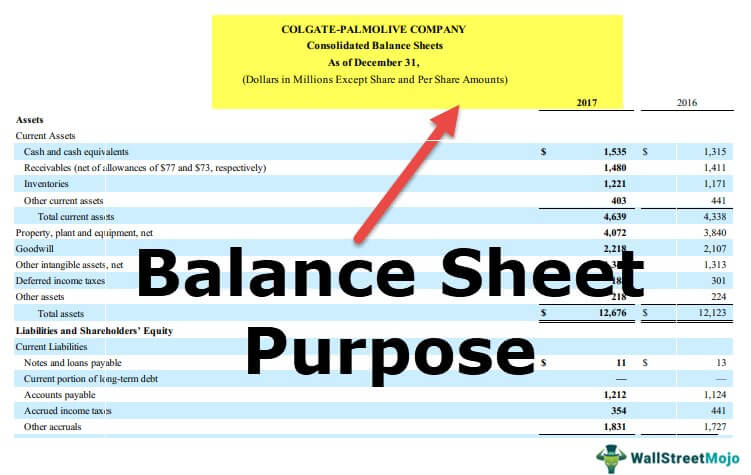

These three core statements areIn this free guide we will break down the most important methods types and approaches to financial. More in-depth remarks can be found from page 50 of the 2014 financial report. Prepare the Trading and Profit and Loss Account as on 31st March 2012 and Balance Sheet as on that date having regard to the following information.