Fine Beautiful Who Need To Sign The Intercompany Balance Letter

For example if one subsidiary has sold goods to another subsidiary this is not a valid sale transaction from the perspective of the parent company since the transaction occurred internally.

Who need to sign the intercompany balance letter. Here is very simple letter format for mailing Account balance to customer as well as asking him to provide confirmation for the same. The letter should also recap the experience you have had your knowledge of your employers current mission and needs and the progressive growth you have enjoyed within the company. This is with reference to 100 pieces of fabric that we delivered to you on 17th February 2019.

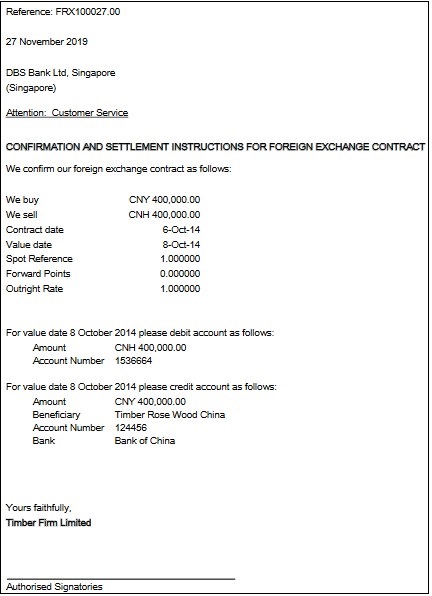

It is important to ensure that the agreement conveys the exact nature of the transaction the intent to enter into a contract and compliance with laws and regulations. Benefits of Intercompany Agreement. A customer located in the UK purchases computers from a sales division in the United Kingdom.

A current rent balance letter is sent from a landlord to a tenant to inform of any past due or monies owed from non-payment of rent or other money owed. Your typed name will go after the complimentary close. The Benefits of Intercompany Agreements.

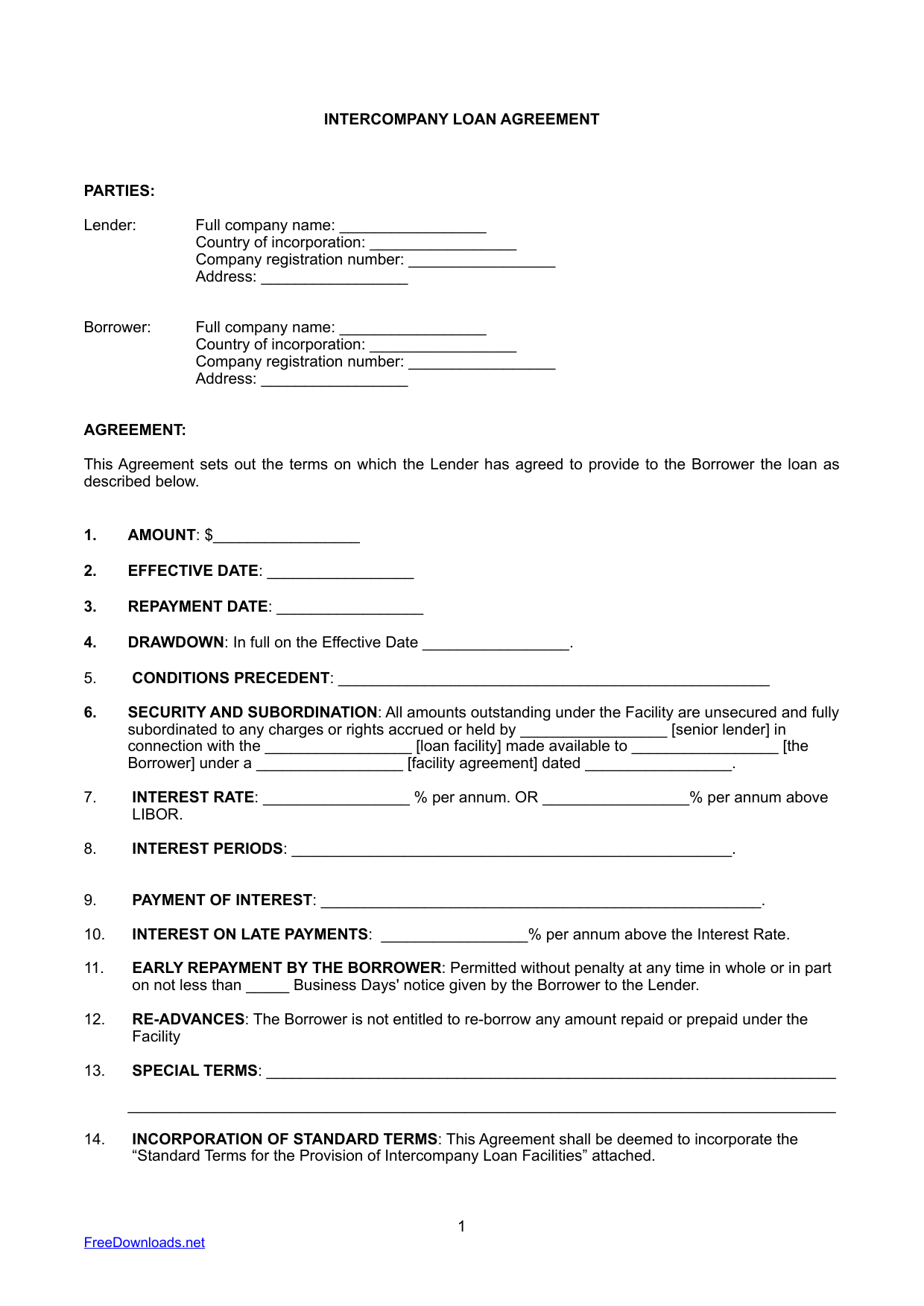

Intercompany accounting is a set of procedures used by a parent company to eliminate transactions occurring between its subsidiaries. If not there may be an unflagged transaction that needs to be eliminated. Lastly you need to give a letter of transfer on Letter head to such employees signed by the Head HR Unit Head Specifying the Date of such transfer.

Intercompany Invoicing for Sales Orders Example. Cameron notes that the added focus on documentation. Youll want your lawyer to be present before you complete the form which will likely include.

Tips on Employee Transfer Agreement About the Transfer. So businesses or divisions of one parent company are expected to give an account of intercompany transactions using a specific method. Intercompany financings that in substance form part of an entitys investment in a subsidiary are not in IFRS 9s scope.