Beautiful How Are Dividends Treated On A Balance Sheet?

A If the whole of the dividend is from the pre-acquisition profits it must be treated as capital gain and must be used either for reducing the cost of shares or for increasing capital reserve.

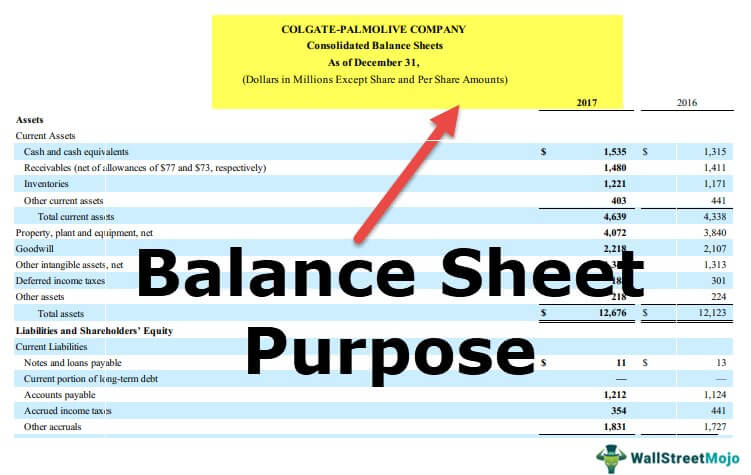

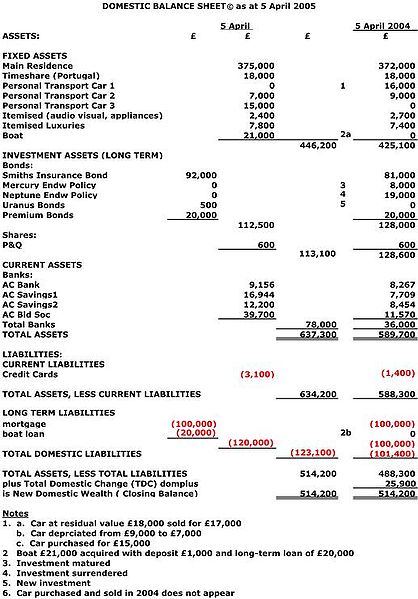

How are dividends treated on a balance sheet?. This is an interesting fact that although they. As at 31st March 2011 and 31st March 2012 were as follows. Cash dividends affect the cash and shareholder equity on the balance sheet.

Paying the dividends reduces the amount of retained earnings stated in the balance sheet. Dividends do not impact net income loss of. As an example a corporation pays out a 1 dividend to each holder of its 250000 outstanding shares.

Simply reserving cash for a future dividend payment has no net impact on the financial statements. Dividends on common stock are not reported on the income statement since they are not expenses. To determine the accounting treatment of preference shares and dividend on such shares first you have to identify if preference shares are redeemable or irredeemable.

Dividends affect a company s cash and shareholders equity accounts primarily. Consider a shareholder with a small. I need to make double enteries for dividends received from a subsidiary by a parent company owns 100 shares.

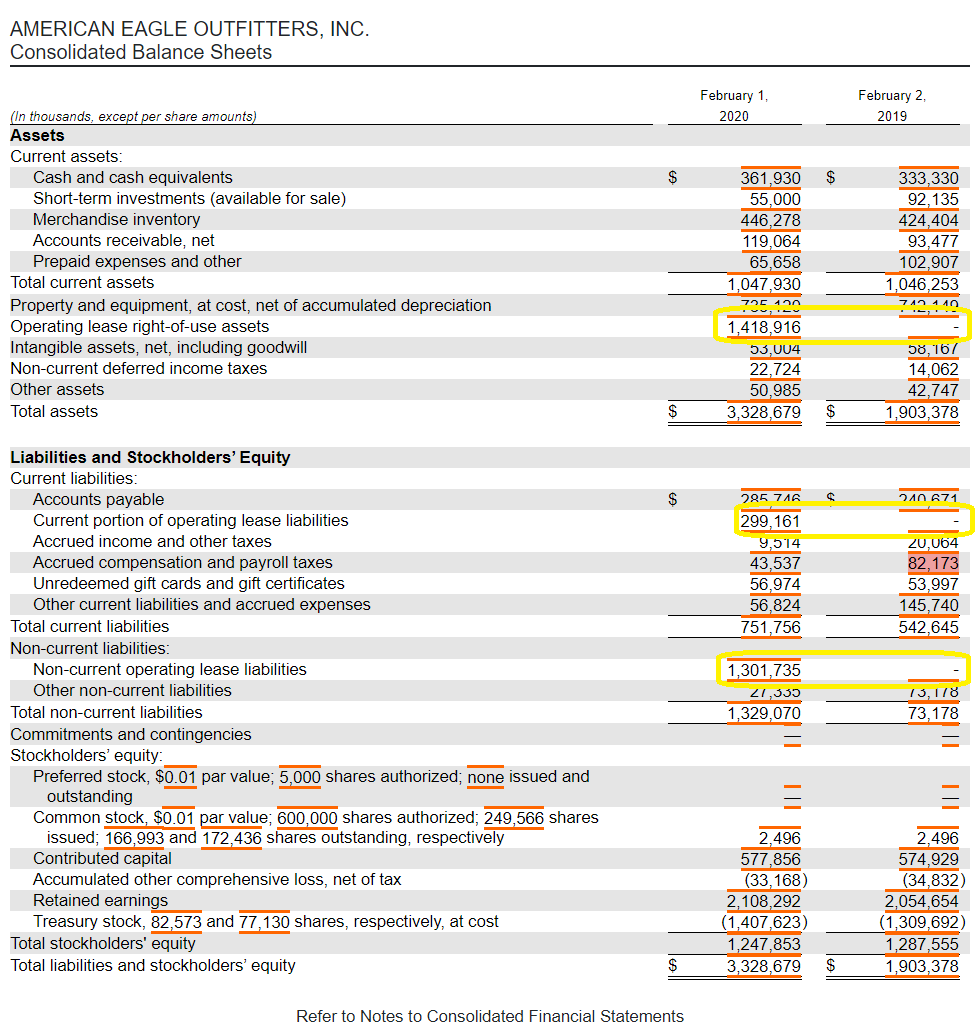

Free Lv2 US Market Data Lv1 SG Market Data TCs Apply. The balance sheets of both the companies as at 31st March 2012 were as follows. If a dividend is in the form of more company stock it may result in the shifting of funds within equity accounts in the balance sheet but it will not change the overall equity balance.

I assume a debit entry would be cashbank and credit entry would be Investment income. Accounting treatment for redeemable preference shares If preference shares are redeemable then shares are reported as liability in statement of financial position. Understanding Dividends When cash dividends are paid this reduces the cash balance stated within the assets section of the balance sheet as well as the offsetting amount of retained earnings in the equity section of the report.