Fun Tax Basis Balance Sheet Pwc

The tax basis balance sheet is based on the tax return filing.

Tax basis balance sheet pwc. 86 21 2323 2896. Balance sheet or a deferred tax asset. This balance sheet approach is used to calculate temporary differences that in effect take into account the total tax that would be payable or receivable if all of an entitys assets and liabilities were realized at their carrying value at a specific time the reporting date.

1 of 3 Save and exit Continue Cancel. Bill Maloney of PwCs Global. The difference between the two balance sheets measured at the right tax rate means that the accounting profit or.

US 5000 is however not a quantitative threshold but an example the IASB has used to illustrate a general principle. Tax Basis Balance Sheets are used to provide assurance to businesses that all of their booktax differences have been identified and properly recorded. Tax basis of C100.

A deferred tax often represents the mathematical difference between the book carrying value ie an amount recorded in the accounting balance sheet for an asset or liability and a corresponding tax basis determined under the tax laws of that jurisdiction in the asset or liability multiplied by the applicable jurisdictions statutory income tax rate. 6 PwC PwC ReportingPerspectives Ind AS 116 does not define the term low value but the Basis for Conclusion to IFRS 16 explains that the IASB had in mind assets with a value of US 5000 or less when new. The taxable income is generally determined on the basis of a tax balance sheet which in turn is based on the statutory accounts according to German generally accepted accounting principles GAAP.

It is costeffective to prepare cash or taxbasis financial statements. Accounting for an Increase in Tax Basis 88 362 Built-in Gain. Adoption of ASU 2020-06 may have unexpected consequences related to how certain instruments are reflected on a reporting entitys balance sheet and treated in the computation of earnings per share.

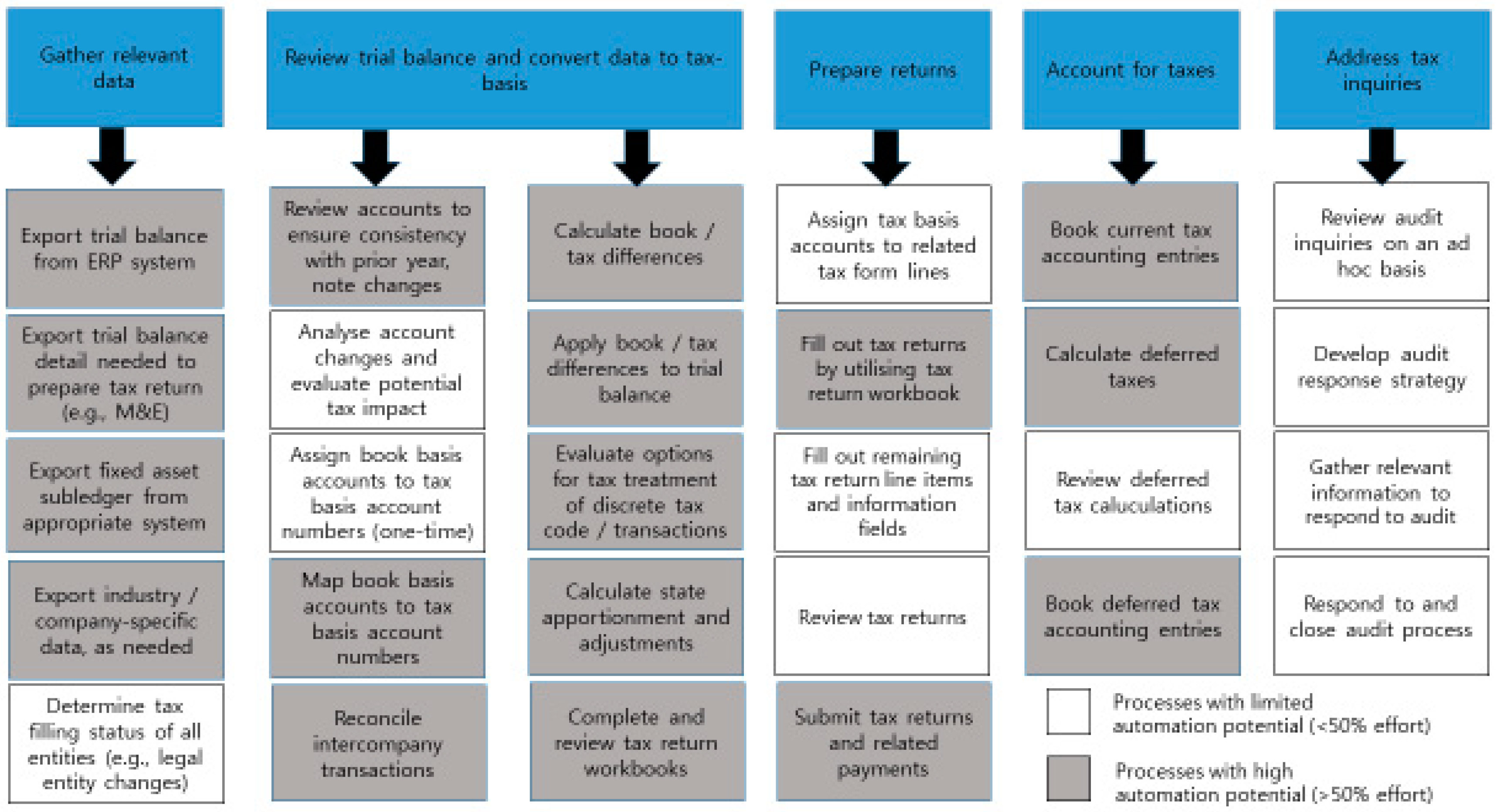

The starting point for the tax basis balance sheet is the book balance sheet. This is the difference between the tax basis balance sheet per the tax accounting records and the tax return. These items should not be evaluated in isolation as there could be interplay between the various changes resulting from the CARES Act and other knock-on effects that impact.