Great Merchandising Business Income Statements Show

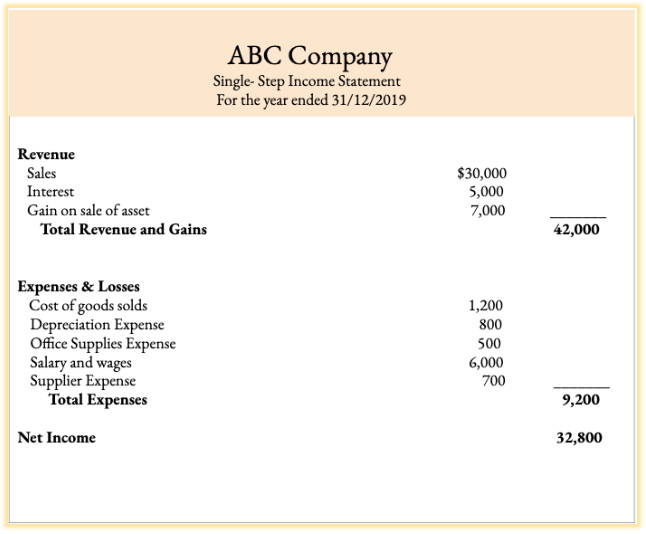

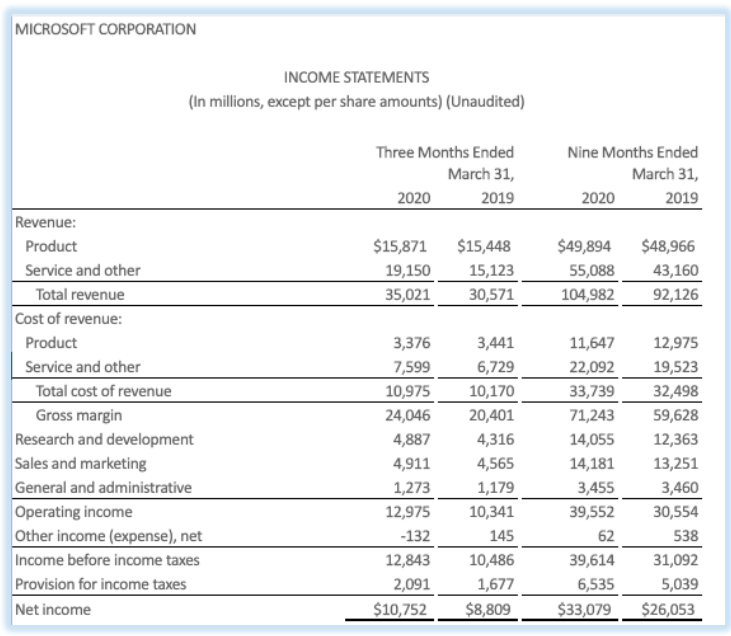

Income is likely to be similar on the income statement for both product and service businesses but expenses are likely to differ.

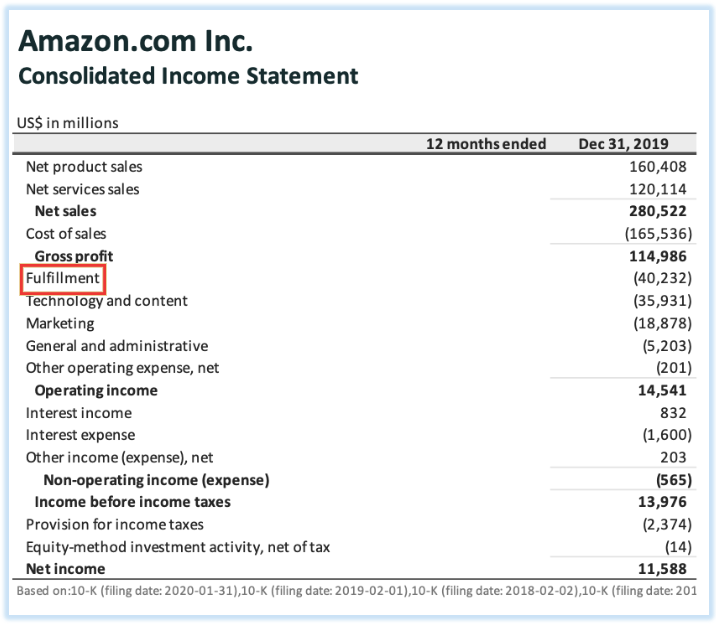

Merchandising business income statements show. The income statement is one of three statements Three Financial Statements The three financial statements are the income statement the balance sheet and the statement of cash flows. Merchandising companies include auto dealerships clothing stores and supermarkets all of which earn revenue by selling. Merchandising companies purchase goods that are ready for sale and then sell them to customers.

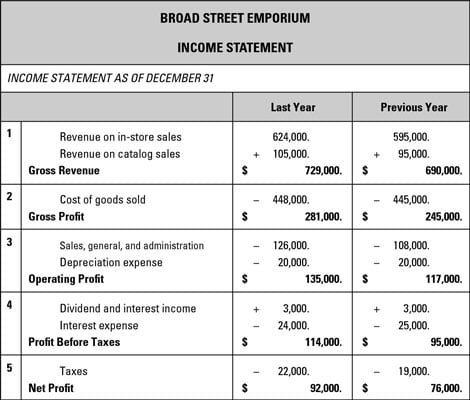

Gross profit is also known as gross margin from sales. Net Sales Sales - Sales Returns - Sales Discounts Gross Profit Net Sales - Cost of Merchandise Sold Net Income Gross Profit - Operating Expenses Net sales is the actual sales generated by a business. The main purpose of the income statement for a service company is to list a companys revenues and expenses and to present the net income of a business for the year.

A merchandising company uses the same 4 financial statements we learned before. Income statement statement of retained earnings balance sheet and statement of cash flows. The income statement for a merchandiser is expanded to include groupings and subheadings necessary to make it easier for.

Product companies include the cost of goods sold as a major component of income-statement expenses whereas service companies may not list cost of. The Multi-Step Income Statement for a merchandising company sub-divides operation expenses into selling expenses and administrative expenses Procedures and processes used to safeguard assets would be part of a companys. Merchandising business income statements show both gross profit and net income Merchandise inventory is classified on the balance sheet as a current asset A perpetual inventory system constantly shows the balance of inventory on hand The journal entry to record a sale would include a credit to sales revenue The journal entry to record the cost of goods sold is cost of goods sold debit.

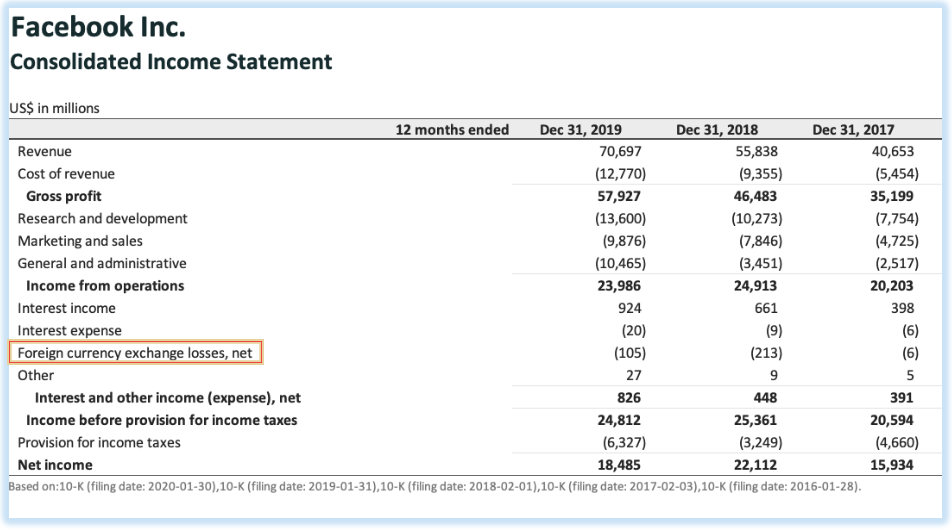

The income statement of a merchandiser begins with gross profit which is the difference between sales revenues and cost of goods sold. The income statements of merchandising companies differ from those of manufacturing companies in several areas. Ad Find the Best Merchandising Tools That Will Help You Do What You Do Better.

Financial statements are based on well defined accounting concepts and standards some of which are fairly technical and require some concentrated study to learn and use. In the case of a business that sells a product we refer to revenue as Sales or Sales Revenue. No Matter Your Mission Get The Right Merchandising Tools To Accomplish It.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-021-eb8d8819386649a898bb94fd7ca3abf8.jpg)