Peerless Net Income Formula Capital Asset Purchases

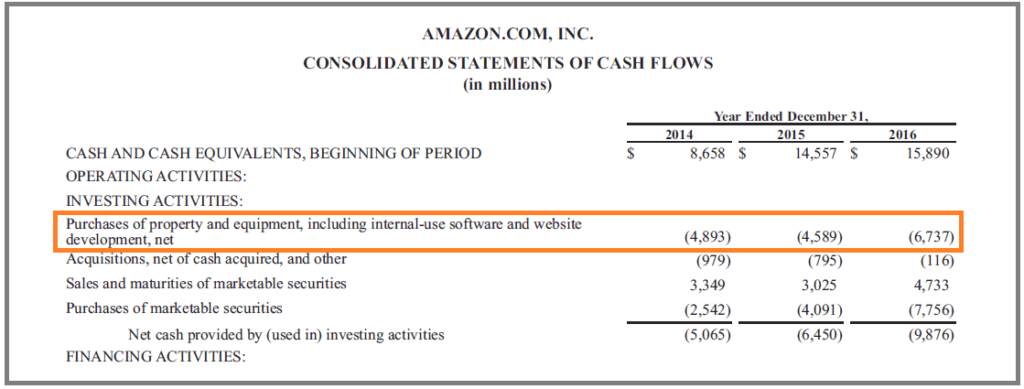

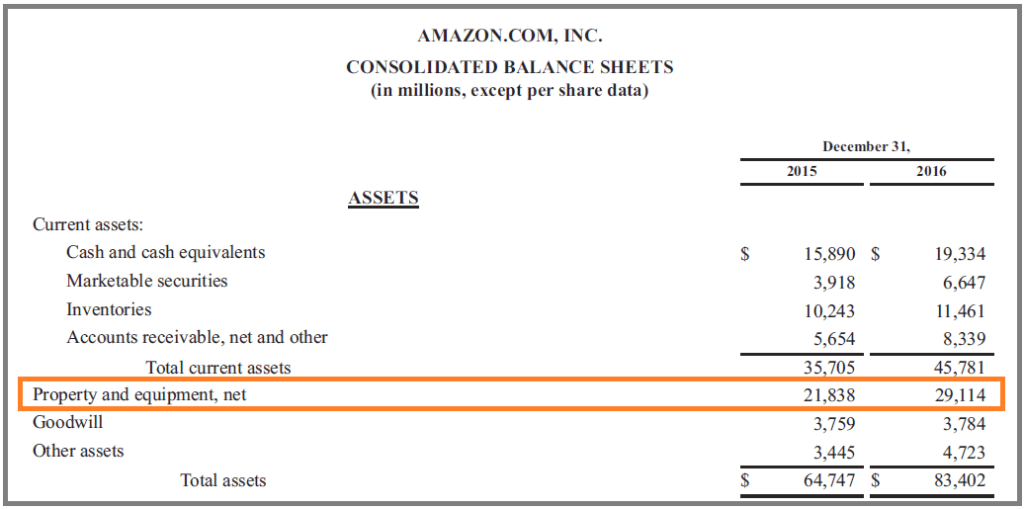

Net Increase in PPE is calculated using the formula given below Net Increase in PPE Closing Net PPE Opening Net PPE Net Increase in PPE 41304 million 33783 million Net Increase in PPE 7521 million.

Net income formula capital asset purchases. Transfers GNDICIGCA National SavingS GNDI-C-GICA Thus SICA so that if CA 0 CA Surplus S I. Lets put in the example of the logging truck mentioned above. Profit compared to assets.

Recording Capital Assets. Flows include purchases of long-term assets and proceeds from the disposal of long-term assets. The assets must be plant and machinery that qualify for capital allowances under Sections 19 19A or 19A1E of the ITA.

To reconcile net income to cash flows from operations. Subtract the retained earnings for the present year from the prior years retained earnings. Of purchases Number of days of receivables Number of days of inventory Number of days Net operating cycle 2.

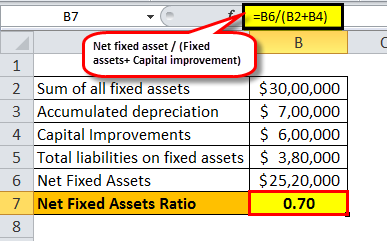

Net Income Average Shareholder Equity. The cost for capital assets may include transportation costs installation costs and insurance costs related to the purchased asset. R O A N e t I n c o m e A v e r a g e T o t a l A s s e t s.

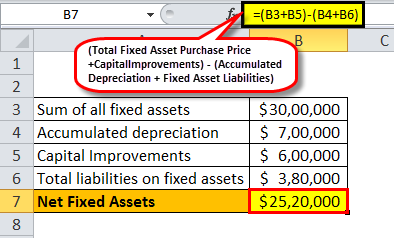

Assets Liabilities Contributed Capital Revenue - Expenses - Dividends. The formula for ROA is. Net Book Value Original Asset Cost Accumulated Depreciation.

To claim a one-year write-off of low-value assets under Section 19A10A of the Income Tax Act ITA including those acquired on hire purchase the following conditions must be satisfied. A liability is what a business owes such as business loans taxes owing or operating expenses. In this way how do you calculate net income from dividends.

:max_bytes(150000):strip_icc()/dotdash_Final_Capital_Expenditures_vs_Revenue_Expenditures_Whats_the_Difference_2020-01-160a38c63f364966bfc46acc4b6b2917.jpg)

/ExxonLongtermAssets2018-5c5485414cedfd0001efdb2c.jpg)