Casual Revised Schedule Vi Of Companies Act

Revised Schedule VI is applicable for the financial year commencing on or after 1 April 2011 Early adoption of the Revised Schedule VI not permitted since Schedule VI is a statutory format Revised Schedule VI is also applicable to consolidated financial statements Except in the case of the first financial statements laid before the.

Revised schedule vi of companies act. Infrastructural ProjectsFacilities Scope Of. Conventionally current asset to current liabilities ratio current ratio. SCHEDULE VI See sections 55 and 186 Effective from 1st April 2014 INFRASTRUCTURAL PROJECTSFACILITIES SCOPE OF.

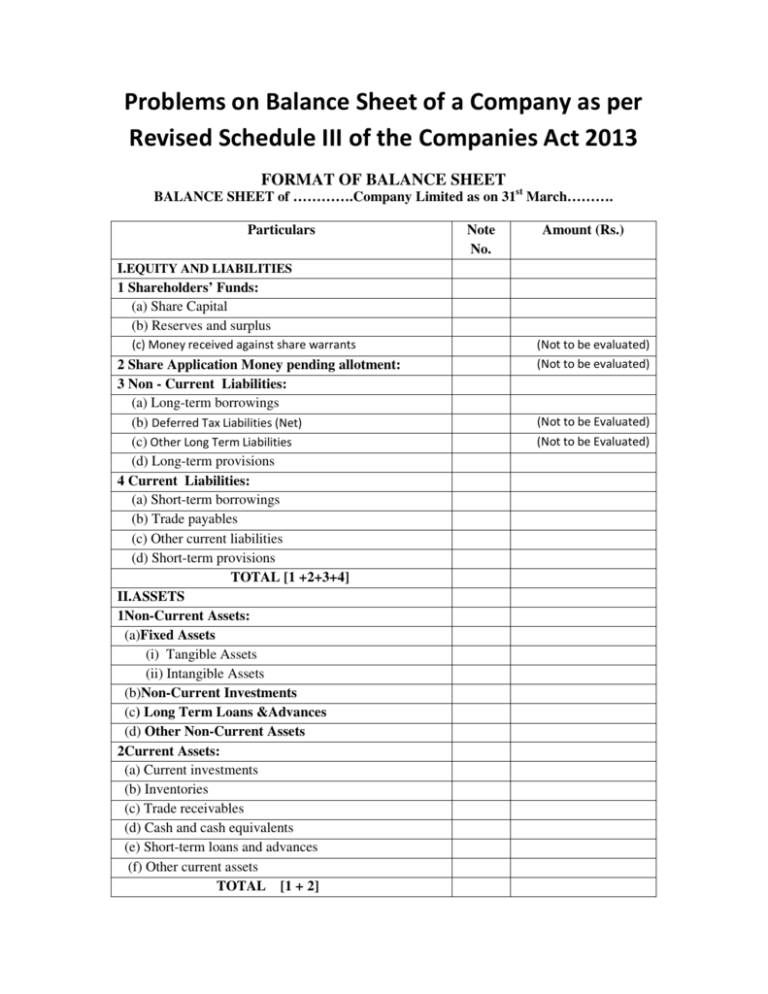

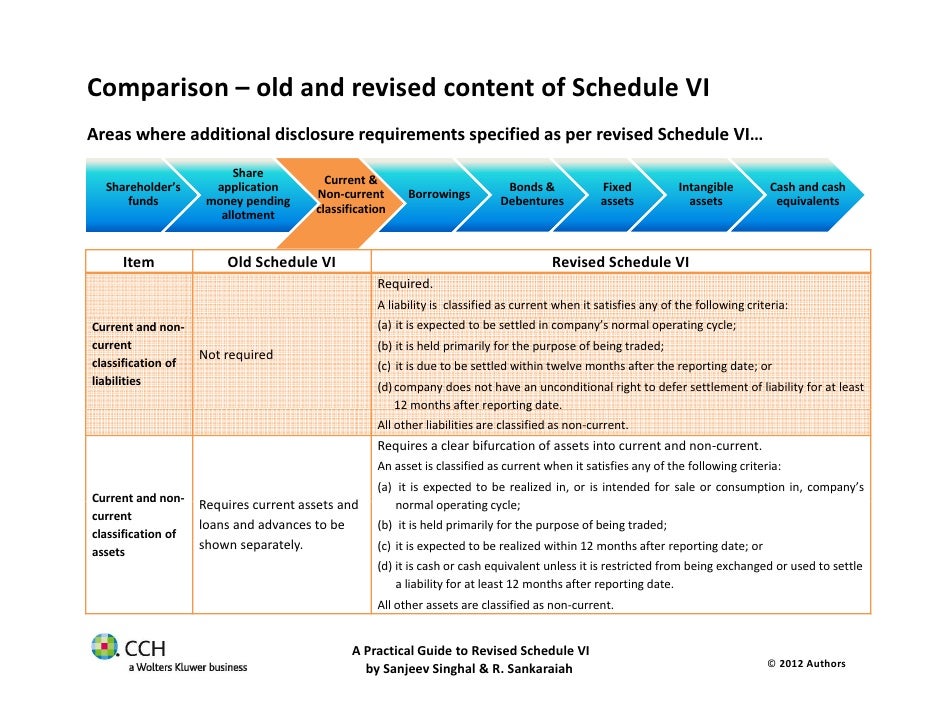

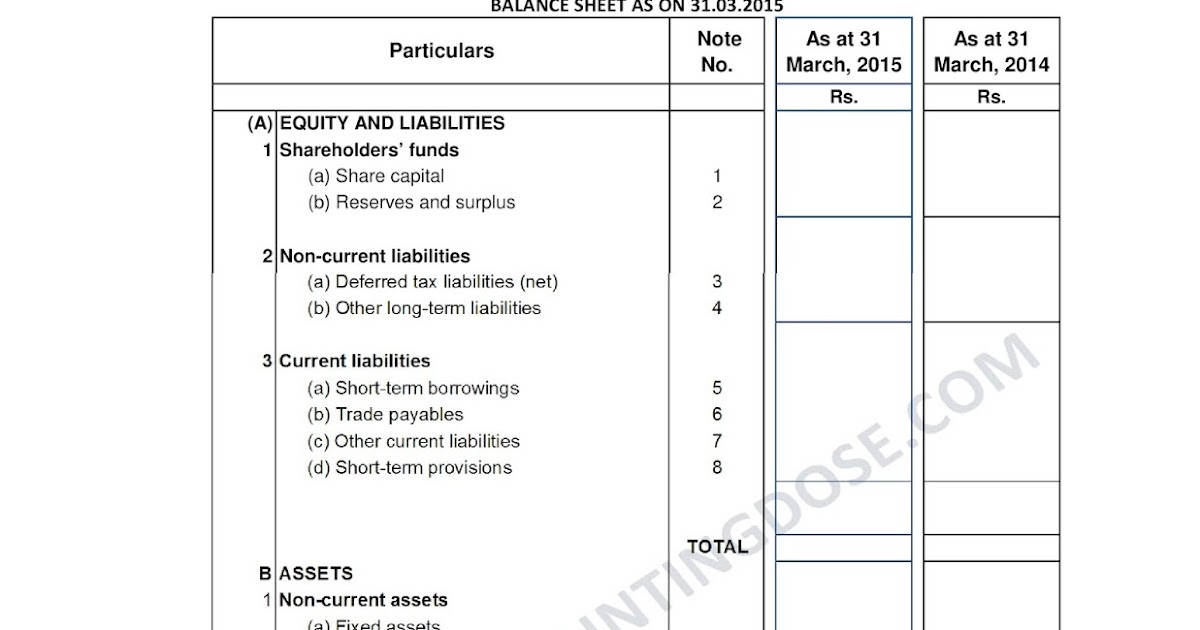

PART I Form of BALANCE SHEET Name of the Company. The Revised Schedule VI is flexible in the case of applicability of Accounting Standards and the Act. The draft revised schedule VI requires companies to classify assets and liabilities into current and non-current categories.

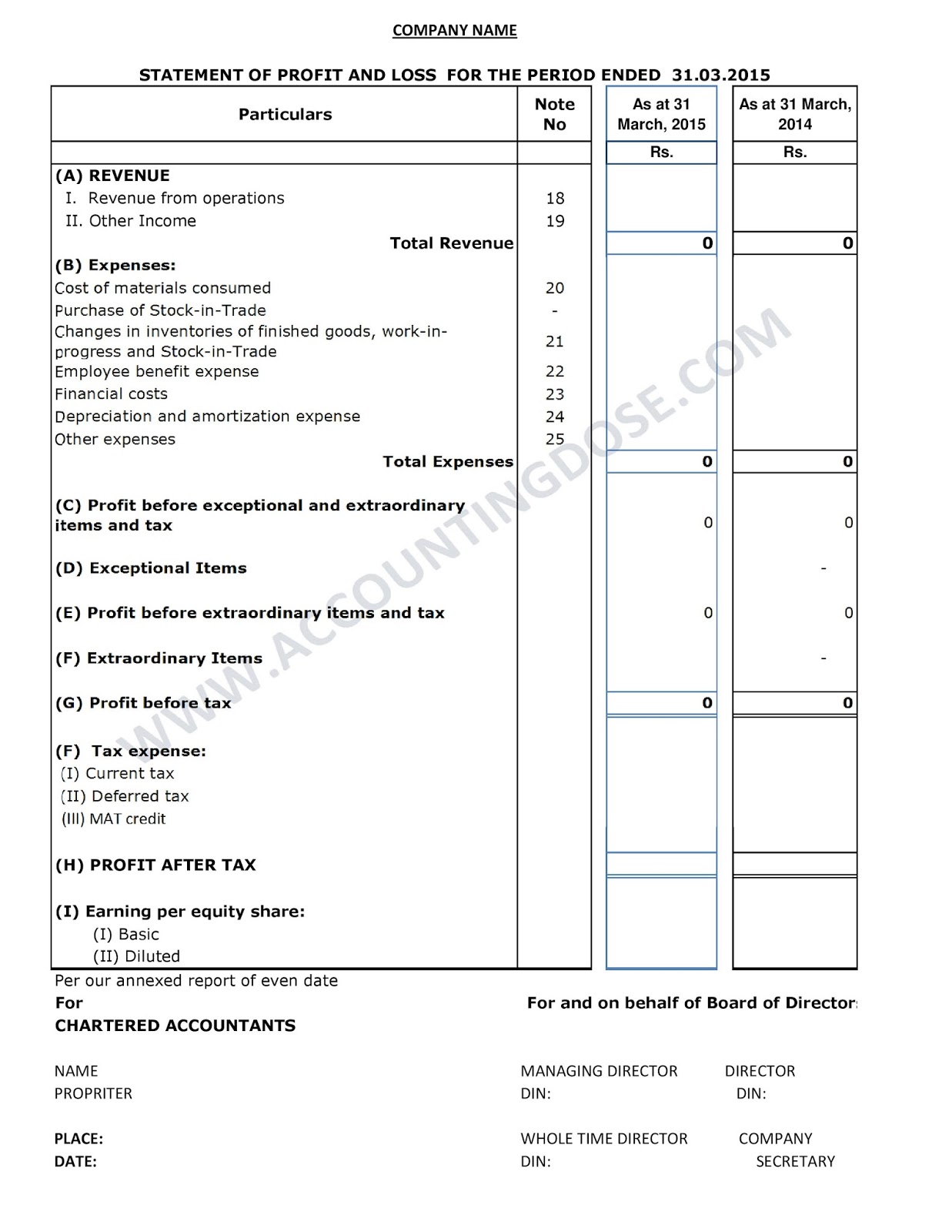

INTRODUCTION TO REVISED SCHEDULE VI Every company registered under the Act shall prepare its Balance Sheet Statement of Profit and Loss and notes thereto in accordance with the manner prescribed in Schedule VI to the Companies Act 1956. Reporting period reporting period 1 2 3 4 I. Revised Schedule VI shall be for the year commencing on or after 01042011.

It is also imperative to note at the very outset that like its predecessor Revised Schedule VI doesnt apply to banking or insurance companies. Section 2111 of the Companies Act 1956 requires the companies to draw up their financial statements as per the form set out in Revised Schedule VI. Except for addition of general instructions for preparation of Consolidated Financial Statements CFS the format of financial statements given in the Companies Act 2013 is the same as the revised Schedule VI notified under the Companies Act 1956.

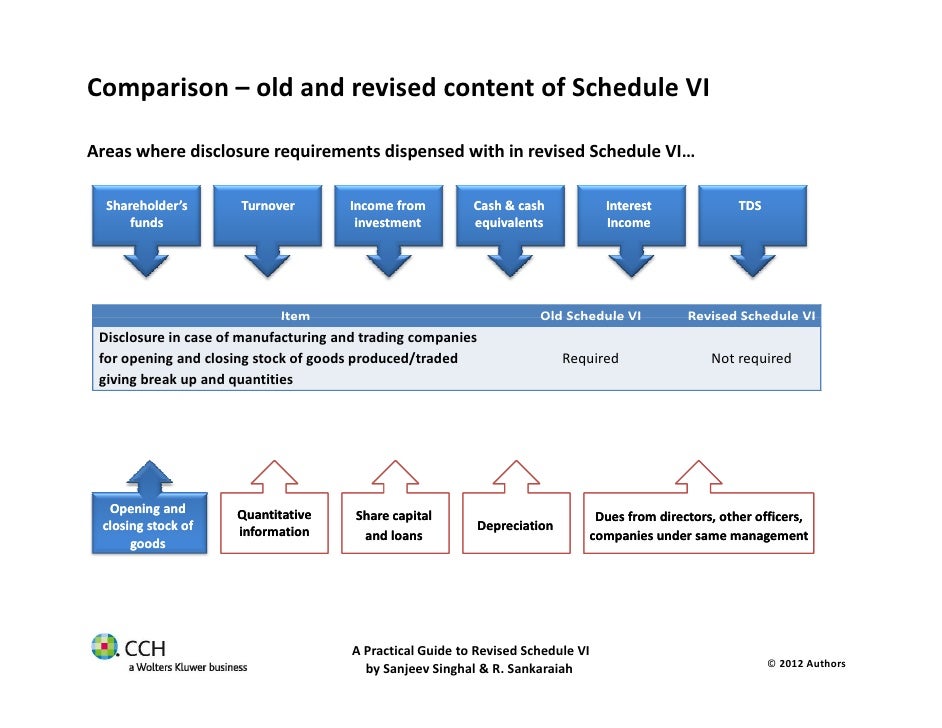

MAIN PRINCIPLES OF REVISED SCHEDULE VI The requirements of the Companies Act 1956 and the Accounting Standards will prevail over the Revised Schedule VI. Revised Schedule VI clarifies that the requirements mentioned therein for disclosure on the face of the financial statements or in the notes are minimum requirements Revised Schedule VI has eliminated the concept of. Schedule 6 of Companies Act 2013.

To harmonise the disclosure requirements with the Accounting Standards and to converge with the new reforms the Ministry of Corporate Affairs vide Notification No. Schedule VI to the Companies Act 1956 the Act provides the manner in which every company registered under the Act shall prepare its Balance Sheet Statement of Profit and Loss and notes thereto. Revised the existing Schedule VI to the Companies Act 1956 and made it applicable to all companies for the Financial Statements to be prepared for the financial year commencing on or after April 1 2011.