Great Saas Balance Sheet Example

In either case balance sheet considerations are one of many variables that need to be considered when choosing between SaaS and on-premise ERP.

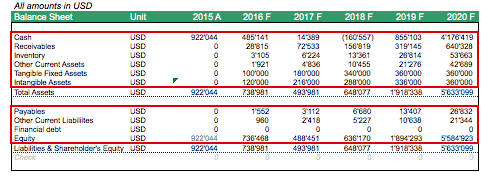

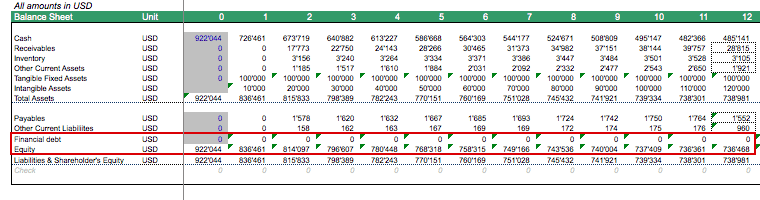

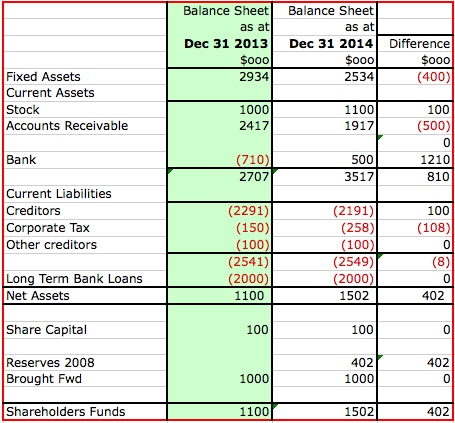

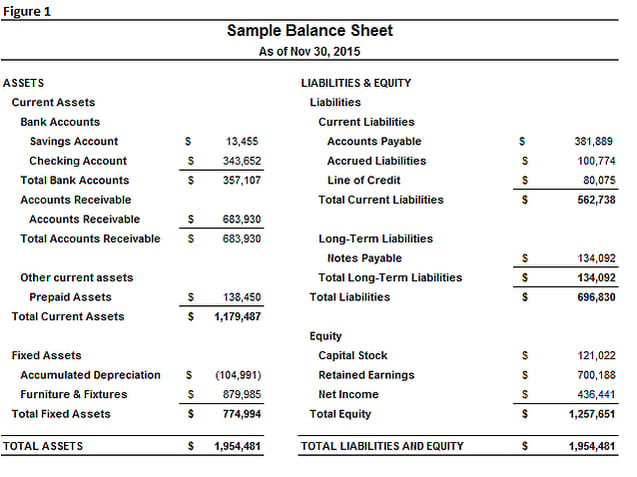

Saas balance sheet example. The fourth column is the Deferred Revenue Balance as of the End of the Period. Annual Balance Sheets This sheet sets out the balance sheet marginsat the end of each year of your financial forecast. GetApp helps more than 18 million businesses find the best software for their needs.

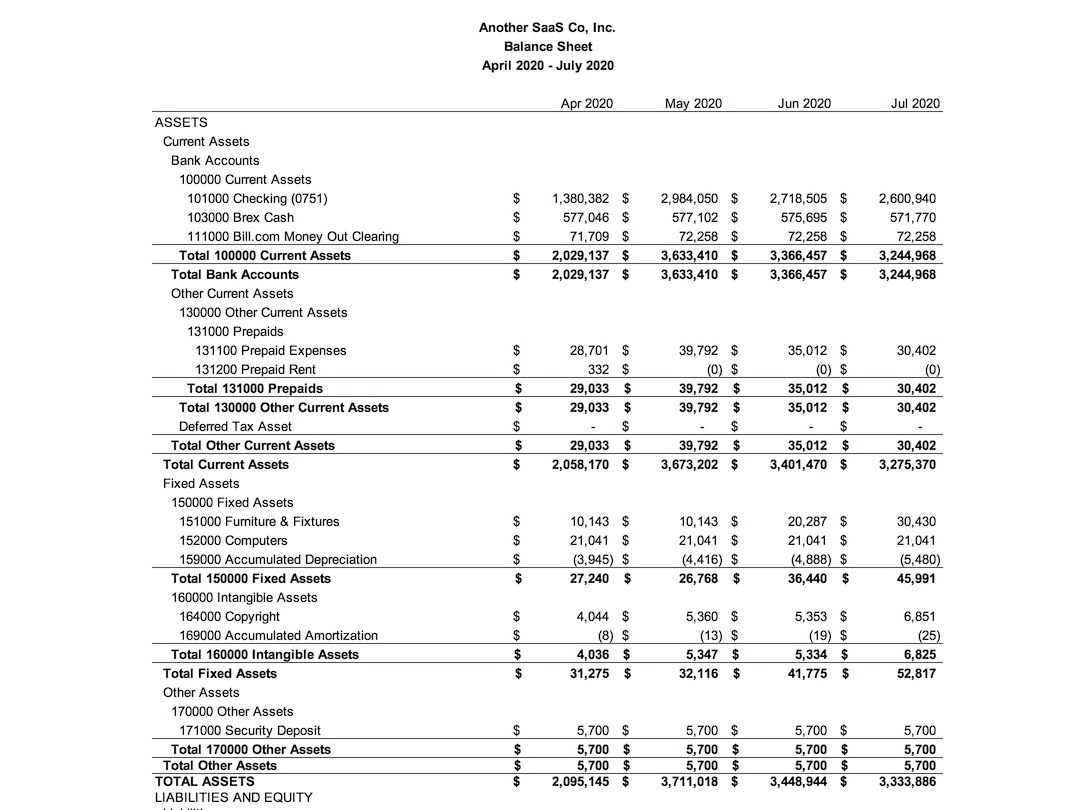

2XXXXX Balance Sheet Liabilities. Yours may a look a little different but it gives you an idea of the categories. Publicly held companies are not required to do this though they are required to disclose their main business interests products and services.

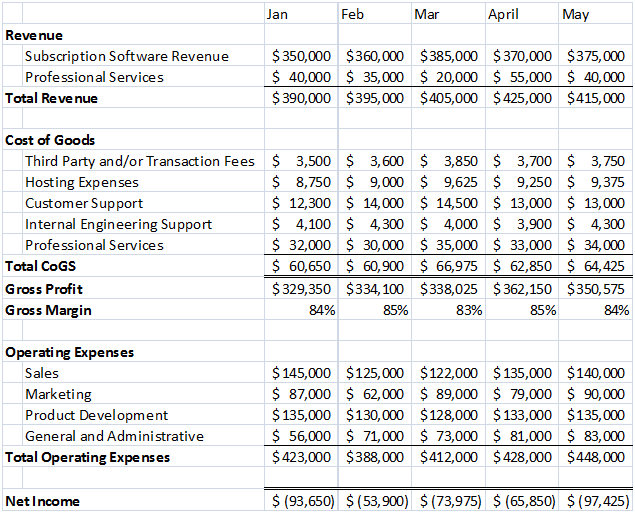

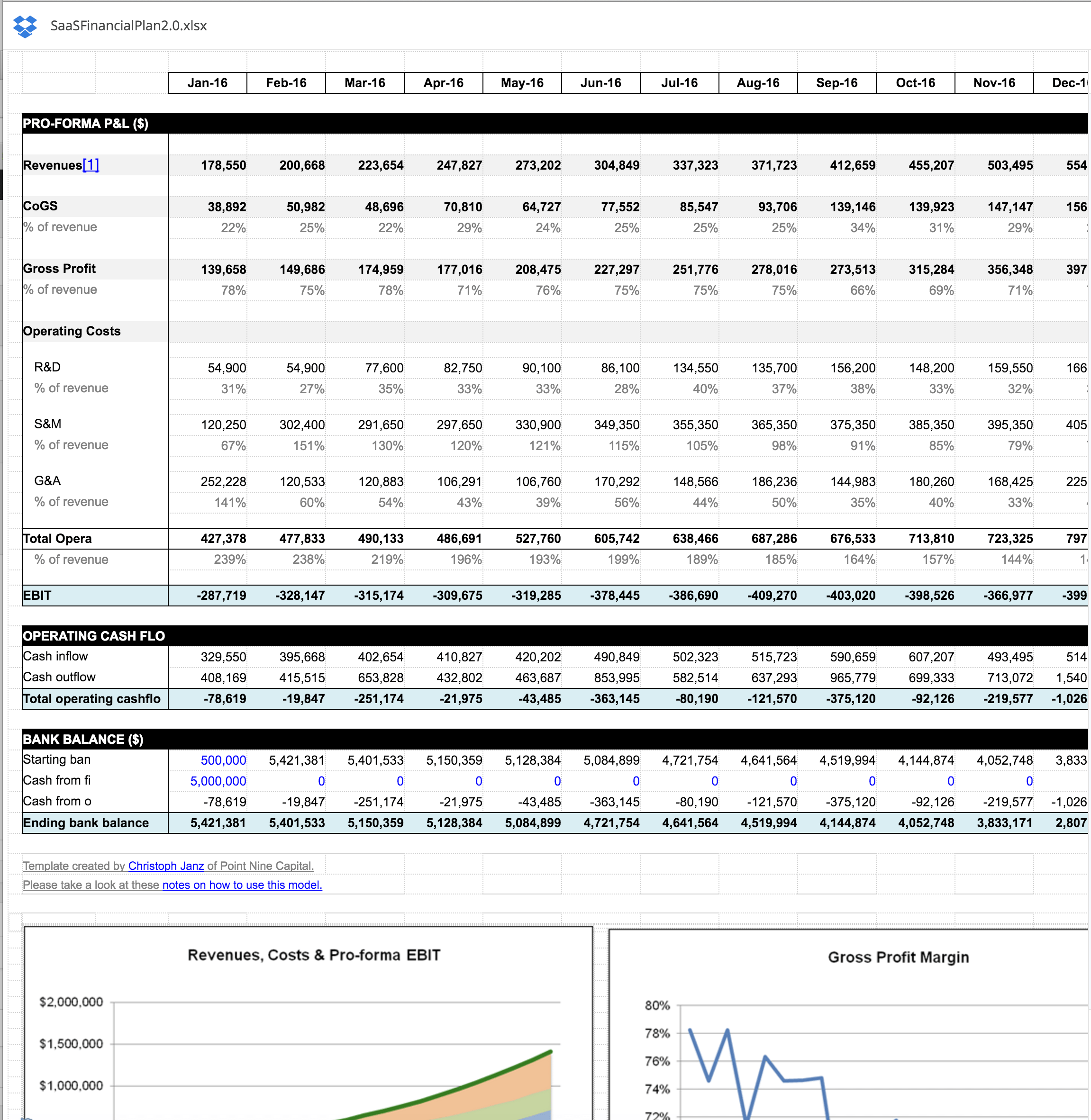

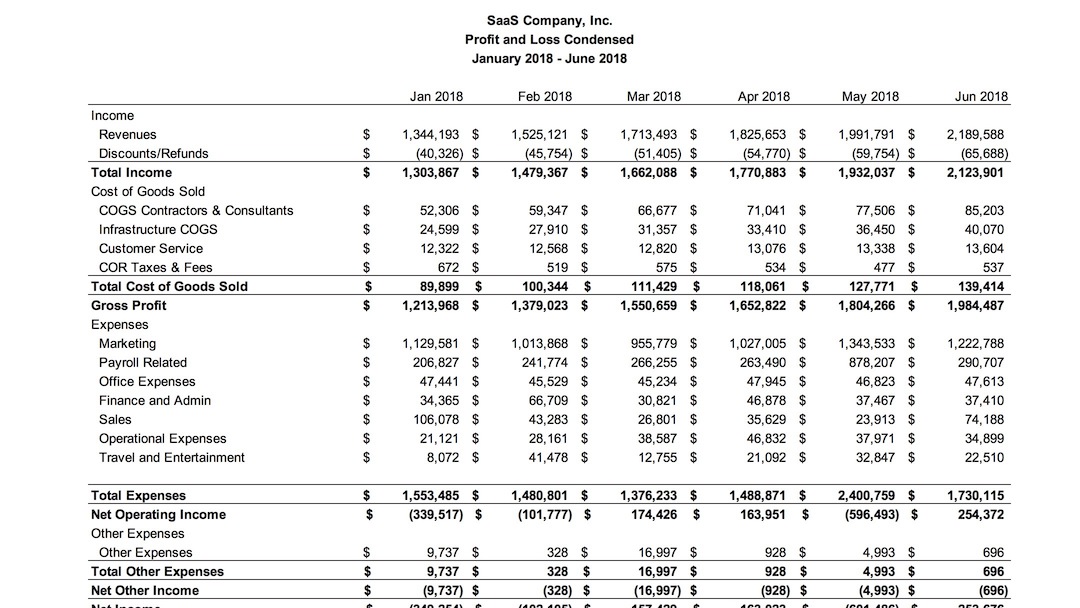

In use in this example is the GAAP friendly daily amortization schedule. 4XXXXX Income Statement Revenue. Change assumptions every month.

Enter the number of paying customers that the saas business has at the start of year 1. The second column Period Revenue is the revenue for the month. SME Users is perfectly fine for most SaaS businesses.

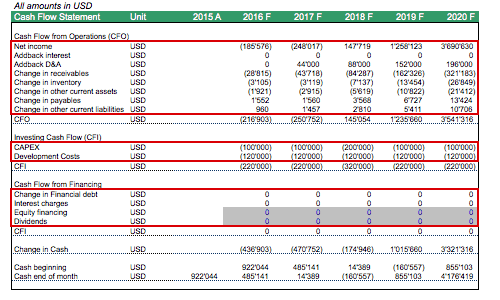

In addition it holds about 28M in on its balance sheet at IPO for a median total raise of about 88M before IPO. 1XXXX Balance Sheet Assets. The cash flow statement.

A SaaS model builds on a traditional three statement model while also includes SaaS specific metrics such as customer acquisition cost CAC customer lifetime value LTV LTVCAC ratio and payback period. The model allows you to have up to 4 subscriptions including a free plan if you need toThe names you enter will flow through the Revenue and Operating Model sheets of the template. It records cash inflows and outflows which is majorly ignored in.