Smart Schedule 6 Of Companies Act 2013

103 rows As per Schedule II of Companies Act 2013 The description of Fixed assets.

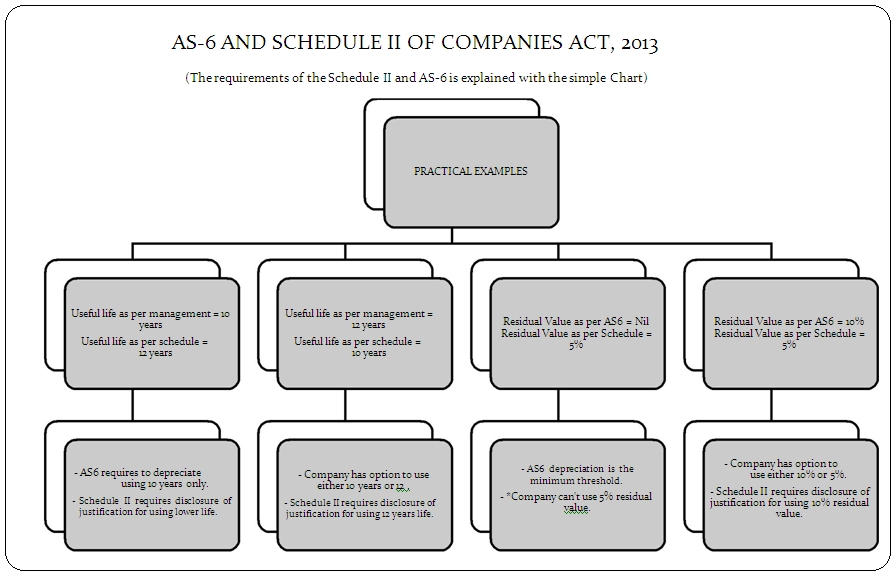

Schedule 6 of companies act 2013. In new era of depreciation useful life of the asset plays a crucial role for calculation of depreciation. The Depreciation on fixed asset as per Schedule-II of Companies Act 2013 became operational from 01042014 vide MCA notification no SO902 E dated 26032014. Name address description and occupation of subscriber.

For the purpose of this Schedule the terms used herein shall be as per the applicable Accounting Standards. It provides that a company engaged in the setting up of and dealing with infrastructural projects may issue preference shares for a period exceeding twenty years but not exceeding thirty years subject to the redemption of a minimum ten percent of such preference shares per year from the twenty first year onwards or earlier on proportionate basis at the option of the preference shareholders. 36 rows Chapter XXIA Producer Companies.

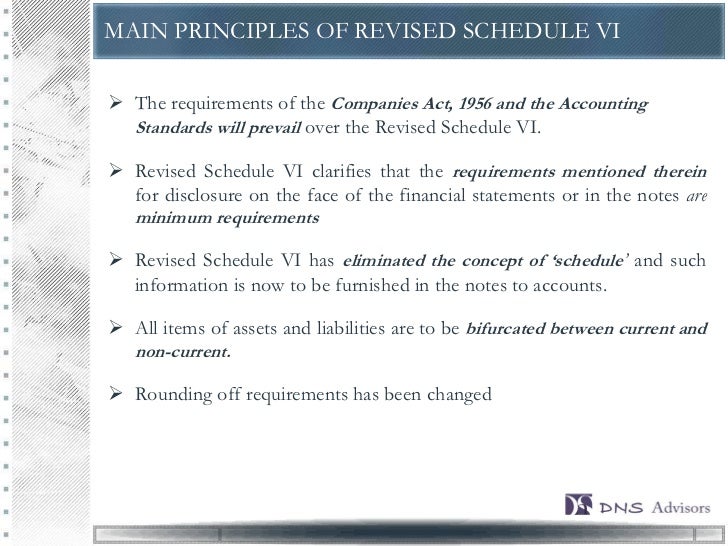

Revised Schedule VI of Companies Act 1956. 9a This amendment not applied to legislationgovuk. Appointment of managing director whole-time director or manager Section 196 and.

In case of conflict requirements of the Companies Act 1956 Accounting Standards shall prevail over Schedule VI Information currently disclosed as schedules and notes to accounts now clubbed as notes to accounts Consistency in definition of terms used will carry the meaning as defined by the applicableAccounting Standards. Memorandum and Articles Section 4 and 5 2. The schedule VI has eliminated the concept of Schedules and such information is now to be furnished in terms of Notes to Accounts.

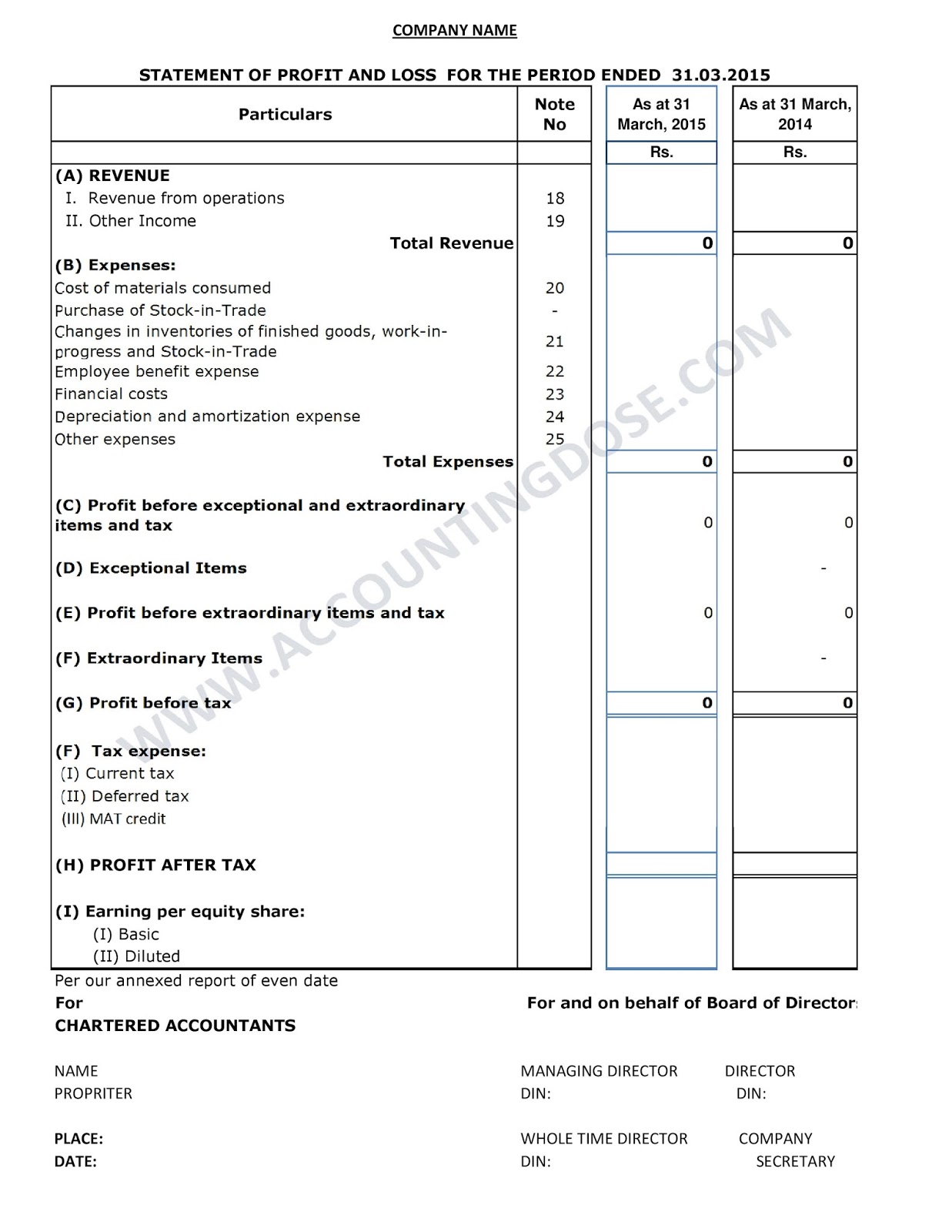

Companies Act 2013. Balance Sheet and Statement of Profit Loss Section 129 4. List of Schedules under Companies Act 2013 1.

Transportation including inter modal transportation includes the following a. Signature name address description and occupation of witness. The change in the method of providing depreciation from fixed percentage.