Perfect Are Dividends Show Non The Balance Sheet

/GettyImages-1128492098-f6606fdc398b4e0bbecbe4c2fe8493eb.jpg)

Xxx with account type as Account Payable.

Are dividends show non the balance sheet. Accumulated Dividend Arrears on preference shares is shown in the Companys Balance Sheet as. Under GAAP or generally accepted accounting principles dividends declared are deducted from shareholders equity when declared not when paid. Financial Statements of a Company.

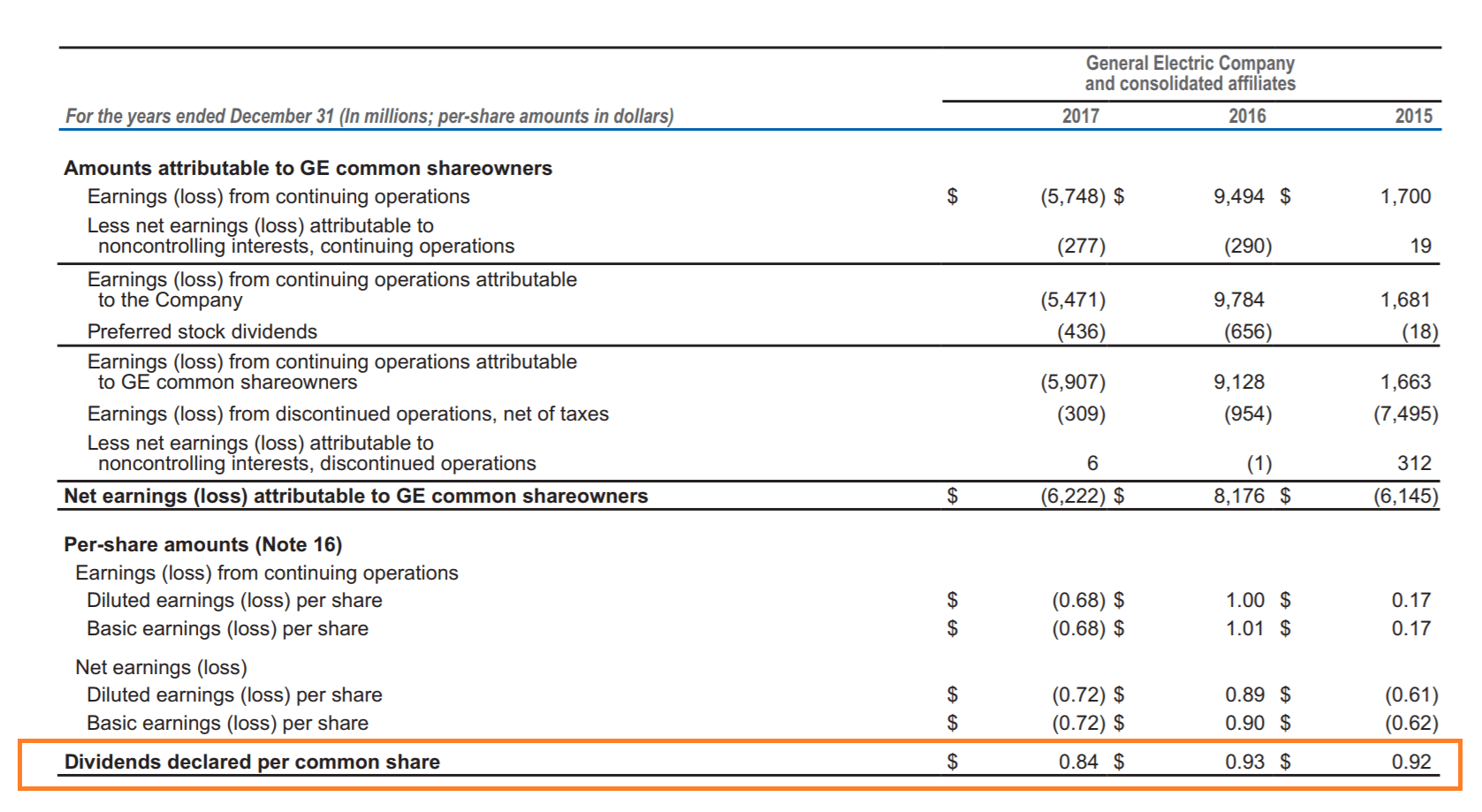

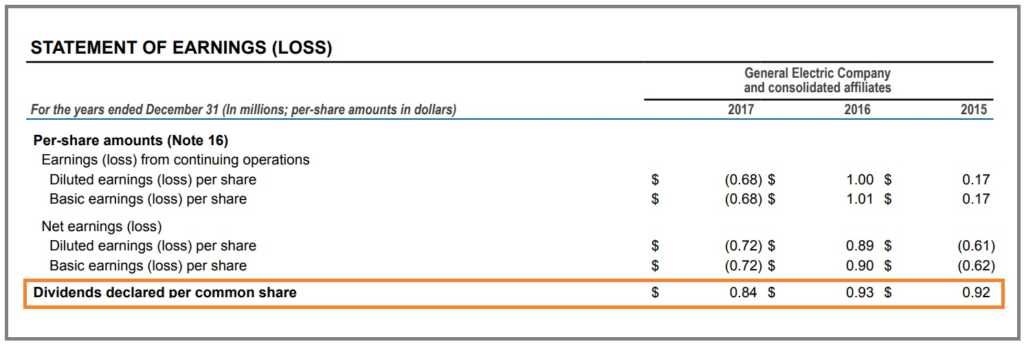

This is because a portion is added to Profit and Loss Account balance of holding company and added the rest to. Investors will not find a separate balance sheet account for dividends that have been paid. The dividend rate for the period is provided in the income statement although it is only listed it is not part of the determination of net income.

Stock dividends however do not require a cash outflow. Dividends on common stock are not reported on. If you want to show declared dividend in your companys balance sheet you should do the following.

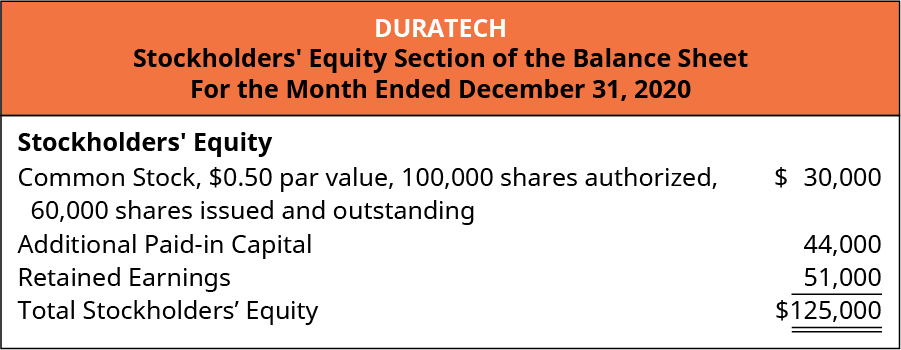

Retained earnings and cash are reduced by the total value of the dividend. It may have fallen into deficit since if there have been subsequent losses. Dividends that were declared but not yet paid are reported on the balance sheet under the heading current liabilities.

If the reserves were sufficient for the declaration of the dividend that was paid then the balance sheet couldnt have shown an overall deficit at the time. Cash dividends represent a cash outflow and are recorded as reductions in the cash account. These reduce the size of a companys balance sheet and asset value as the company no longer owns part of its liquid assets.

They are reflected in your capital and reserves figure on your balance sheet. Understanding Dividends When cash dividends are paid this reduces the cash balance stated within the assets section of the balance sheet as well as the offsetting amount of retained earnings in the equity section of the report. But any dividend that causes the balance sheet to go into deficit is by definition illegal.

:max_bytes(150000):strip_icc()/FacebookbalancesheetREDec2018-5c73549b46e0fb00014ef630.jpg)