Fine Beautiful Change In Stockholders Equity Formula

Equity ending equity.

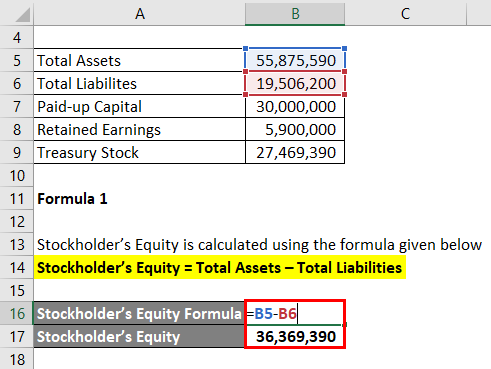

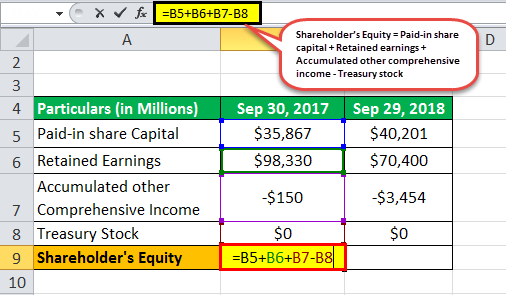

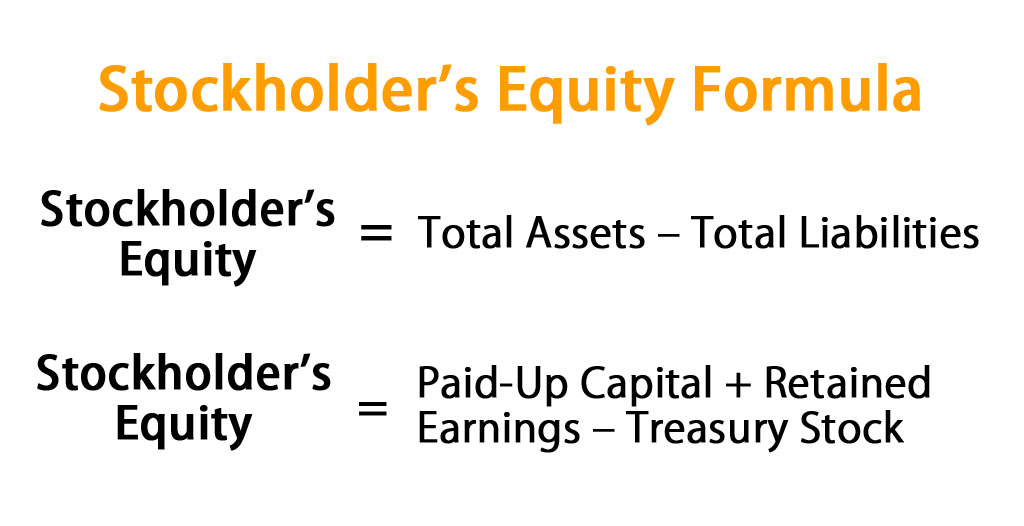

Change in stockholders equity formula. Stockholders Equity Assets - Liabilities But beyond the fact that it must match up with assets and liabilities what goes into stockholders equity on a balance sheet. Common stock Preferred stock Additional paid-in capital - Retained earnings - Treasury stock Stockholders equity. Alternatively equity can also be directly calculated as the combination of contributed capital commons stock preferred stock treasury stock and retained earnings net income other comprehensive income.

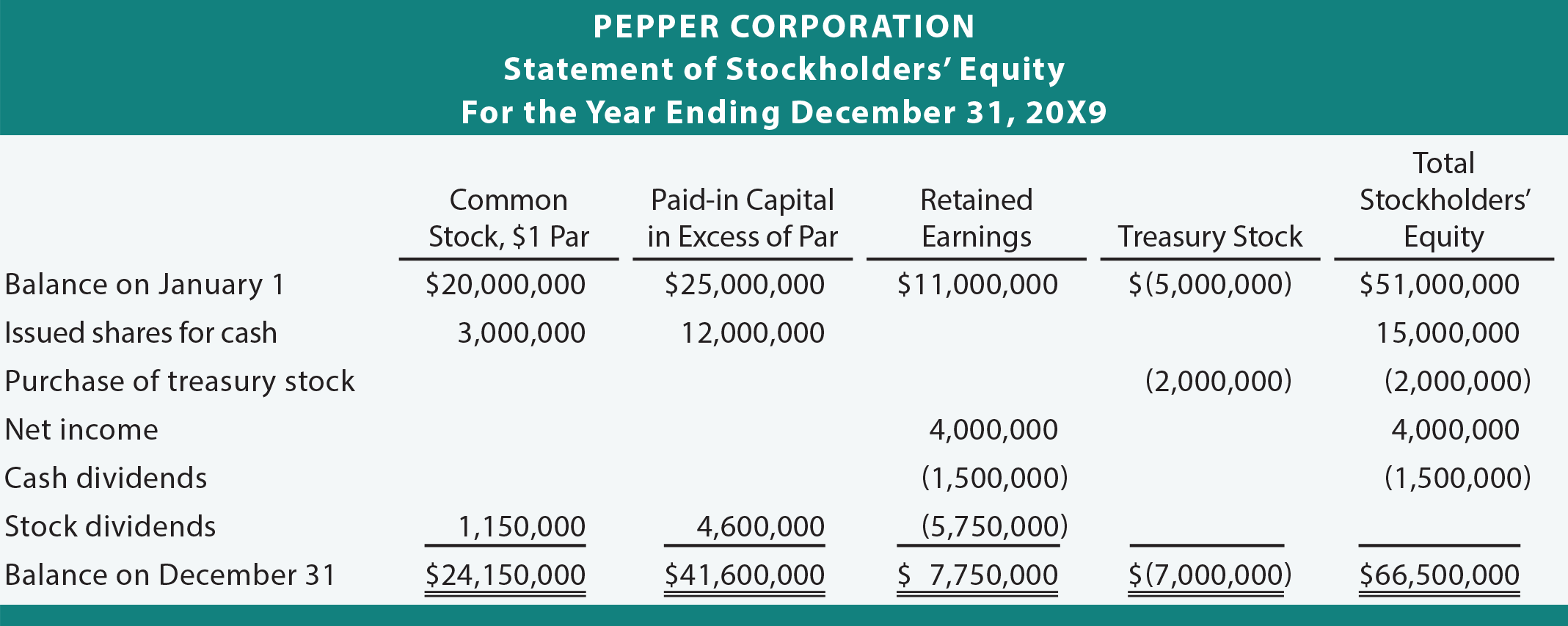

It increases the common stock and additional paid-up capital component. Following are the most common changes in shareholders equity. Changes in stockholders equity can lead to cash inflows or outflows depending on the specific activity.

Stockholders equity increases due to additional stock investments or additional net income. Net income loss for the period. Common Stock Retained Earnings Total Stockholders Equity.

The formula for a statement of changes in equity includes the opening and closing value of the equity net income for the year dividends paid along with other changes. GAAP details the change in owners equity over an accounting period by presenting the movement in reserves comprising the shareholders equity. No Commissions Spreads Apply.

TextStockholders Equity Assets - Liabilities This simple equation does a lot in demonstrating that shareholders equity is the residual value of assets minus liabilities. In other words the shareholders equity formula finds the net value of a business or the. Equity beginning equity.

Stockholders Equity Assets Liabilities In the above-mentioned formula the equity of the stockholders is the difference between the total assets and the total liabilities. Any change in the Common Stock Retained Earnings or Cash Dividends accounts affects total stockholders equity. Since stockholders equity is equal to assets minus liabilities any reduction in stockholders equity must be mirrored by a reduction in total assets and vice versa.

/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)