First Class Aro Accounting Entries

Learn about accretion in accounting and read a full example of an asset retirement obligation ARO liability with journal entries.

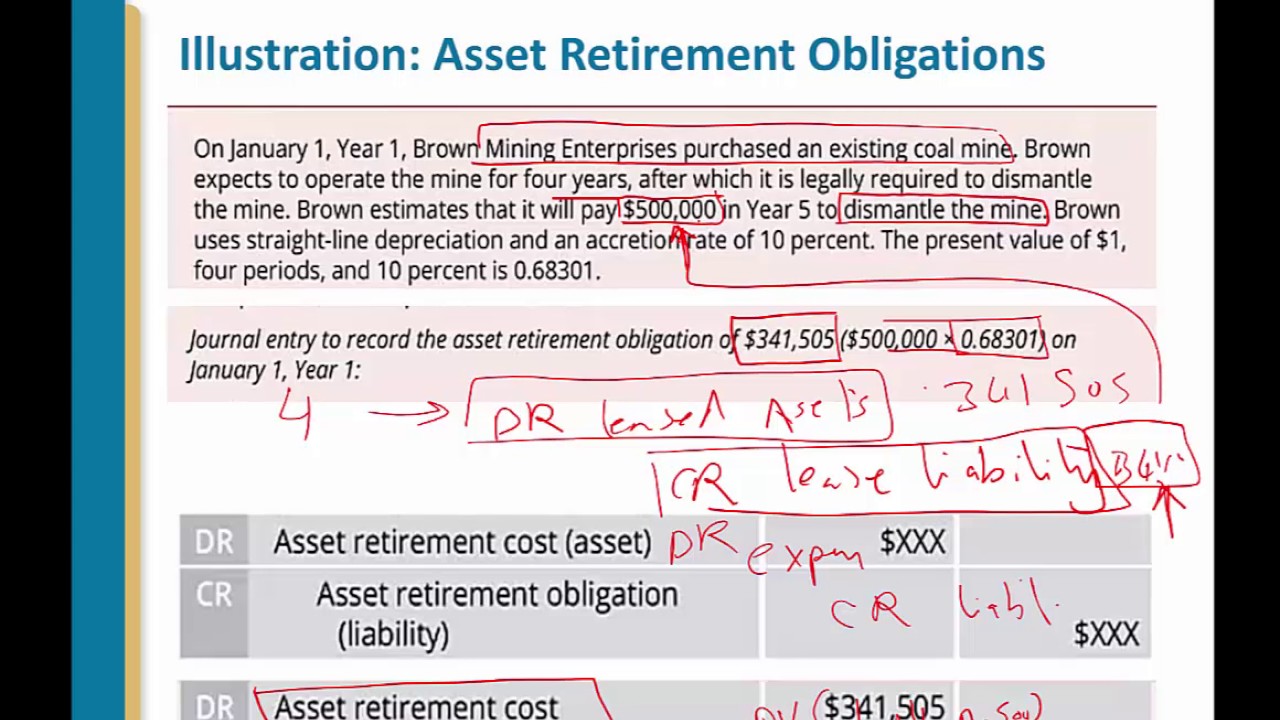

Aro accounting entries. Accounting the following entry would be recorded. The accounting for environmental obligations and asset retirement obligations AROs will vary depending on the laws and regulations governing such obligations. 143 Accounting for Asset Retirement Obligations which was seven years in the makingshifts to a balance-sheet approach requiring businesses to recognize a liability for a retirement obligation when they incur iteven if that is far in advance of the assets planned retirement.

Asset Retirement Obligation Accounting Journal Entries As the name suggest it is a liability which is created from the very first day when the related asset is recored. ARO accounting is particularly significant for remediation work needed to restore a property such as decontaminating a nuclear power plant site removing underground fuel storage tanks cleanup around an oil well or removal of improvements to a site. Idaho Power provided the ARO accounting entries annually for the years ending 2004 2005 and 2006 but failed to provide the ARO entries annually beginning in 2007.

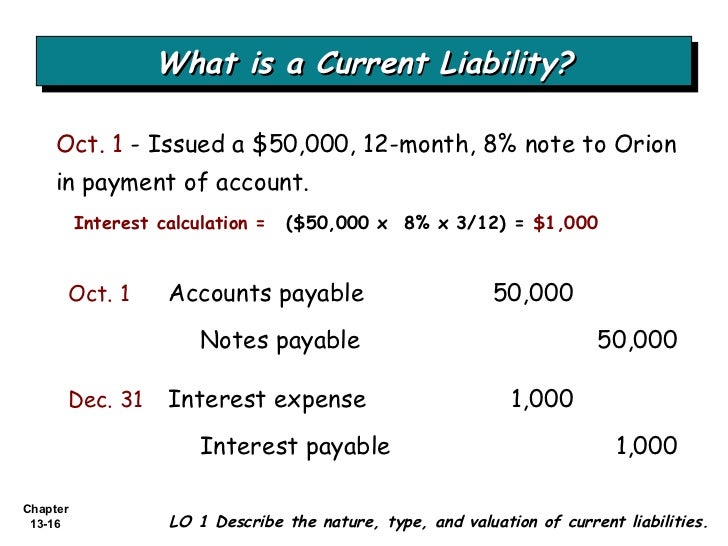

Accrued regulatory liability 365 Dr. This concept in accounting is called Asset Retirement Obligation. Accounting Requirements An accounting entry is required when a liability has been incurred and can be reasonably estimated.

When an Asset that is set up for ARO is retired the Create Accounting Entries process generates only the usual Fixed Asset FA Accumulated Depreciation AD and GainLoss GAGL lines. Initial Accounting for an Asset Retirement Obligation In most cases the only way to determine the fair value of an ARO is to use an expected present value technique where the probabilities of several possible outcomes are used. Pursuant to Order No.

This Roadmap is intended to help entities address the impact of certain environmental and asset retirement laws and regulations on accounting for environmental obligations and AROs. It is denoted by ARO. It does not apply to unplanned cleanup costs such as costs incurred as a result of an accident.

The asset retirement obligation arises. The Company is committed to filing the ARO entries timely in the future. An external obligating event is the legal requirement.