Great Most Likely Prepaid Expenses On Balance Sheet

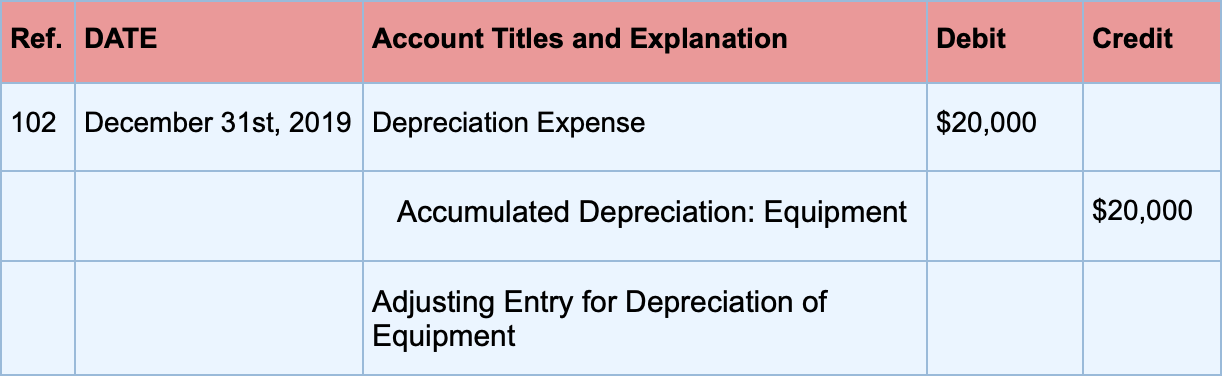

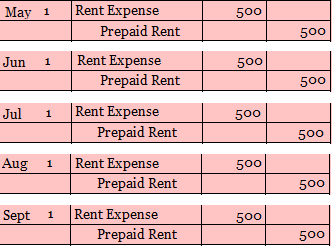

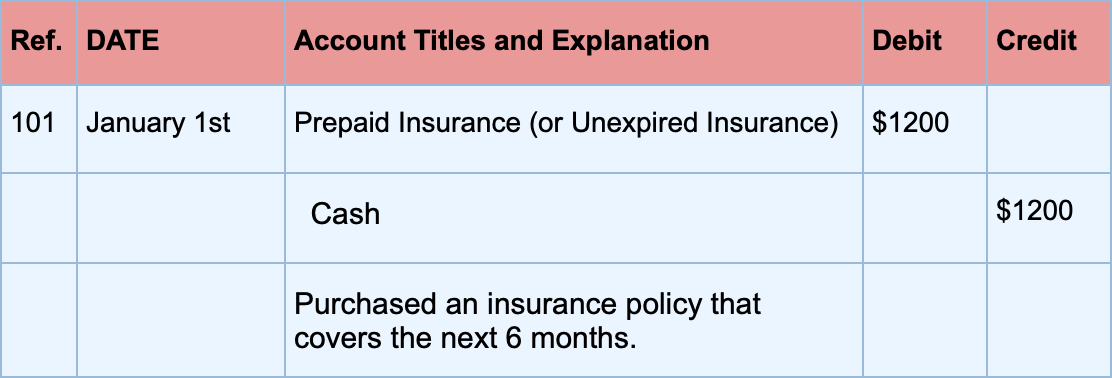

Refer to the first example of prepaid rent.

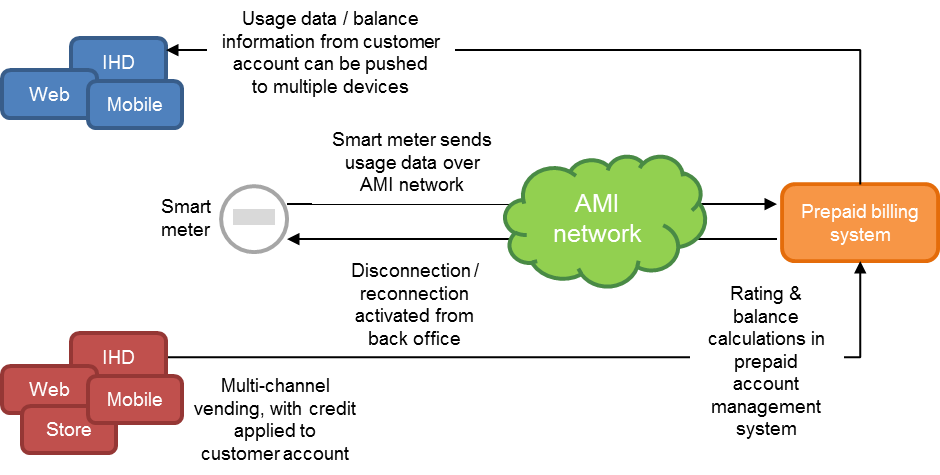

Most likely prepaid expenses on balance sheet. This means that even though the expense has been paid upfront it is not considered an expense yet in a businesss financial records. These are both asset accounts and do not increase or decrease a companys balance sheet. An accrued expense liability is most likely recognized when.

The statement of owners equity should be prepared. It is usually mentioned as a long-term asset on the yearly balance sheet. We penalise companies with a high level of prepaid expensesinventory relative to industry peers.

Quarterly tax estimates insurance premiums and retainer fees are among the pre-paid expenses. The service was billed at the agreed upon amount of 3500. Recall that prepaid expenses are considered an asset because they provide future economic benefits to the company.

Validate or refuse with just one click. Most agree that rent and insurance are the most expensive prepaid items on a balance sheet. If a company pays cash before it recognizes the associated revenue it results in a prepaid expense asset.

After the income statement and before the balance sheet. Its necessary to correctly break down all items to be sure your profit is properly calculated. If a prepaid expense were likely to not be consumed within the next year it would instead be classified on the balance sheet as a long-term asset a rarity.

Debited Accounts Receivable for 3500 and credited Service Revenue for 3500. A prepaid expense is an advance payment made with a reasonable certain anticipation of a future expense. Name two items on McDonalds balance sheet that most likely represent unexpired prepaid costs.

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Prepaid_Expenses_Recorded_on_the_Income_Statement_Oct_2020-06-7efbf5b828c64e319cca3507cd3210bf.jpg)

/dotdash_Final_How_Are_Prepaid_Expenses_Recorded_on_the_Income_Statement_Oct_2020-01-5994210f98a84b468a9a113c94643d50.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Other_Current_Assets_OCA_Dec_2020-01-1ef8bd75eff345e7ac48ba70fb718619.jpg)