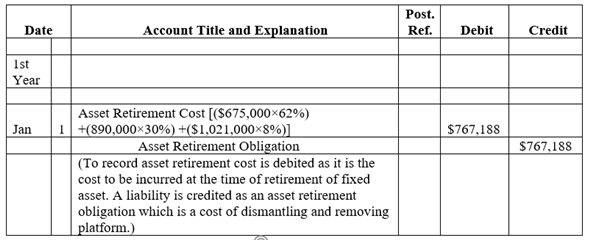

Impressive Asset Retirement Obligation Journal Entry Example

Below youll find a full example of how to account for an asset retirement obligation with journal entries.

Asset retirement obligation journal entry example. C For AROs related to acquired tangible capital assets the event is the acquisition of the tangible capital asset. You can download this Asset Retirement Obligation Excel Template here Asset Retirement Obligation Excel Template Example 1 Assume a power company builds a power plant at a site with a 50-year lease. What is an asset retirement obligation.

In Year 3 Quarter 3 you discover that the asset was sold in Year 3 Quarter 1 for 2000. Lets take an example to understand the calculation of Asset Retirement Obligation in a better manner. An asset that may require decommissioning at a substantial cost to a government such as power plants nuclear reactors or sewage treatment plants.

Some examples specific to the oil and gas industry include oil well plugging and abandonment and underground storage tank removal. An Example of an Asset Retirement Obligation Consider an oil-drilling company that acquires a 40-year lease on a parcel of land. The liability is commonly a legal requirement to return a site to its previous condition.

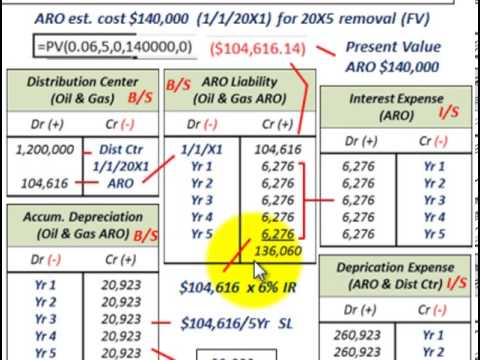

Section PS 3280 Asset Retirement Obligations was issued by the Public Sector Accounting Standards Board PSAB or the Board August 2018. A simple promissory note to pay certain amount within a certain period is an example of a pure obligation. This video explains how to account for an asset retirement obligation in the context of financial accounting.

An asset retirement obligation ARO is a liability associated with the eventual retirement of a fixed asset. In this and following balance-sheet illustrations debits are denoted by Dr and credits by Cr. Lets begin with the.

For example certain obligations such as nuclear decommissioning costs generally are inc urred as the asset is operated. It is effective for fiscal years beginning on or after April 1 2021 which means March 31 2022 and December 31 2022 will be the first. The asset cost is 4000 the life is 4 years and you are using straight-line depreciation.