Impressive Balance Sheet Heading Format

The balance sheet discloses financial position of the business.

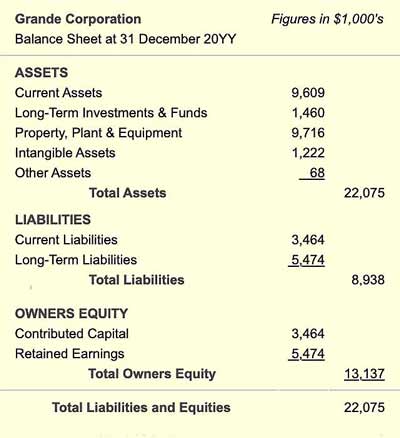

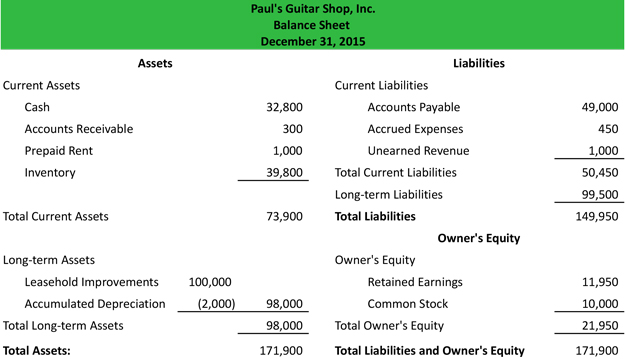

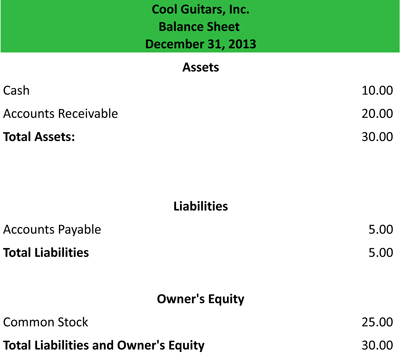

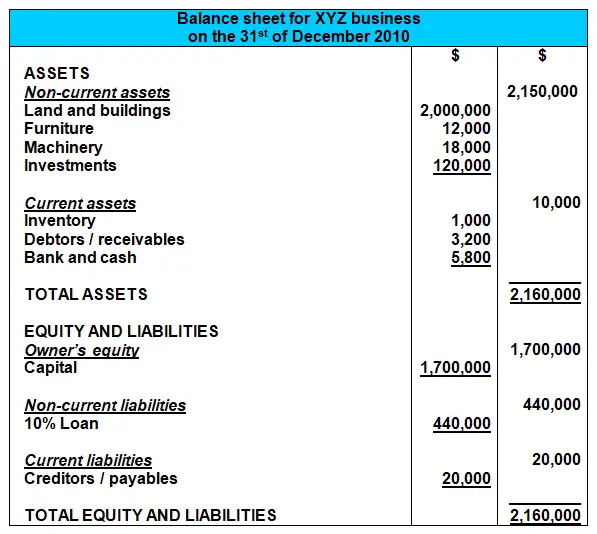

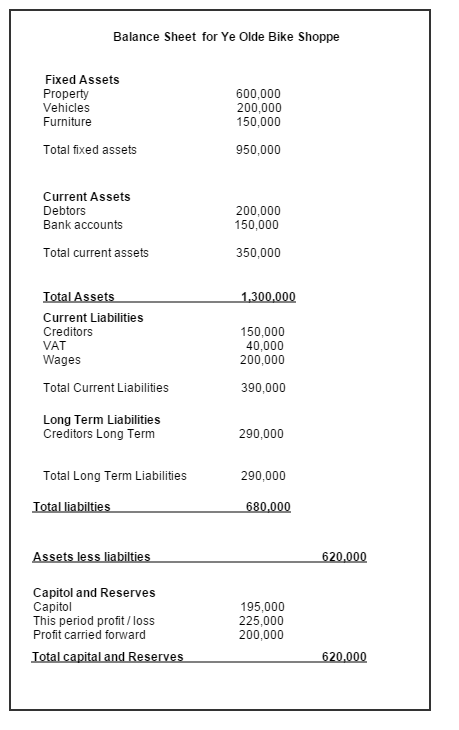

Balance sheet heading format. Assets Fixed Assets Current Assets intangible assets stock cash money owed from customers accounts receivable ledger and prepayments. It often subtracts total liabilities from total assets to arrive at net assets and show it to be equal to the shareholders equity. In brief A L OE.

And the third states the date of the report. Balance sheet reveals the financial position of the firm on a particular date at a point of time so it is also called position statement. The following example shows a simple balance sheet based on the post-closing trial balance of Company A.

This is the date as of which assets liabilities and shareholders equity ending balances are being reported such as as of December 31 20X4. Format of the balance sheet There are two formats of presenting assets liabilities and owners equity in the balance sheet account format and report format. The comparative balance sheet is a balance sheet which provides financial figures of Assets Liability and equity for the two or more period of the same company or two or more than two company of same industry or two or more subsidiaries of same company at the same page format so that this can be easily understandable and easy to analysis.

The header needs to include your company name the title of the financial statement ie. Notice that the third line is worded As of. The total of both side should always be equal.

Assets are placed in the left hand side while the liabilities are placed on the right hand side. This is a report designation which is Balance Sheet. To ensure the balance sheet is balanced it will be necessary to compare total assets against total liabilities plus equity.

The comparative balance sheet presents multiple columns of amounts and as a result the heading will be Balance Sheets. The heading includes the business name and date. The additional column allows the reader to see how the most recent amounts have changed from an earlier date.

3.jpg)