Neat Bank Indebtedness Balance Sheet

:max_bytes(150000):strip_icc()/dotdash_Final_Liability_Definition_Aug_2020-01-5c53eb9b2a12410c92009f6525b70e7a.jpg)

The balance sheet equation.

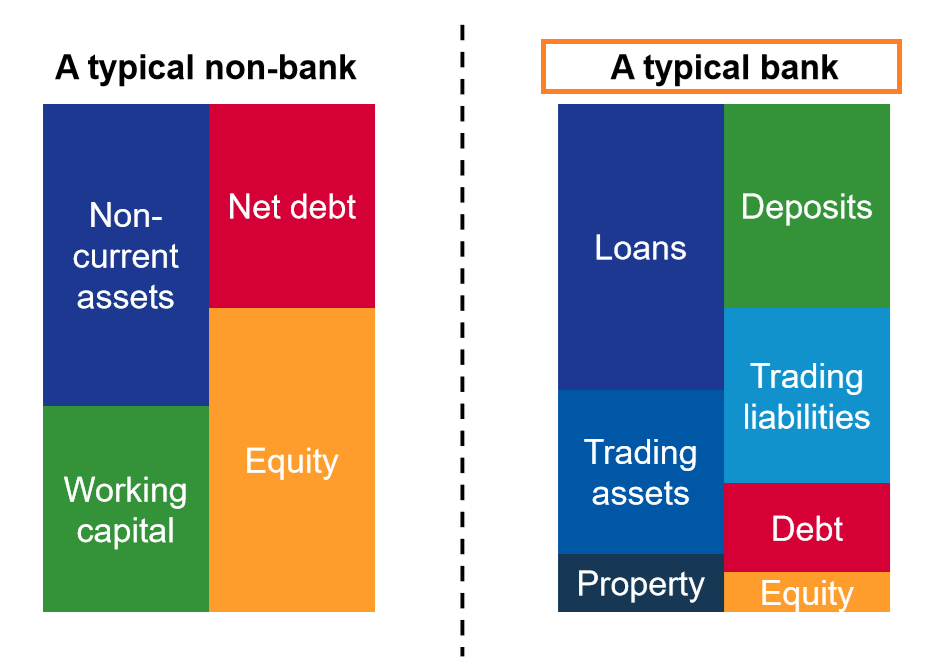

Bank indebtedness balance sheet. The balance sheet gives an outline of where the company is right now in terms of what it owns and what it owes. We also analyse the effect of a range of shocks on households emphasising that they affect different households in different ways. Net income of 182 billion is the profit earned by the bank for 2017.

That is a balance of indebtedness states all the assets a country owns examples include national art taxes not yet spent and stock in nationalized corporations and all liabilities including accounts payable to government workers unpaid entitlement spending and especially the national debt. Indebtedness of households along with the vulnerability of different household groups. Introduction This report presents a concise analysis of the level of indebtedness and the financial position of the main borrowers of the Cyprus banking system the domestic household and nonfinancial corporations sectors.

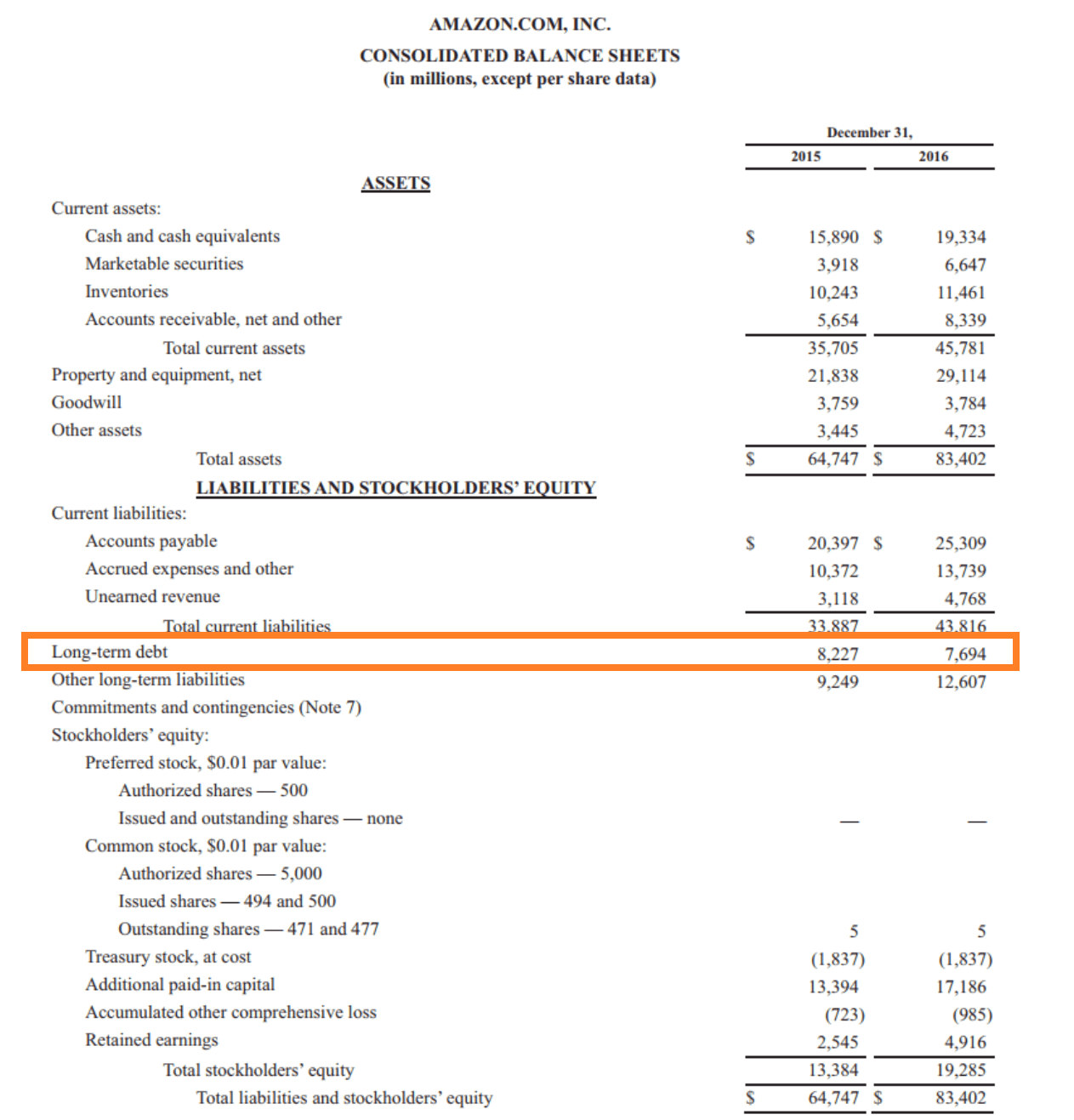

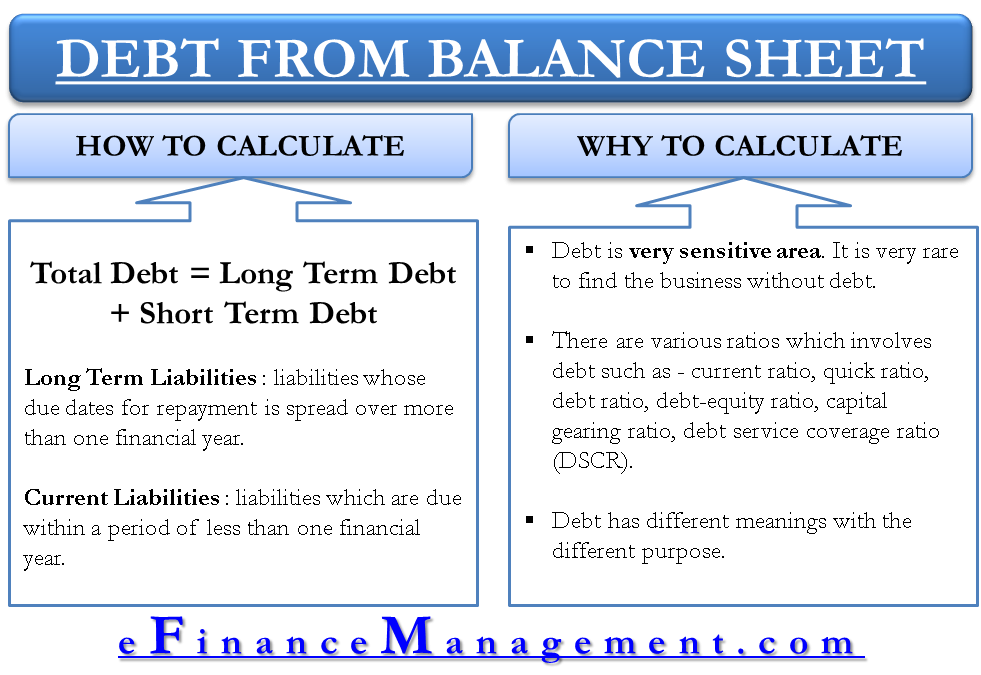

It means that if the companys bank balance reaches zero there is a certain limit allowed by the bank that the company can still make transactions. When your Cash category is in a negative position it will be classified as bank indebtedness which is under the Current Liabilities section of the Balance Sheet. Companies use bank debt to pay for long-term assets such as land buildings and equipment or to add more cash to their working capital to cover ongoing short-term expenses current liabilities.

The two sides must balancehence the name balance sheet. 79 rows The balance sheet of authorized institutions excludes certificates of indebtedness issued by. In new IMF staff research we observe the resilience of private sector balance sheets.

Household and NonFinancial Corporations Indebtedness Report 1. The preparation of a bank balance sheet is really complicated since the banking institutions will need to calculate their net loans and it is really time consuming and the items recorded in this balance sheet are loans allowances Short Term Loan Short Term Loan Short term loans are the loans with a repayment period of 12 months. It appears under liabilities on the balance sheet as part of all the money the company owes its creditors.

The first thing youll notice about the balance sheet is. The paper is organised as follows. Represents amounts owed by company to suppliers for purchases made on credit Accrued liabilities amount owed by the company for salaries interests sales tax rent income tax like items Notes Payable.

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)

:max_bytes(150000):strip_icc()/FacebookbalancesheetREDec2018-5c73549b46e0fb00014ef630.jpg)

/ExxonMobilCashflowstatement09-30-2018-5c671f2e46e0fb0001a20a17.jpg)

/DEBTEQUITYFINALJPEG-098e44fb157a41cf827e1637b4866845.jpg)

/dotdash_Final_Liability_Definition_Aug_2020-01-5c53eb9b2a12410c92009f6525b70e7a.jpg)