Unique Computation Of Income Of Charitable Trust In Excel

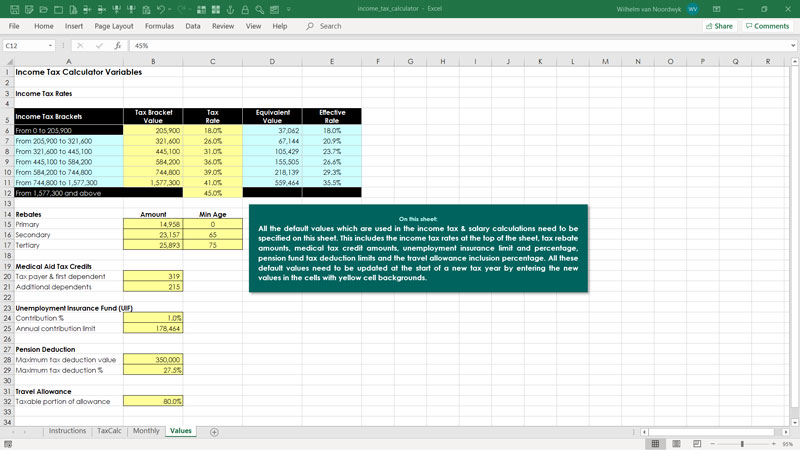

Accumulation of Income Section 112 Where 85 of the income is not applied to charitable or religious purposes the charitable trust or institution may accumulate or set apart either the whole or part of its income for future application for such purposes.

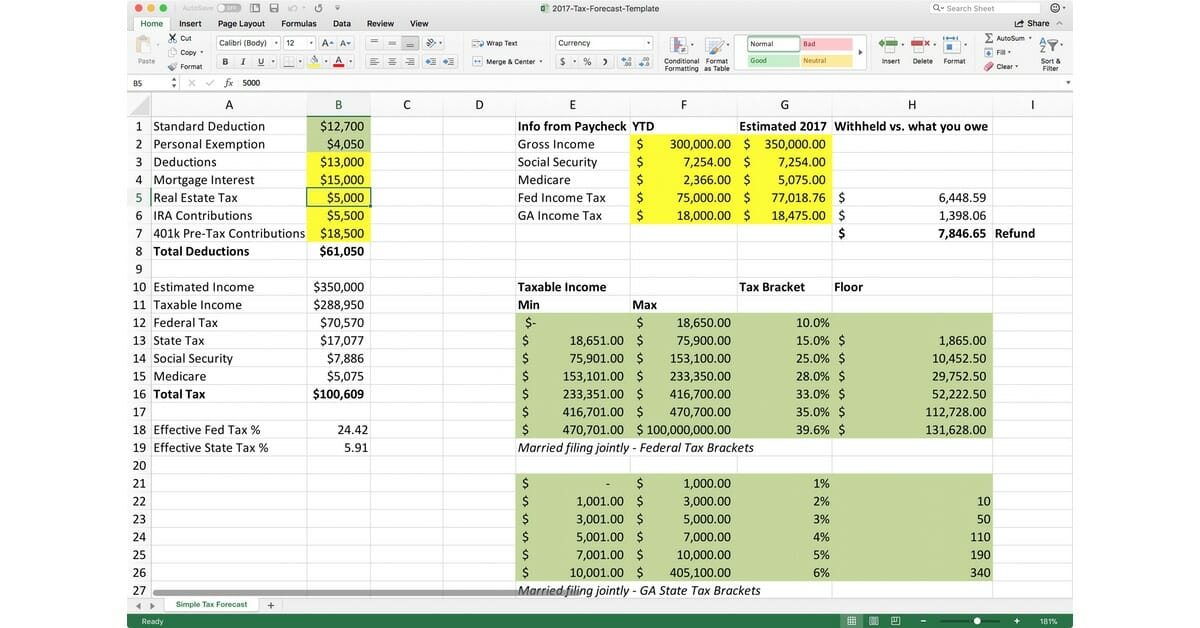

Computation of income of charitable trust in excel. 30 April 2013 In case of Charitable Trust exemption is for the amount they utilised for charitable purposes. Deduction under section 24. The remainder factor multiplied by the funding amount equals the value of the charitable contribution.

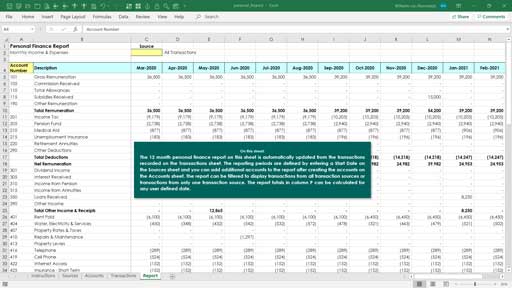

Amount spent for acquisition of fixed. Xxxxx Income From House Property 2 XXXXX. In other words the income for the purpose of section 11 is the income as per the accounts of the trust.

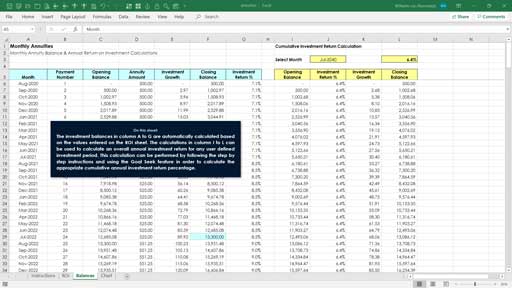

Section 111 of the Income Tax lays down that any income profits and gains derived from property held under trust wholly for religious and charitable purposes or held in part only for such purposes-in case of trust created before 141962 shall not be included in the total income of the trust or institution including a society or any other legal obligation to the extent such income is applied or. A great way to make a gift receive fixed payments and defer or eliminate gains tax. Charitable Remainder Annuity Trust Calculator.

This calculation is based upon the trusts beginning value the trust withdrawal or income rate and the rate at which the trust grows. Income from house property. Depreciation on sports equip.

Income of the Trust. Adjusted net annual value. If trust has utilised the amount they received for the charitable purpose acoording to time limit no need to tax them at all.

It will also include donations other than Corpus donations received by the trust by virtue of the provisions of section-224 iia. Income derived from the trust property has also got to be computed on commercial principles and if commercial principles are applied then adjustment of expenses incurred by the Trust for charitable and religious purposes in the earlier years against the income earned by the Trust in the subsequent year will have to be regarded as application of income of the Trust for charitable and religious. Charitable Remainder Unitrust Calculator.