Unbelievable Fedex Financial Ratios

Full Report 258 MB opens in new window 2008.

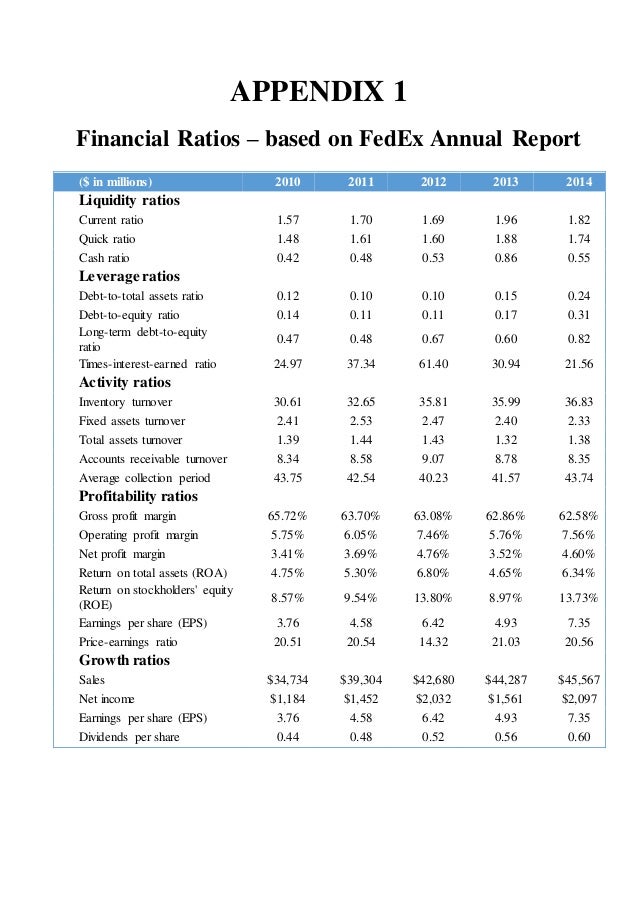

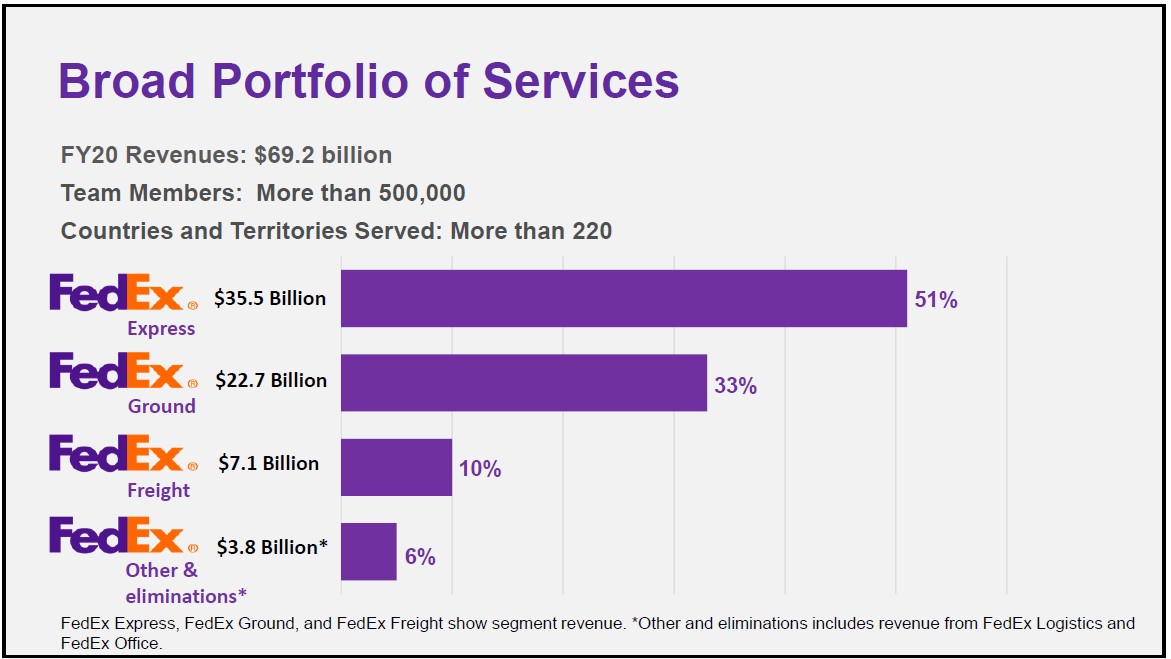

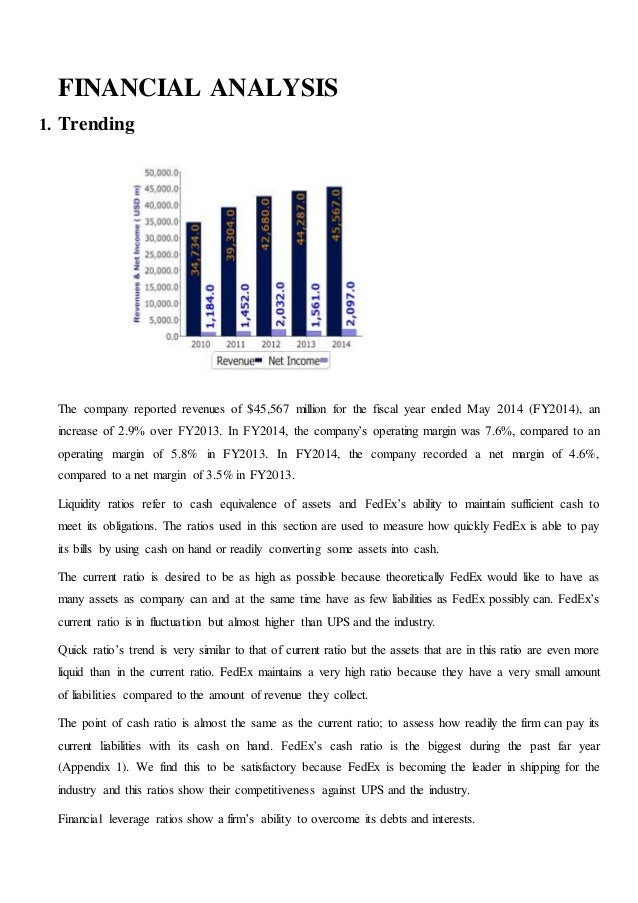

Fedex financial ratios. Operating performance ratios describe the relationship between the FedEx Corps level of operations and the assets needed to sustain operating activities. As the reach and influence of our networks expand peoples lives improve communities grow and the global marketplace thrives. Companys Price to Sales ratio is at 103.

Fedex Corp financial ratios usually calculated using numerical values taken directly from Fedex Corp financial statements such as income statements or balance sheets. We Help Others See Reach Thrive. Balance sheet income statement cash flow earnings estimates ratio and margins.

FedEx Debt ratio. Transport Logistics industrys Price to Sales ratio is at 202. They help investors to obtain meaningful information about Fedex Corp.

Generally speaking Fedex Corps financial ratios allow both analysts and investors to convert raw data from Fedex Corps financial statements into concise actionable information that can be used to evaluate the performance of Fedex Corp over time and compare it to other companies across industries. Fusion Media would like to remind you that the data contained in. 22 rows Financial ratios and metrics for FedEx stock FDX.

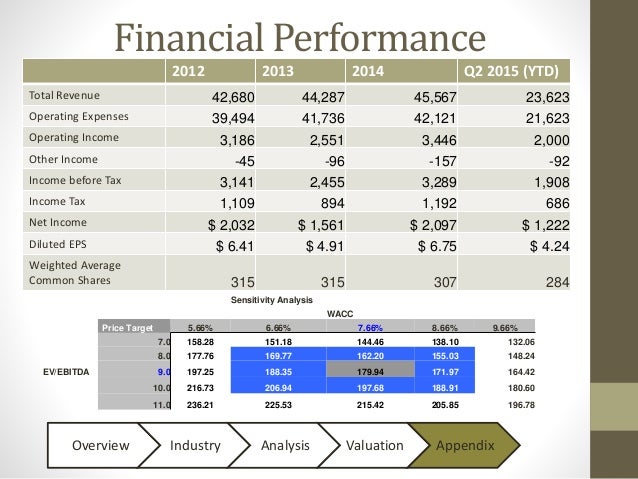

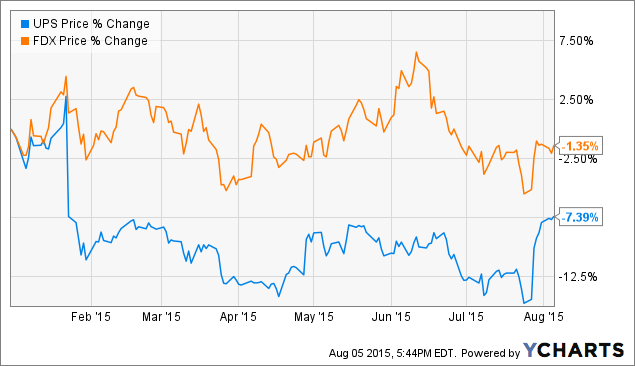

Investors should also note FDXs current valuation metrics including its Forward PE ratio of 1328. The EVEBITDA NTM ratio of FedEx Corporation is significantly higher than its historical 5-year average. Analysis of Short-term Operating Activity Ratios Evaluates revenues and output generated by the FedEx Corps assets.

Data is currently not available. View FDX financial statements in full. In 2015 the FedEx Corporation had a debt ratio of 195.