Top Notch Financial Statement Analysis Project Of Tata Motors

Ad Find Visit Today and Find More Results.

Financial statement analysis project of tata motors. Our analysis will be based on financial ratios calculated from historical financial data which is available in Companys annual reports and other reliable sources. A Study On Financial Statement Analysis Of Tata Steel Odisha Project Kalinga Nagar Corresponding Author. Tata Motors Ltd.

TATA MOTORS Income Statement Analysis. Financial statement analysis is a technique of revising and analysing an organisations accounting reports or financial reports so as to considered its previous present or upcoming execution. Let us have a look at the detailed performance review of the company during FY18-19.

2012 13 4476572 338031 755 2013 14 3431928 238202 694 Financial analysis of Tata motors was Average 4317066 402468 950 carried out by Rakhi Daniel Patel up to the Std Deviation 838223 117087 329 financial year 2009-10. To analyze the financial statement of TATA Motors Ltd. Tata Motors posts Q4 loss at Rs 76054 crore revenue growth at 42 meets estimates 02022021 Tata Motors Consolidated December 2020 Net Sales at Rs 7565379 crore up 555 Y-o-Y.

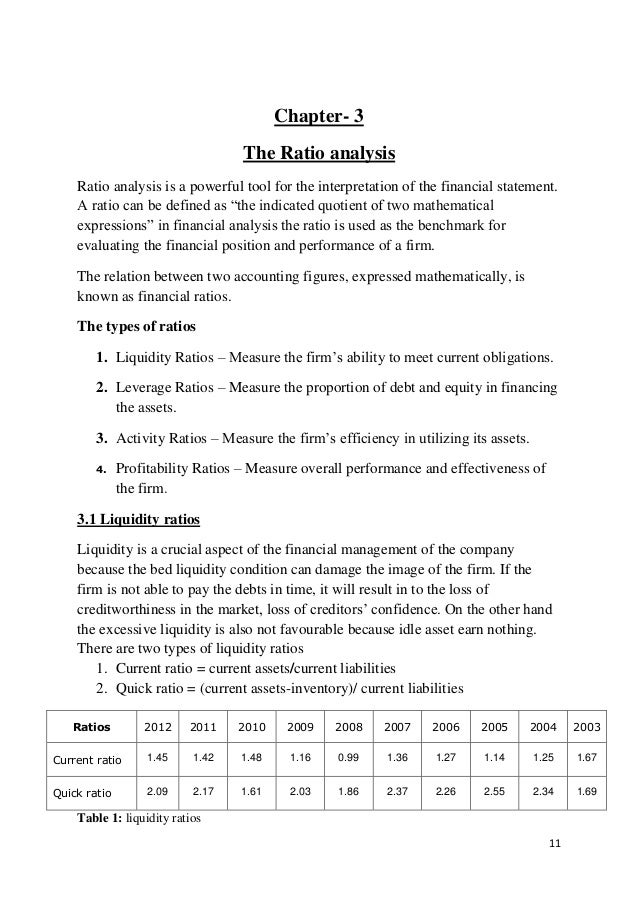

To use various activity ratios and liquidity ratios to find out the activity of assets and liabilitiesandtofindouttheliquiditypositionofthecompany. Visit the page to download annual reports balance sheet and other key financial statements of Tata Motors. This study aims at analyzing the overall financial study of the Tata Motors by using various financial tools.

This paper presents financial analysis of TATA Motors based on data up to 2012. This study covers a period of 2010 to 2014 for analyzing the financial statements such as income statements and balance sheet. Financial Analysis of TATA Motors.

Both quantitative and qualitative methods were used for this report. The income statement indicates a companys financial performance measured over a reporting period. Financial ratio analysis of tata motors submitted by- name.