Smart Itr Final Balance Sheet Of Shop In Haryana

Schedule AL is not new since it was applicable to taxpayers having total income of more than Rs.

Itr final balance sheet of shop in haryana. However after abolition of Wealth Tax schedule AL is also added in other ITR Forms to protect the. Income Tax Filing For Company. For the financial year ending March 312017 the accountant of the company is not certain about the presentation of the following items under relevant Major Heads Sub Heads if any in its Balance Sheet.

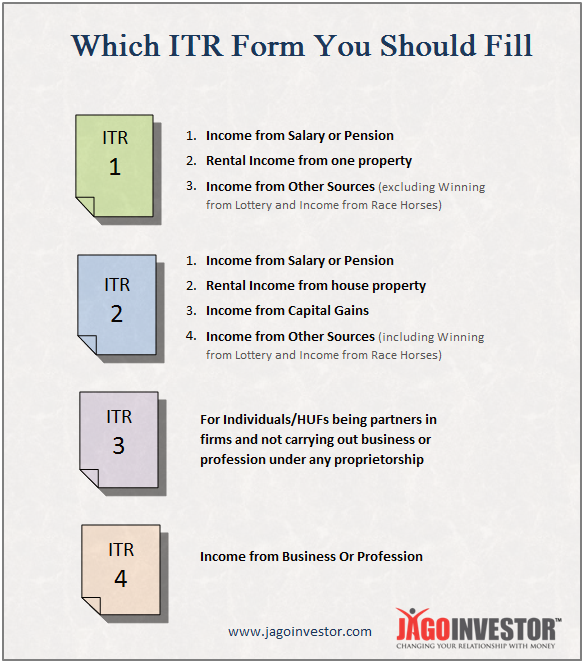

Public applied for 14000 shares. It also prepares its Income Statement and Balance Sheet as per the format provided in Schedule III to the Act. An important change made in ITR Forms is introduction of Schedule AL Assets and Liabilities.

It is preferred that the person applying for the GST Suvidha Kendra should have prior experience of handling businesses. To e-File the ITR using the upload XML method the user must download either of the following ITR utility. E-Way Bill is a mandatory declaration about the transport of Goods worth more than 50000 from one place to another before moving the goods.

However the assessing officer treated the said amount of Rs. Loss due to Write off of Debentures BondsShares. Its Financial Statements depict its true fair financial position.

TAX AUDIT IN CASE OF BUSINESS LOSS. 1322 2nd Floor Yatra TNGO Colony West Karikalan Street Adambakkam Chennai - 600088 Dist. The person applying can be a individual or a firm.

Search the worlds information including webpages images videos and more. Download the applicable ITR fill the form offline save the generated XML file and then upload it. To enquiry about study material.