Great Schedule Vi Of The Companies Act 2013

By virtue of his disqualification or removal or the revocation of his appointment as a director as the case may be under section 148 149 149A 154 155 155A or 155C of this Act section 50 or 54 of the Banking Act Cap.

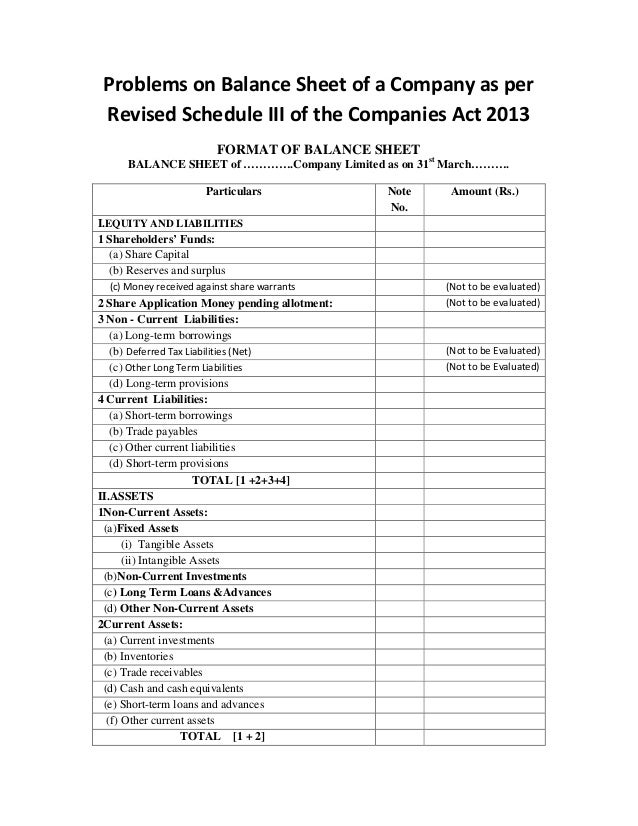

Schedule vi of the companies act 2013. Thus a company will not have option to use horizontal format for presentation of financial statements. The Old Schedule VI required separate presentation of debtors outstanding for a period exceeding six months based on date on which the billinvoice was raised whereas the Revised Schedule VI requires separate disclosure of trade receivables outstanding for a period exceeding six months from the date the billinvoice is due for payment. In Schedule V in Part II in section III for clause b b where the company.

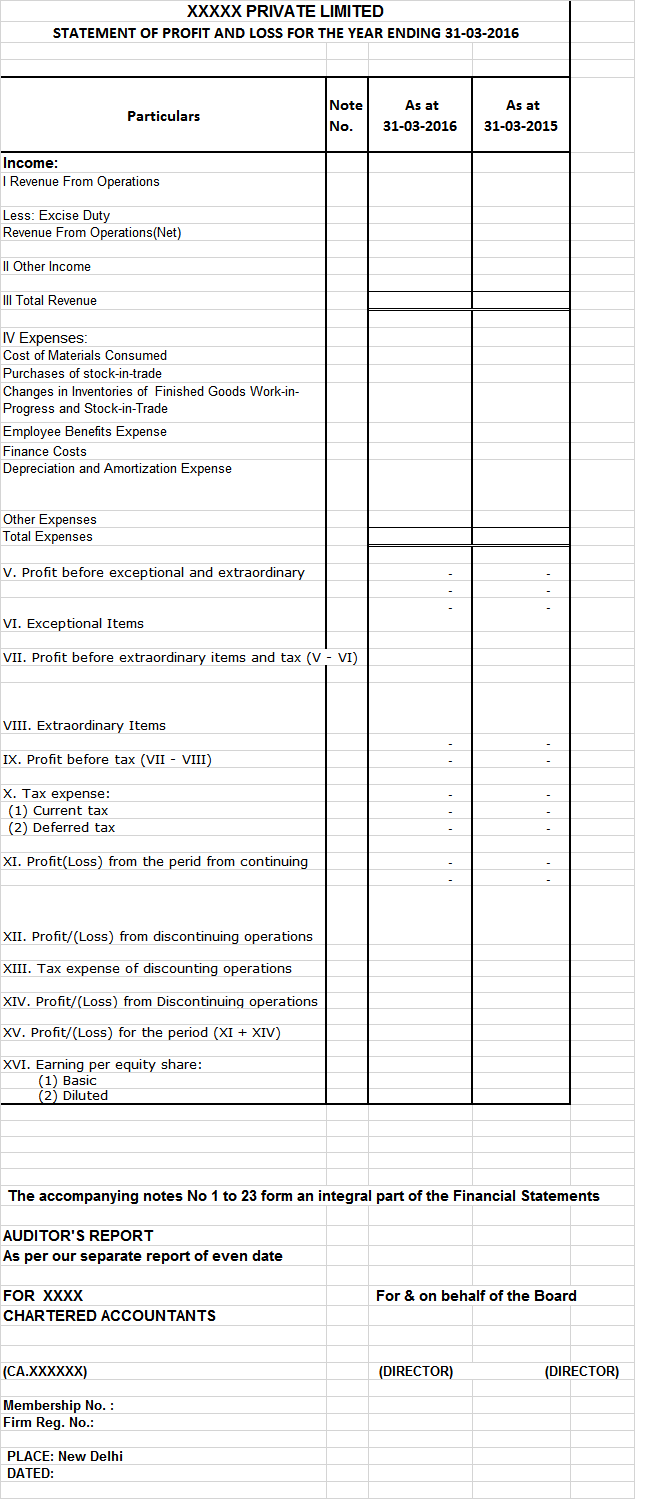

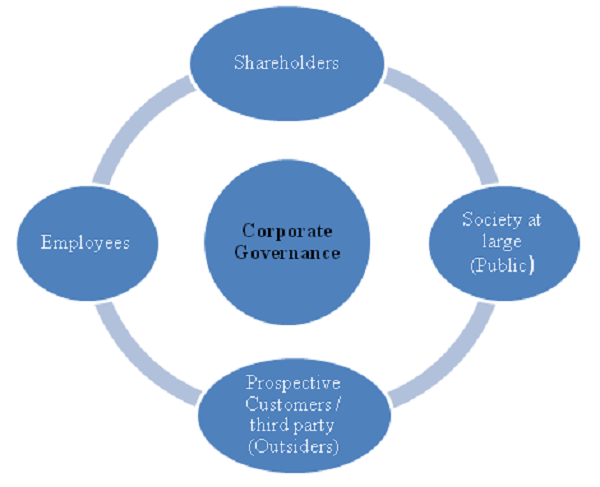

Vi the Companies Act2013 18 of 2013 or any previous company law 2. Code for Independent Directors Section 1498 5. Depreciation Section 123 3.

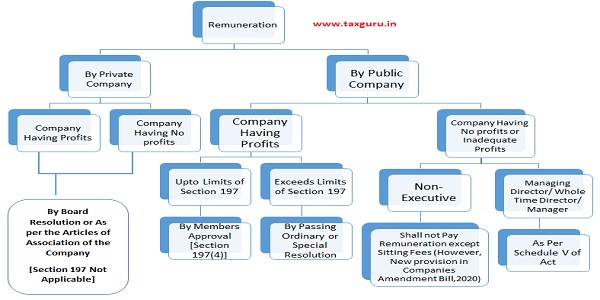

BE it enacted by Parliament in the Sixty-fourth Year of the Republic of India as follows. 19 section 50 or 54 of the Banking Act as applied by section 55ZJ of that Act section 467 of the Credit Bureau Act 2016 section 47 of the Finance Companies Act Cap. Section V Remuneration payable to a managerial person in two companies.

1 i Eradicating hunger poverty and malnutrition 2 promoting health care including preventinve health care and sanitation 4 including contribution to the Swach. As per Schedule II of Companies Act 2013 The description of Fixed assets has been more detailed to short out the problem of rates of charging depreciation and the maximum life of assets has been provided so that the Financial statement can provided a true and fair view. SCHEDULE I SCHEDULE II SCHEDULE III SCHEDULE IV SCHEDULE V SCHEDULE VI SCHEDULE VII.

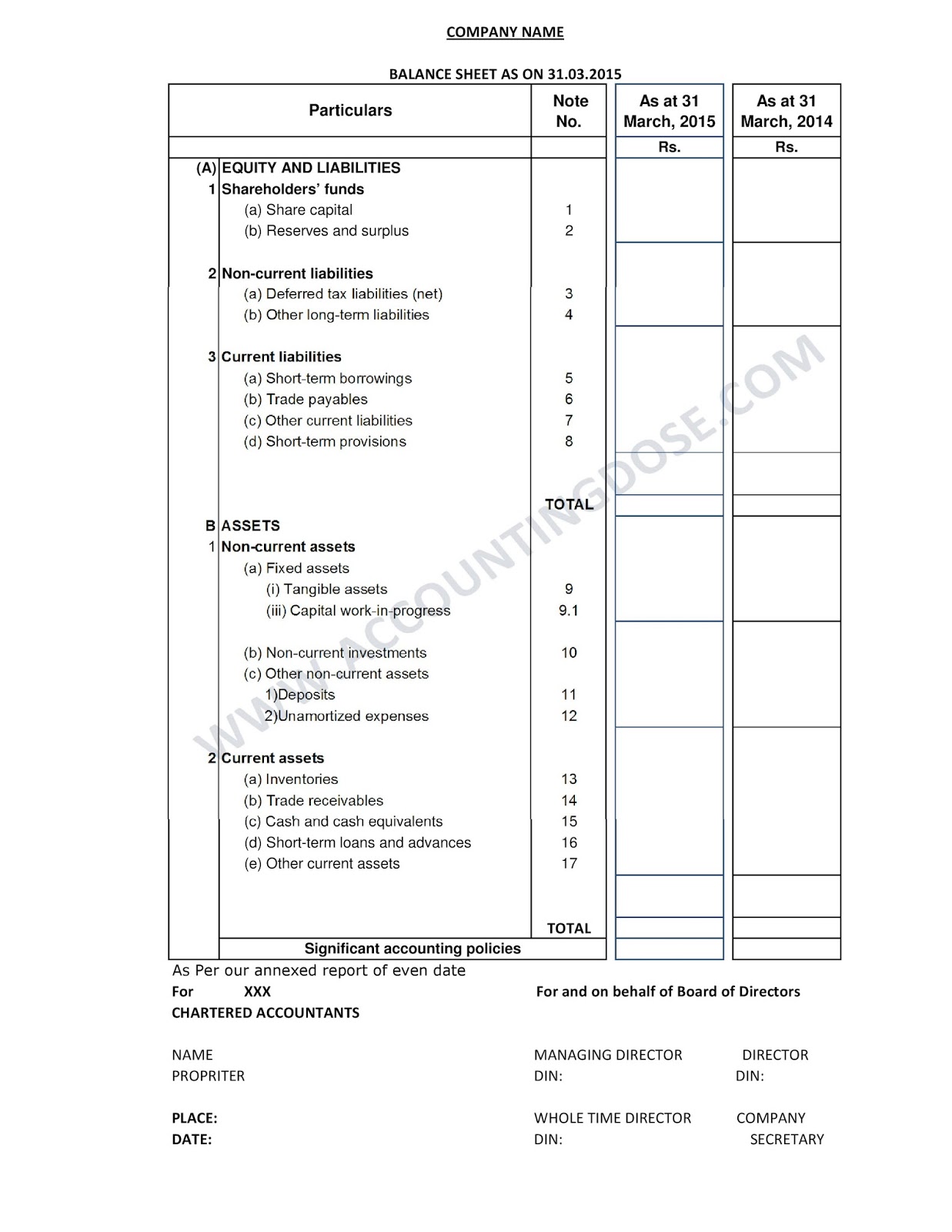

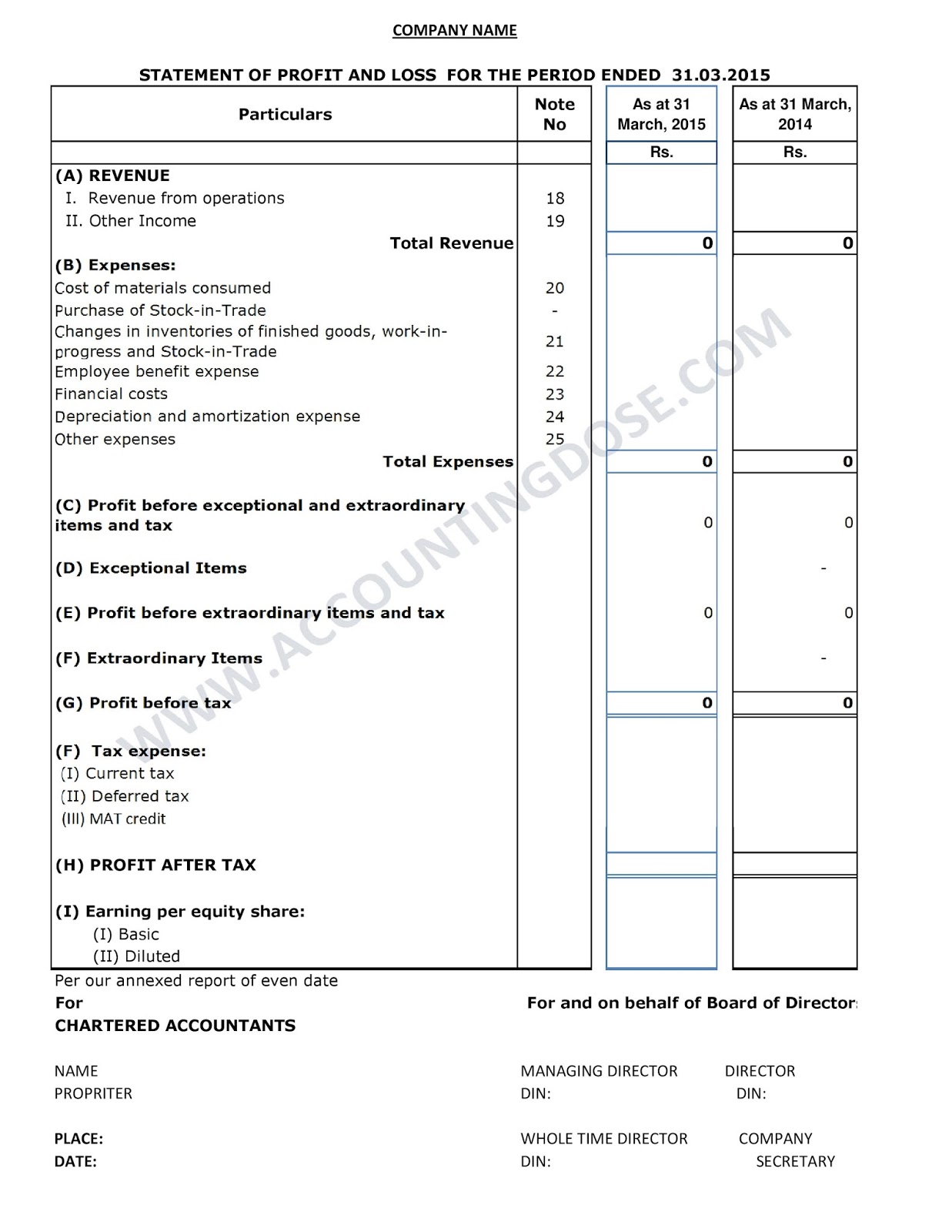

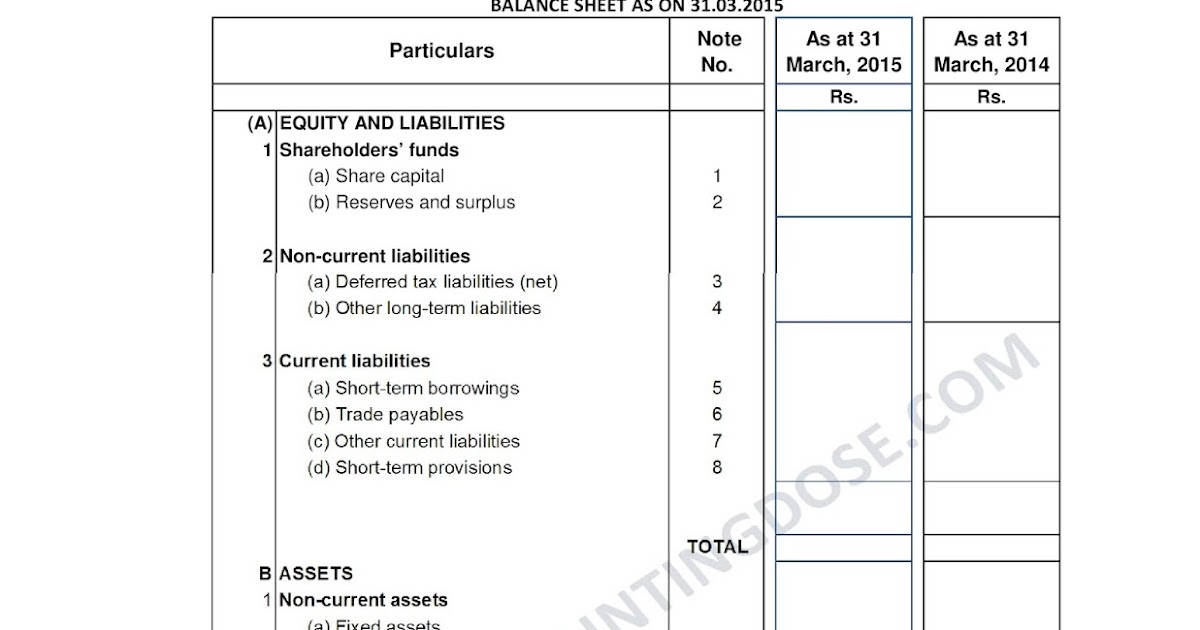

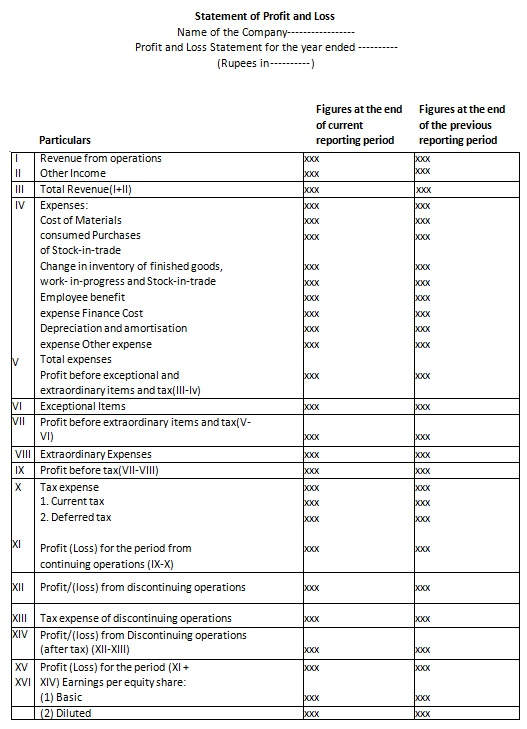

Balance Sheet and Statement of Profit Loss Section 129 4. As per Part C of Schedule II of The Companies Act 2013 Nature of Assets Useful Life Rate SLM Rate WDV viii Plant and Machinery used in manufacture of non ferrous metals 1 Metal pot line NESD 2 Bauxite crushing and grinding section 3 Digester Section NESD 4 Turbine NESD 5 Equipments for Calcinations NESD. The provisions of sub-paragraph 2 and 7 of paragraph II paragraph IV paragraph V clauses a and b of sub-paragraph 3 of paragraph VII and paragraph VIII shall not apply in the case of a Government company as defined under clause45 of section 2 of the Companies Act2013 18 of 2013 if the requirements in respect of matters specified in these paragraphs are specified by the concerned.

As per Part C of Schedule II of The Companies Act 2013 V a 10 Years 950 2589 b 8 Years 1188 3123 VI a 10 Years 950 2589 b 6 Years 1583 3930 c 8 Years 1188 3123 d 8 Years 1188 3123 e 8 Years 1188 3123 VII a i 25 Years 380 1129 ii 20 Years 475 1391 iii 1 With Stainless steel tanks 25 Years 380 1129. As applicable to the companies require any change in treatment or disclosure including addition amendment substitution or deletion in the head or sub-head or any changes in the financial statements or statements forming part thereof the same shall be made and the requirements of this Schedule shall stand modified accordingly2 The disclosure requirements specified in this Schedule. It provides that a company engaged in the setting up of and dealing with infrastructural projects may issue preference shares for a period exceeding twenty years but not exceeding thirty years subject to the redemption of a minimum ten percent of such preference shares per year from the twenty first year onwards or earlier on proportionate basis at the option of the preference shareholders.