Breathtaking Financial Ratio Analysis Of Samsung

Shows a Profitability Score of 700.

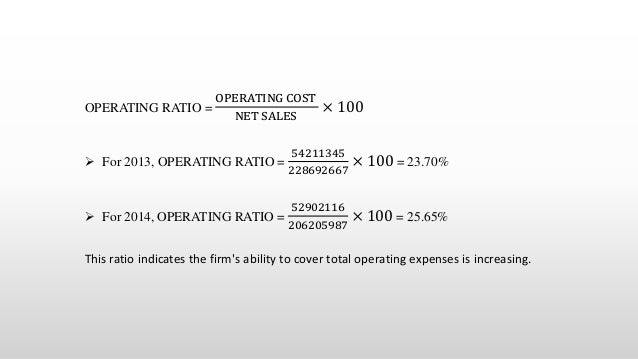

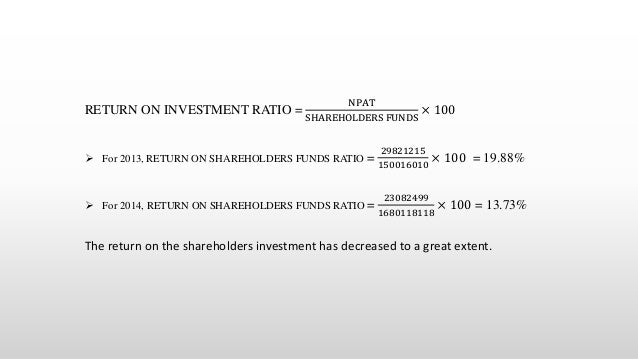

Financial ratio analysis of samsung. Samsung Electronics Co Ltd 005930 - Financial and Strategic SWOT Analysis Review - provides you an in-depth strategic SWOT analysis of the companys businesses and operations. OPERATING RATIO OPERATING COST NET SALES 100 For 2013 OPERATING RATIO 54211345 228692667 100 2370 For 2014 OPERATING RATIO 52902116 206205987 100 2565 This ratio indicates the firms ability to cover total operating expenses is increasing. Is significantly higher than its peer groups.

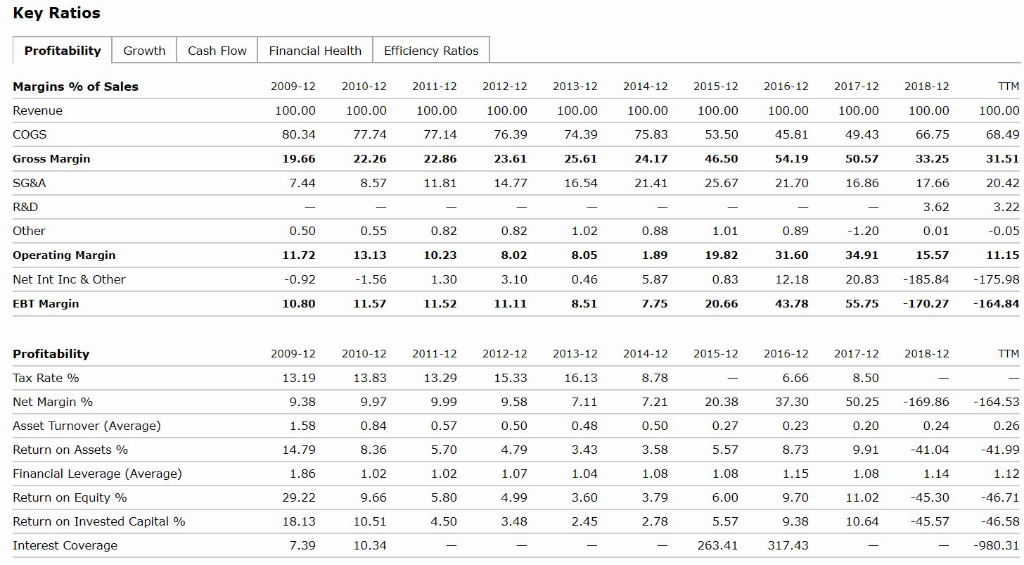

Has been able to grow revenues from 1650T KRW to 2011T KRW. However in terms of operational efficiency Apple is one of the industrys worst with their 1932 days accounts receivables worth of sales outstanding. For the three months ended 31 March 2021 SamsungElectronics Co Ltd revenues increased 18 to W65389T.

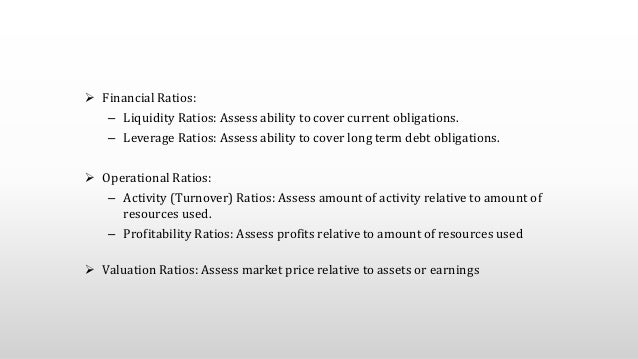

This is an area that has been troubling Samsungs investors. Total Debt to Equity MRQ. Financial ratios are categorized according to the financial aspect of the business which the ratio measures.

The Operational Performance Ratio is equivalent to the dividend of net sales divided by net fixed assets. Is significantly lower than the average of its sector Consumer Electronics. Samsung Electronics Co Ltd.

Days sales uncollected Ac receivable Net Sales 0125 012 8. Most impressively the company has been able to reduce the percentage of sales devoted to cost of goods sold from 6797 to 6298. Samsungs Operational Performance Ration shows 057 in 2017 062 in 2016 and 068.

Liquidity ratios measure the availability of cash to pay debt. Samsungs most recent debt-to-total capital ratio stands at 908 a sharp increase from the previous years 546. LT Debt to Equity MRQ.